DAX Outlook: Cautious Trade Ahead Of The ECB Rate Decision

Image Source: Pexels

The DAX is easing from its all-time high ahead of the ECB rate decision & after the Fed pointed to 2 more hikes.

DAX falls ahead of the ECB rate decision

- China data misses forecasts

- ECB expected to hike rates by 25 basis points; are they near the end of the cycle?

- Fed left rates unchanged but pointed to 2 more hikes this year.

After rising to within a breath of its all-time high, the DAX is easing lower as investors weigh up weaker-than-expected China data and look ahead to the ECB interest rate decision.

Chinese retail sales and industrial production improved in May but still missed estimates, raising concerns over the strength of the economic recovery. Chinese industrial output rose 3.5% YoY in May, below forecasts amid faltering domestic and foreign demand.

Retail sales jumped 12.7% YoY, slowing from an 18.4% jump in April and below the 13.6% forecast.

The rebound in China's losing momentum has prompted the PBoC to cut some key interest rates.

Attention is now turning to the ECB, which is widely expected to raise interest rates by 25 basis points to 3.5% as it continues its hiking cycle to address above-target inflation.

The big question will be whether the ECB is willing to signal that it could be thinking about pausing interest rate hikes. Cooling energy prices, a sharp drop in inflation, and signs of economic growth stalling as the eurozone and the German economy tipped into recession in the first quarter support a less hawkish ECB. In any other period, this would usually be a significantly depressed backdrop for the central bank to pause interest rate hikes.

However, the central bank will likely err on the side of caution as services and wage pressures remain high.

In addition to the interest rate decision, the ECB is set to reveal its latest staff projections. Growth will likely be downwardly revised, and the inflation forecast will be key for determining whether there could be more rate hikes beyond the 25 bps expected in July.

Any sense that the ECB is considering a pause in hikes could be regarded as good news for stocks.

The ECB meeting follows the Fed rate decision, which saw the central bank keep rates on hold but point to 2 further rate hikes this year, ahead of previous forecasts. The dot plot points to a terminal rate of 5.6%, above the 5.1% previously expected. This upward revision comes as the Fed’s growth forecast was revised higher to 1%, and core inflation was also revised higher to 3.9%.

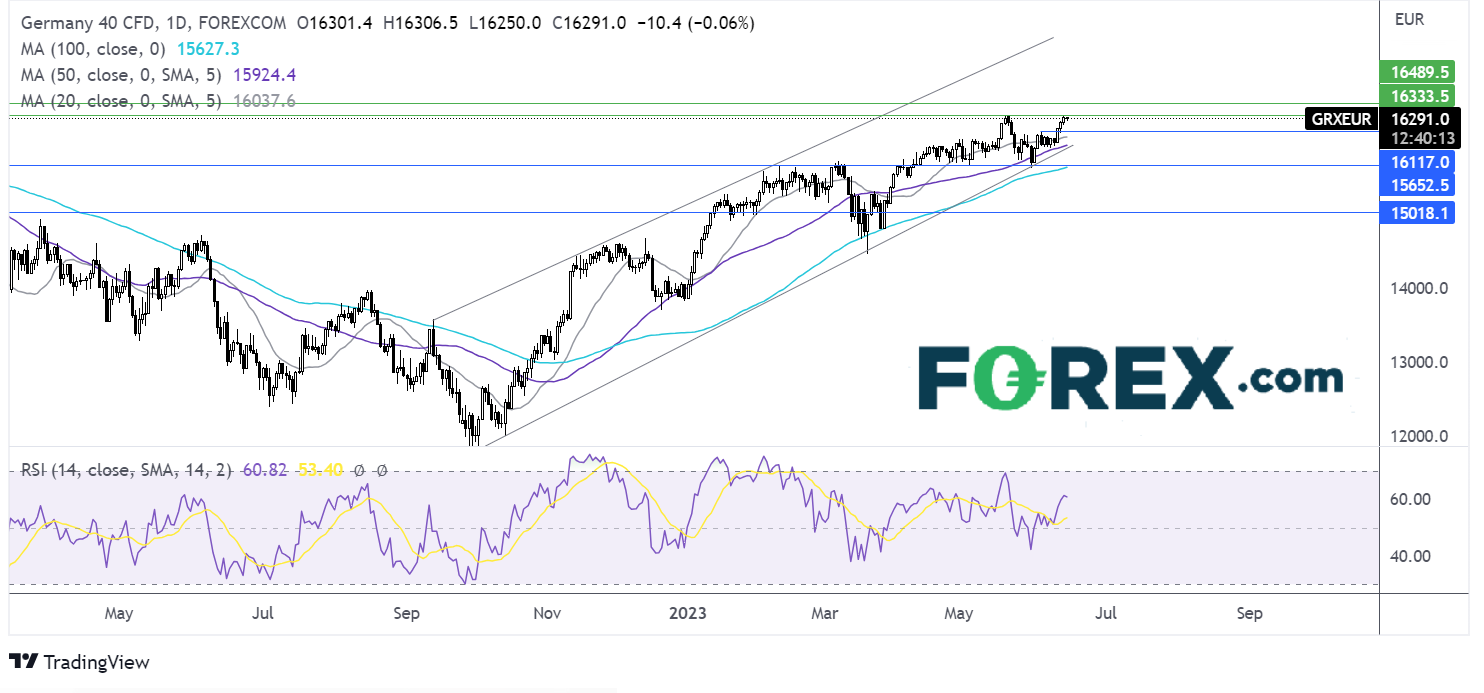

DAX outlook – technical analysis

The DAX is easing off from its all-time high but remains within its multi-moth rising channel. The RSI is supportive of further upside.

The DAX needs to rise above 16336, its all-time high, to give a bullish signal and create a higher high. In the case of an extended rally, DAX bulls could target 16500 round number.

Sellers could look for a move below 16114, the early June high, to open the door to 15910 the 50 sma and rising trendline support. A break below here brings the 15625 the May low into play.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: GBP/USD, Oil - Wednesday, June 14

Two Trades To Watch: GBP/USD, DAX - Tuesday, June 13

S&P 500 Outlook: Stocks Rise Cautiously Ahead Of The Fed Decision This Week

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more