Czech Republic: Lower Financing Needs Than MinFin Expects, But Still A Lot To Cover

We expect this year's deficit to be lower than MinFin forecasts, implying lower financing needs. On the other hand, MinFin still needs to cover an unusually large part of its needs by the end of the year. The bond supply should remain high in the coming months, resulting in government bonds cheapening in ASW terms. Spreads should remain wider than in previous years.

Fiscal policy again suggests a happy ending

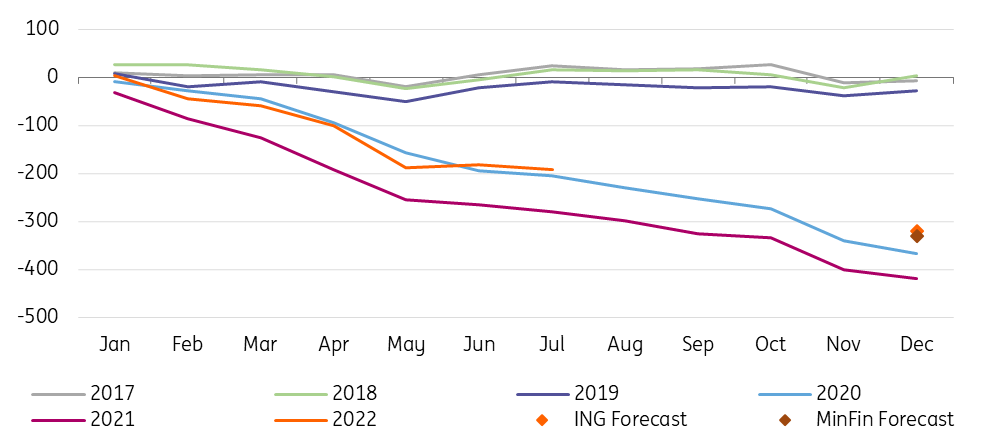

The state budget reported a deficit of CZK192.7bn (2.8% of GDP) in the January-July period. Although total revenues are below the current plan, tax revenues are higher by CZK17.3bn. EU inflows, on the other hand, are well below plan, but this should be offset in the coming months. On the tax side, the details show that all items except excise are above the Ministry of Finance's (MinFin) expectations. On the expenditure side, the overall picture is basically balanced compared to the government's plan. Current expenditure is slightly higher but mainly due to the refinancing of the transfer to municipalities. On the other hand, investment is lower than planned in the middle of the year, which should be compensated for in the coming months. In nominal terms, however, it is the highest on record.

We project a general government deficit of 4.1% of GDP this year and 3.3% of GDP next year

So the overall picture looks good given the conditions, and it is all the more interesting because the government recently approved an increase in the planned deficit from CZK280bn (4.1% of GDP) to CZK330bn (4.9% of GDP) and the proposal is expected to be approved by the Chamber of Deputies in the coming weeks. The government's draft increases spending mainly related to rising energy prices while boosting expected tax revenues. However, as every year, we believe the spending plan will not be met and tax revenues have room to outperform the updated MinFin estimate. Moreover, the CZK7.6bn on the expenditure side should serve as a buffer for any unexpected expenses. Thus, overall, we retain an optimistic bias and expect this year's general government budget to show a deficit of CZK310bn (4.6% of GDP). Combined with the surplus of municipalities and the balanced performance of social security funds, we project a general government deficit of 4.1% of GDP this year and 3.3% of GDP next year.

Czech state budget (CZKbn)

Image Source: MinFin, ING forecast

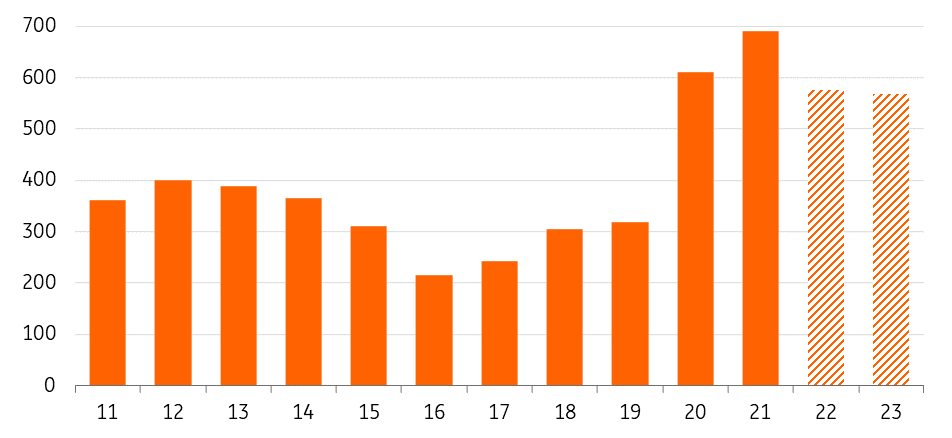

Czech government bond supply should remain strong despite seasonality

On Friday, MinFin published an update of its funding strategy based on the approved state budget adjustments. As expected, this change has moved the projections of this year's financing needs to CZK595.8bn. Given our fiscal policy forecast, we see slightly lower financing needs of CZK575.6bn (8.5% of GDP). According to our calculations, MinFin has covered roughly 72% of all financing needs since the beginning of the year. CZK70.5bn matures in September, however, we believe MinFin has covered this by issuing T-bills, which have been rolling over since the beginning of the year. Thus, the rest of the CZK needs will be purely driven by the state budget developments over the rest of the year. However, MinFin covered significantly less of its needs in the first half compared to previous years and after a long time, we should see a solid Czech government bond supply (CZGB) in the second half of the year as well, which we believe reflects the Czech National Bank hiking cycle.

MinFin significantly shortened the maturity of the offered bonds from the average maturity of 12y+ in January to 4.5y in June due to the decreasing demand in the first half of the year. However, demand has come back with average bid/cover back above 2, and MinFin will thus look to extend the average maturity of its portfolio again from the current 6.4y closer to or above its 6.5y target, we believe, which implies supply mainly in the 8-10y segment.

Pre-financing as an opportunity for EUR issuance under local law

We also estimate that this year's EUR needs of CZK3.4bn were covered by a combination of EUR issuance under local law, money market loans and loans from supranational institutions. However, part of this financing is likely to mature in the first half of the next year, which we expect MinFin to try to refinance later this year with at least EUR2bn. In our view, the number one option for MinFin remains to issue euro-denominated CZGBs under local law. Technically, it can use the current issues (2y and 5y), which each offer EUR1bn of free limit, to do so. However, MinFin can be expected to introduce a new issue to further expand this new market.

Total financing needs (CZKbn)

Image Source: MinFin, ING forecast

Technicals: Strong inflows despite worse rating outlook

Fitch downgraded the outlook from stable to negative for the Czech Republic in May and Moody's did the same in August. In both cases, the main reason was the Czech Republic's energy dependence, which is one of the highest in the region, and its impact on fiscal indicators in case of supply problems. Given the earlier views of the rating agencies, the deterioration in the outlook is not surprising. A similar move can be expected from S&P in October. However, we do not expect a downgrade in the rating itself. In general, we expect better development of financial indicators, and a full cut-off from Russian gas is not our baseline at the moment, but it is necessary to keep an eye on this issue.

During the summer months, MinFin has been silent on the secondary market, but given the financial needs, we expect activity to pick up in September, especially in taps. Currently, MinFin has around CZK100bn of CZGBs in its portfolio with the largest holdings of CZGB 1.75/32, CZGB 3.50/35, and CZGB 0.00/24 expected to circulate in the taps.

In the GBI-EM space, we don't see much of a story for the coming months. Pretty much all eligible bonds are included in the index at this point except CZGB 1.95/37 and CZGB 4.85/57. However, there are currently four bonds in the 10y+ maturity bucket, so we don't see much chance of the remaining bonds being included in the index. In case of exclusion, the first candidate is CZGB 0.45/23, however, this is not an issue until March next year.

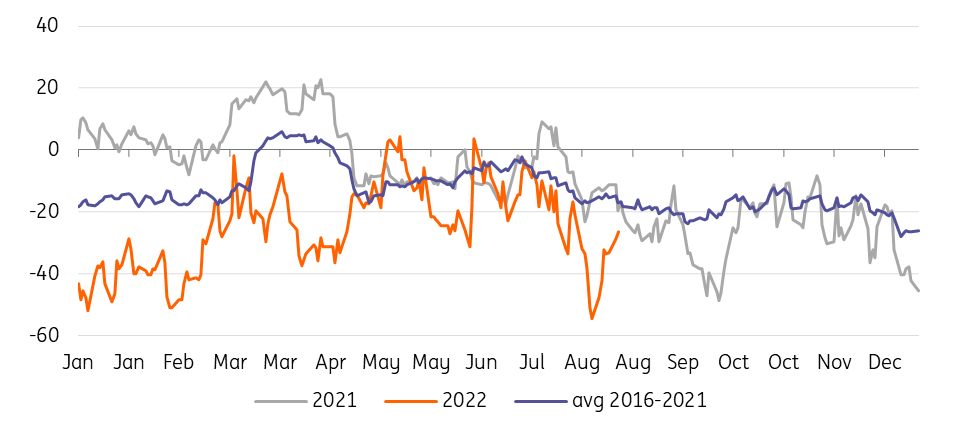

Foreign bondholders in CEE (%)

Image Source: Macrobond, ING

As of June, the proportion of foreign holders of CZGBs has fallen to 28.6%, slightly above the average for this year, but still confirms the trend of a long-term decline from levels above 40% three years ago. However, in relative terms, the Czech Republic remains the highest in the region. In nominal terms, foreign holdings are stagnant, but debt growth has been covered mainly by domestic banks. But, over the past two months, we believe the trend has changed and the peak hiking cycle has attracted foreign buyers across the Central and Eastern European region, which should be reflected in official numbers soon.

CZGB 10y ASW (bp)

Image Source: Macrobond, ING

Market view: CZGBs cheapening should continue

After a massive tightening of the asset spreads vs IRS curve due to strong buying interest, CZGBs finally saw some relief. However, spreads still remain tighter than would be consistent with previous years and the normal seasonal pattern. Although we expect lower financing needs than MinFin for this year, there is still an unusually large amount to cover by the end of the year. Supply will thus remain elevated in the months ahead. Therefore, we expect CZGBs to get even cheaper in ASW terms and spreads to remain wider compared to previous years.

More By This Author:

China’s Economic Weakness Goes Beyond Real EstatePoland’s Foreign Trade Deficit Narrowing Gradually

Key Events In Developed Markets For Week Of Aug. 15

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more