Czech Republic: CPI Inflation Edges Below CNB Estimate, Challenging Possible Hike

Image Source: Pexels

In April, headline inflation moderated from 15% to 12.7% year-on-year, mainly due to a slowdown in food inflation. The continuous decline of core inflation for the seventh consecutive month in a row suggests that domestic inflationary pressures are slightly softening.

CPI growth continued in April

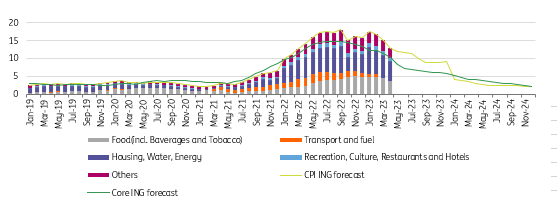

In April, Czech CPI decreased by 0.2% month-on-month. The YoY growth moderated from 15% to 12.7% YoY (below the market consensus at 13.3% and the CNB estimate of 13.2% YoY). The decrease in headline inflation was mainly attributable to a slowdown in food price growth, which decreased by 1.6% MoM while in YoY terms, growth slowed down from 24% to 17% YoY. As a result, the contribution of food prices to headline inflation decreased from four to three percentage points in YoY terms. The negative contribution to headline CPI of transport (including fuel) slightly increased from -0.1 to -0.2 percentage points). Also, owner-occupied housing costs (imputed rentals) continued on a descending path as growth decelerated further from 6.8% to 4.9% YoY. Core inflation decreased from 11.5% to 10% YoY, which is the seventh consecutive decline in a row. This suggests that demand-pulled inflationary pressures are gradually fading on the back of a sharp decrease in household purchasing power.

Contributions to CPI growth

Source: CZSO, ING estimates

Continuous moderation of core inflation suggests softening demand pressures

It is clear that the moderation of Czech headline inflation is continuing. The continuous decline of core inflation is a positive sign as in some other EU economies, core inflation is still picking up. This suggests that domestic inflationary pressures are slightly softening, which can be partly attributed to the relatively early start of hefty rate hikes from the Czech National Bank beginning in June 2021, when the Czech economy was only emerging from the Covid lockdown. The CNB's spring forecast shifted the headline trajectory slightly upwards, expecting CPI growth a touch above 8% YoY by the end of 2023 and reaching the 2% target only around mid-2024 (previously the CNB was expecting to be at target in the first quarter of 2024). Hence the CNB's forecast has converged with ING's forecast, expecting a slower decline in inflation during the remainder of 2024.

Softer inflation is welcome, but high wages concern the CNB

The gradual decline of both headline and core inflation must make the central bank board feel more comfortable as it signals that domestic inflationary pressures are softening. What may worry the CNB board, however, is the still hefty growth of industry wages at the beginning of the year. However, in March the growth of industrial wages moderated to 9% YoY, providing a sort of relief for the Bank's board, which sees the risk of a wage-inflation spiral and the 10% threshold as critical. The lingering tightness of the labor market was also confirmed by the recently published decline in the unemployment rate of 0.1bp to 3.6% in April.

In addition, today the government announced a new fiscal consolidation package, suggesting cuts on the expenditure side and increases in revenues which in sum should reduce the budget deficit in 2024 by CZK94bn and another CZK54bn in 2025. Bearing in mind the budget deficit was mentioned by the CNB as an important factor of domestic inflationary pressures, the fiscal efforts of the government (should they materialize) would also contribute to a wait-and-see approach at the CNB rather than an active monetary policy tightening.

At the last meeting, three dissenters voted for a rate hike (their names we will learn from minutes published on Friday 12 May). Today's CPI report could to some extent calm the willingness of some board members to tighten monetary policy further.

More By This Author:

Bank Of England Hikes Rates And Keeps Options Open For Further IncreasesPhilippines’ First Quarter GDP Surprises On The Upside But Could Mark The Peak

FX Daily: Bank Of England Still Averse To The Dovish Pivot?

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more