Currency War Combatant Capability Comparisons

College football teams are broadly ranked by their strength so that a contest between teams may be both interesting to watch and be seen as fair. Accordingly, teams ranked being in Division One, only play other teams in the same division. In the Olympics, where fairness and sportsmanship are elevated, boxers, wrestlers, and weightlifters compete in their own specific weight class. It is immediately obvious that members of a lighter weight class have little chance of winning against someone in a heavier class. No such fairness or “sportsmanship” is extended in the contest over currencies.

College football teams are broadly ranked by their strength so that a contest between teams may be both interesting to watch and be seen as fair. Accordingly, teams ranked being in Division One, only play other teams in the same division. In the Olympics, where fairness and sportsmanship are elevated, boxers, wrestlers, and weightlifters compete in their own specific weight class. It is immediately obvious that members of a lighter weight class have little chance of winning against someone in a heavier class. No such fairness or “sportsmanship” is extended in the contest over currencies.

Currency wars usually are clandestine, and information regarding their operations are usually difficult or impossible to confirm. As a result, anyone trying analyze or get information on such activities will quickly be stymied. However, one can infer from important market price information evidence related to currency wars. For example, if a country’s currency declines 20% or more over a short period of time, it is reasonable that some currency manipulation has occurred, and that it is the likely cause of the decline. A currency war is an act of war.

By contrast, sanctions against a specific country are usually widely broadcast, so they are not secret. An interesting feature of sanctions is that other countries and their corporations are expected to honor the dictates of the country or organization doing the sanctioning. In recent history of the world, the country most frequently declaring sanctions against other countries is the United States – dictating that other sovereign nations always support America’s foreign policies. In previous centuries naval blockades, embargoes, or otherwise forced isolation were considered acts of war. Sanctions is today’s modernized version of a blockade, and equally an act of war – but like a currency war requires no congressional approval.

Importance of low sovereign debt

In their book “This Time is Different” authors Carmen E. Reinhart and Kenneth S. Rogoff analyze the default history of sovereign country debt. In their analysis the researchers conclude that countries with a ratio of debt to Gross National Product (GDP) approaching 60% are already at a heightened risk of default. They note that “Ultimately, default often occurs at levels of debt well below the 60 percent of debt to GDP enshrined in Europe’s Maastricht Treaty, a clause intended to protect the euro-system from government defaults.” We will show herein as to what extent countries have disrespected this EU treaty provision.

Countries, regardless of size, have learned from experience that borrowing U.S. dollars on seemingly favorable terms in a few years can turn into disgorging interest rates of effectively expanded loans via unfavorable dollar exchange rates. As a result, countries which have a higher level of debt to GDP ratio are even more dangerously exposed to currency manipulation and loss of economic sovereignty.

Comparing country GDP’s

In economic and political discussions foreign countries are almost always cited and referenced without considerations of “size and weight”. In this way we lose sight of the vast difference in the size of countries, their populations, their GDP, or their “Division” of competitor class in currency wars. For the purpose of making such comparisons in analyzing currency wars we first compare the GDP, population, debt, and debt/GDP ratio of the U.S. and its English speaking allies, and its immediate southern neighboring country Mexico.

The source of this information comes from “The Economist” magazine’s global debt clock which compares global debt by country. It should be noted that “The Economist” statisticians compile data on a basis of their own design; for example they seem to exclude U.S. inter-governmental agency debt, as U.S. debt which is now at $22 trillion is shown as only $17 trillion. There are likely other anomalies; however, for a consistent basis of so many country comparisons, this data base serves our purposes well.

TABLE 1

Country Population GDP GDP to U.S. Debt/GDP

(mil.) ($ bil.)

U.S. 322 17,441 100.0% 100.0%

England 64 2,841 16.6 108.0

Canada 36 2,140 12.5 84.4

Australia 24 1,460 8.5 27.6

Mexico 119 1,750 10.2 38.0

The preceding table demonstrates that the U.S. is in a size and class all its own. Not only are the populations of the English speaking countries relatively small to that of the U.S., their relative GDP’s are commensurately smaller as well. With apologies to the people and cultures of these countries, we can characterize them as economic monkeys compared to the big gorilla – meaning that in economic or financial warfare there is no possible contest here on account of the vast difference in economic heft between the United States and these other countries. Note that while Mexico’s population is as large as the population of England, Canada, and Australia combined, their GDP is 3.6 times larger than Mexico indicating its relative economic underdevelopment. Note also, that according to “The Economist” global debt clock statistics, the U.S. debt just happens to be 100% in size relative to its GDP.

The second very important statistic to note is the ratio of public debt relative to the size of GDP. One cogent reason to show this ratio is that smaller countries which have a high debt to GDP ratio are particularly exposed to default because of the possible contribution of hostile currency manipulations. Note that the U.S., England, and Canada show debt to GDP ratios far higher than the 60% ratio for heightened risk to default cited by authors Reinhart and Rogoff. Note also that despite Mexico’s relatively low debt to GDP ratio, it experienced default issues in the 1980’s, as a Latin American debt crisis rose from the FED’s interest rate hikes.

European Union Countries

Our next comparison looks at some European Union countries and compares them to that of the United States.

TABLE 2

Country Population GDP GDP to U.S. Debt/GDP

(mil.) ($ bil.)

U.S. 322 17,084 100.0% 100.0%

Germany 82 3,216 18.8 86.8

France 65 2,434 14.3 106.0

Italy 62 1,846 10.8 123.3

Spain 47 1,207 7.1 96.8

Greece 11 121 0.7 143.5

Ireland 5 179 1.0 155.3

The preceding table demonstrates that the major individual countries of Europe are small relative to the size of the United States in both population and economic heft. Indeed, we can see that taking all of these countries’ GDP and adding it to that of England does not quite measure up to the power of the United States. Again, in a contest, the United States is the big gorilla fighting with a bunch of monkeys.

However, more alarmingly, all of these countries have debt to GDP ratios far higher than that provided for in the Maastricht Treaty. It is not comprehensible as to why the governing body of the EU permitted such disregard for its treaty regulations, particularly since it undermines the financial integrity of the EU, increasing risk of debt default which could unravel the whole EU enterprise.

Neighbors in South America

America is blessed in its geographical placement of the globe, in so far as it is isolated by two large oceans from potential aggressors, and its northern and southern country neighbors are amicable or acquiescent to the United States. Here is a short comparison of some selected countries in South America as they relate to the United States

TABLE 3

Country Population GDP GDP to U.S. Debt/GDP

(mil.) ($ bil.)

Columbia 51 814 4.8% 26.4%

Peru 33 431 2.5 10.4

Guatemala 17 81 0.4 27.6

Ecuador 16 82 0.5 34.6

Bolivia 11 35 0.2 33.8

Panama 4 54 0.3 33.2

This table confirms that the United States is vastly larger and economically stronger than countries of South America, such that we could characterize these comparisons of the gorilla to a couple of monkeys and a bunch of chimps. In other words, America in any goal seeking contest can have its way with these countries at will. The only reasonably sized economy in South America is Brazil which has a population of 202 million, and a GDP of $3.6 trillion, and a debt to GDP ratio of 55.2%, but it has previously experienced borrower’s remorse from IMF’s loan default renegotiation.

Another important distinction to observe is that the debt to GDP ratios of all these South American countries is low relative to that of the EU and English-speaking countries. There as two likely reasons for this; the first is that their economies are evaluated such that bankers may not be keen to make loans to these credits, and because these countries have been previously damaged by taking on enticing loans which have turned out to be draconian in retrospect, and therefore these countries are resistant or unwilling to accept new loans from the World Bank or International Monetary Fund.

Historically, there was also grave danger in not accepting loans for large development projects as explained by author John Perkins in his book “Confessions of an Economic Hit Man”. He writes: “Jaime Roldos, president of Ecuador, and Omar Torrijos, president of Panama both had just died in fiery crashes. Their deaths were not accidental. They were assassinated because they opposed that fraternity of corporate, government, and banking heads whose goal is global empire.”

Competitors and Enemies

Lastly, we should compare the U.S. to some countries that it has identified as its most persistent competitors, and therefore perceived as adversaries or “enemies”.

TABLE 4

Country Population GDP GDP to U.S. Debt/GDP

(mil.) ($ bil.)

U.S. 322 17,084 100.0% 100.0%

China 1,361 11,781 69.0 18.3

Russia 140 3,429 20.0 7.9

Iran 80 653 3.8 16.5

Turkey 78 1,381 8.0 36.2

Venezuela 31 278 1.6 65.7

Argentina 43 575 3.4 36.9

The most important economic fact to note is that the United States has the largest GDP in the world by far; however, China’s economic growth rate from a low base has been higher for decades and its GDP is likely to exceed that of the U.S. in a few years. Therefore, China is potentially the only individual country that could challenge the U.S. in the future either economically, militarily or via currency war.

This observation means that China in the past was not capable of a currency war with America, and is not able to be an effective currency war challenger even at this time. Confirming this conjecture the highly credible geopolitical observer and author F. William Engdahl in his book “Target China” states “In fact the only real currency manipulator in the world today is and has been for decades the U.S. Government, not China.” Indeed thirty years ago China was an economic chimp that grew to become a monkey which is slowly evolving to a global economic gorilla. Despite America’s attempt to contain or suppress China’s economic growth (which likely is the real reason behind Trump’s tariff gambit), it cannot succeed over the longer term.

Another important observation to be made is that America’s major “enemies”, the countries of China, Russia, and Iran in recent years have been increasingly supporting each other, and have conducted some joint military exercises. Collectively these countries have enviable natural resources available, a mighty combined military, and they are building a vast business infrastructure via the RBI (Road Belt Initiative), and are building trade payment systems which bypasses SWIFT making U.S. sanctions ineffective, – yet their public debt outstanding is but a small fraction of that for the United States. Said differently, while their economies are still exposed to America’s currency war, economic tariff pressures, and sanctions by the U.S. - they actually have a sounder financial profile because their public debt is far lower than that of all the developed countries of Europe and the United States. These countries learned from harsh prior experience that they cannot permit themselves to have dollar denominated debt to any significant degree - as long as America retains its dollar global reserve currency status permitting it to print additional dollars at will and dominate interest rate changes and currency exchange values.

Financial War Strategy

One approach to a financial war is relatively simple. By appealing to a smaller undeveloped country with a promise of developing some natural resources that the country owns, a large infrastructure plan is proposed and financed. Countries are interested in developing such potential, as it should improve the economic lives of their citizens – so the sale of such a plan is not overly difficult. The projected sale of these resources is expected to pay for the financing, provide profit, jobs and income to the indigenous country citizens.

It is easy for a large country with a strong economy and a great amount of currency outstanding to overwhelm a small country and its currency. There is no contest. When there are 10 sell orders for one buy, the currency will decline. Derivatives and forex trading provides another means of controlling country exchange rates. Thus currency trading allows a dominant currency to crush another smaller country’s purchasing power. When the currency declines by half, everything the country buys from the US increases by 100%. Effectively, country debt servicing and loan payback increases also by 100%. For countries importing U.S. grains it can produce countrywide hunger and revolutions or cause existing government to be overthrown - which is usually the reason for an aggressor to implement currency destabilization operations.

Once a large development plan is in place, the interest rate and the dollar exchange rate after a couple of years can be made to develop unfavorably against the client nation. So for example, a $20 billion dollar project that has been entered into at 3% interest seems attractive to the client country. However, when the financial markets change and interest rates run up to 6% and the dollar exchange rate is made to decline by 50%, the client country experiences dire economic conditions.

Since such large numbers are difficult to relate to as to their impact, imagine what happens on an individual basis utilizing the following example: instead of the $20 billion national project, you have purchased a house for $200,000 with a 3% mortgage for 20 years. The transactions seems attractive to you, but you are exposed to an interest rate and currency conversion risk. Your personal monthly payment for this house purchase is presently $1,121. However three years later the interest rate has leaped to 6% and in addition the value of your currency in the foreign exchange market has declined by 50%. In this case your new monthly mortgage payment would be as if you had purchased a $400,000 property with a 6% mortgage. The new monthly mortgage payment is now $2,865. On a personal basis you would probably find this increase in your mortgage cost financially debilitating. The combined result of this wild price increase likely would be that you might fail to continue your mortgage payments and default on your mortgage. If such a price increase happened to many individuals, the economy would take a dive, bringing on a recession or depression. Back at the national level, a country would be facing huge price increases, and would default on its debt. Over the last several decades, the collective prior experience of smaller countries in such business deals has taught them to seek dollar financing only with great skepticism or reluctance.

Remember that the original loan is confirmed by a simple bookkeeping entry made by the bank for funds it does not own or have – therefore it is free to the bank. However, by extending credit the bank seemingly initiates a long term business commitment, but by later cutting off credit, increasing the interest rate, or crashing the currency exchange rate, it can control that nation. President Nixon’s Secretary of State Mr. Kissinger is credited as saying “If you control the money, you control the world.” How true.

The initially cheap debt was merely a vehicle for eventually establishing economic control over sovereign countries, which after default were open to debt “renegotiation” or looting. Author F. William Engdahl in his book “Gods of Money” writes “The debtor countries had been caught in a debt trap from which the only way out, offered conveniently by the creditor banks of New York and London, was to surrender their national sovereign control over their economy, especially over valuable national resources such as oil and raw materials.” This form of financial colonialism is very effective, as the borrowing country surrenders its economic policy to the lender, and this requires no military intervention.

Of course currency wars can be conducted also simply by changing interest rates, printing more currency and or by selling currency derivatives in the forex markets. When U.S. fiat currency printing causes inflation internationally, foreign countries in order to protect themselves, respond in kind by printing proportionally in their own currency. This reactive printing has resulted in a “race to the bottom”, whereby all currencies lose value in relation to real nonfinancial assets. Therefore, as currency manipulation affects imports and the ability to service and repay dollar loans, the manipulation of oil prices (or other major exports) affects a country’s revenues crashing its economy. The combination of such actions is deadly to any indebted country.

America’s global promotion of democracy and self-determination with a free market economy has proven to be an effective cover for decades to an advanced form of colonialism utilizing the global reserve dollar together with controlled international financial institutions such as the IMF and World Bank, backed by a powerful military. How else does one explain the fact that the U.S. has bases in most countries of the world, and occupying-size forces seventy years after WWII in Germany and Japan. This has the unmistakable appearance of imperialism, which has been evolving to globalism and its twin, global corporatism - thereby ultimately destroying western individual country sovereignty, culture, democracy, and ultimately personal freedom.

Currencies outstanding

It should be not surprising that the size of a country’s economy correlates somewhat with the amount of currency outstanding. The amount of currency outstanding also correlates with the amount money available in market operations and currency trading. Finally the amount of money available in trading for a specific purpose can move the market to make it so. The gorilla will win against the monkeys and chimps every time.

The following table shows current M1, cash and checking deposits outstanding of America and its three main adversaries.

Country GDP Currency Outs. Exchange Rate

($ bil.) ($ tril.)

U.S.A. $17,084 $14.4 -

China 11,781 7.7 7

Russia 3,429 .3 67

Iran 653 .1 41,981

As the holder of the global reserve currency, the U.S. produces enough fiat currency so that it is available for international trade liquidity and foreign bank reserves. Therefore, it also is a far stronger currency, dominating foreign currency exchange markets.

A Currency under attack

In human relations, one will never see a 140-pound weakling pick a fight with a 240-pound muscle-bound bully. It is equally likely that small, financially weaker countries will not start a currency war with the global hegemon. So do not expect Panama or Thailand, two economic chimps, to start a currency attack on the dollar. Thus it is more reasonable to expect that the hegemon throws its weight around, while the monkeys and chimps simply try to protect themselves, diverting attacks of the gorilla.

Over past decades there is likely no country currency which has not been under attack. A currency attack on the Bank of England several decades ago merits mention because it was carried out by the Soros Fund rather than by a country central bank. This demonstrates the huge pool of global money which is available for speculation that can and did “break the bank of England”, which produced a massive devaluation of the pound and over one billion dollars of profit to the fund.

Currency exchange experience of Iran

Since the country of Iran has been repeatedly in news over the last several years, it is an interesting case to view more closely. America first froze Iran’s dollar assets in the U.S. and imposed sanctions in 1979 after Iranians took over the U.S. embassy in Tehran and kept its U.S. employees captive for 444 days. These hostages were released on President Reagan’s inauguration day in 1982.

This seemingly irrational act by Iranians had its genesis three decades earlier when the CIA through clandestine operations overthrew the first democratically elected president of Iran who had nationalized their oil fields to benefit its people. This coup installed the pliant Mohammad Reza Shah Pahlavi who would stay in power by allowing the continued plunder of Iranian oil by both Britain and the United States. Iran has fabulous world-class oil and natural gas resources which should make its people prosperous, but they have remained poor through century-long foreign democratic country oppression.

The Shah’s rule was unpopular and required increasingly repressive police measures that led to the 1979 revolution which installed a virulently anti-American Shiite theocracy. Those who may be interested in reading more about Iran’s recent history can refer to an article entitled “Iran: Public Image Versus Historical Reality – Part 2”.

The sanctions were severe, as their intent was to limit any trade or financial transactions with the outside world and to essentially destroy their currency. Iran’s economy was/is greatly dependent on both imports and exports with its main export industries of oil shipping, shipbuilding, and transportation, which made them especially vulnerable to sanctions. Iran’s national Airline was blacklisted, as were their oil shipping facilities, while large world shipping companies were intimidated not to ship any products to Iran in order to avoid their running afoul of sanctions. Thus, unable to export or import, Iran’s economy was quickly brought to its knees.

The currency dropped drastically, increasing inflation; and in conjunction with the lack of raw materials for industrial production, their most productive industries crashed dramatically increasing unemployment. Life-saving medicines became unavailable; while milk fruit, the meat had become hard to get and expensive luxuries.

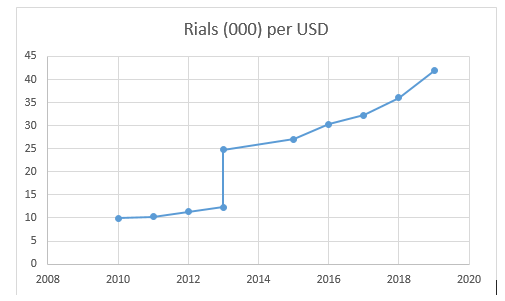

The following table shows the collapsing of Iran’s currency, the rial, over the last ten year period. We can be sure that there was a currency attack on the rial, and that in conjunction with the sanctions it was deadly effective - as shown by the following chart.

The most important thing to note in the previous chart is that over a ten year period, the cost of one U.S. dollar had increased from 9,903 to 42,025 rials – a fourfold (4.2 times) increase. It also shows the dramatic loss in currency value when a sanction is announced. This is why currency wars are highly effective, or devastating – and are hardly less damaging than a physical war, for sanctions affect millions of people, while physical war brutalizes but a fraction of inhabitants. There is zero probability that the Iranian economic chimp can escape the brutal beating by its larger relative. Currency manipulations and sanctions are modern-day wars which do unlimited damage without a rifle shot being fired. To add insult to injury, the unofficial black market exchange rate is nearly three times (110,000 rials per dollar) to that of the official rate.

Conclusions

Specific comparisons of country GDP, population, and M1 currency outstanding in this report make plain that the United States is so much larger and more powerful than every single nation on the globe except China, that these weaker countries would never pick a currency fight with America. China is not initiating or participating in a currency war as it understands its vulnerability and continues to hold over one trillion dollars in its central bank reserves. Yes, China may purchase fewer Treasury bonds going forward as the trade tariff war gains momentum, but they are acting quite restrained considering the consequential trade war initiated by president Trump.

Over the last forty years, China has amassed over eighty thousand factories, which profit-increase-seeking companies moved from the United States to China. America deindustrialized as it moved and lost significant ability to manufacture and produce locally, while this capability has grown in China expanding exports and its own economy. China’s population, being four times the size of the U.S., will eventually evolve to exceed the economic measures of today’s global leader.

At this time no single country can beat America in a currency war, nor can any retaliate against its currency war onslaught. However, China, Russia, and Iran, together with a multitude of countries which have become members of SCC (Shanghai Cooperation Council) and AIIB (Asian Investment and Infrastructure Bank) will soon escape the domination of globalist hegemony allowing small and medium-sized countries to regain increased national sovereignty. China and Russia have increased dramatically their gold banking reserves, raising the prospect for an alternative competitive future money system to become gold-backed. Such an event would change the dynamics of any currency war substantially in their favor.

The Truman doctrine, initially intended to contain the expansion of Communism, has over time morphed into a self-assumed right by the U.S. to intervene or change government in any country it does not approve. In addition, while Europe feared the Soviet Union, America was able to dictate economic policy and NATO military operations for decades. Now with that threat in reality long gone, and Europe ready to do business with Russia, China and the Middle East, it becomes far more difficult for globalists to extend their Mackinder strategies for global control.

It appears that the time and acceptance of America spreading democracy, fake self-determination, and free market economies – that is, opening themselves to outside corporate takeover has nearly run its course. Sovereign countries want to choose their own path, and not be dictated to or dominated by outside forces. So the strategy of promising democracy, self-determination, and free markets to countries which have previously responded affirmatively, only to experience harsh consequences now rings hollow. Indeed, it appears that democracy, political fulfillment of citizen dictates, and un-manipulated free markets increasingly need to be restored in America itself.

Currency wars are being conducted now, and will continue in the future. But currency wars in whatever form, whether Federal Reserve policies of money expansion and interest rate setting, foreign currency takedowns through foreign exchange markets, sanctions, manipulation of oil prices, or fake media stories intended to evoke fears of evil foreign actors, false flag operations “proving” foreign country ill intent – all of these actions are simply parts of an overall strategy intended for corporate elitists to consolidate control over sovereign country economies and ultimately their governments. Too a great degree, they have already succeeded! However, a truly interesting and promising world future awaits, as for the first time ever the world’s monkeys and chimps are banding together to standup to the gorilla.

With hindsight, introspection, and reflection of the information presented here, some may conclude that up to the present time no currency wars have taken place. Instead, since the definition of war requires two belligerents, it may be more appropriate to conclude that we have only witnessed currency attacks.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and ...

more

Yes, this is an interesting article. World cooperation advances to offset the abuser, our very own nation!

Sad but true.

EXCELLENT article! A long but worthwhile read.