Crude Oil Price Outlook: OPEC+ Meeting, Iran Talks In Focus

Crude Oil Forecast: WTI Price Hinges on OPEC+ Supply and Iran Nuclear Deal

- Crude oil price action just extended its advance for the fifth consecutive week.

- WTI crude oil prices have benefited from rising demand as economies reopen.

- OPEC+ boosting production, Iran nuclear deal progress, COVID-19 variants are risks.

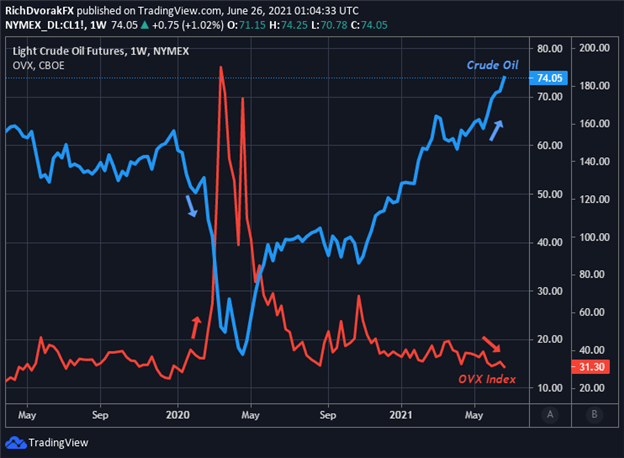

WTI crude oil price extended its rally another 3.9% last week. The commodity now trades 11.7% higher month-to-date largely thanks to surging oil demand as major economies accelerate reopening efforts into the summer. Brent oil has climbed higher in similar fashion. Iran nuclear deal discussions seem to have hit a snag as well, which reduces the threat of Iranian oil supply flooding the market. A combination of falling volatility and seasonality factors have provided bullish tailwinds, as well.

Oil prices might face downward pressure next week, however, due to the threat of OPEC+ deciding to boost production at the oil cartel’s scheduled meeting on Thursday, July 2. The primary risk to crude oil price action is if OPEC+ members and key allies, like Saudi Arabia and Russia, agree to hike output by more than the 500,000/bpd figure expected by markets.

Crude Oil Price Chart: Weekly Timeframe (April 2019 - June 2021)

Chart by @RichDvorakFX created using TradingView

That said, even with calls for more supply to counterbalance soaring demand and curb the sharp rise in WTI prices, a materially bigger-than-expected increase in OPEC+ production appears to be the less likely scenario. This is on account of recent remarks from Saudi energy minister, Prince Abdulaziz, who noted both upside and downside risks to crude oil outlook, adding that there is a need to be cautious and ensure there are ‘not any missteps.’

Specifically, Prince Abdulaziz mentioned that OPEC+ cannot ignore resurgent COVID-19 cases and new variants. Traders might be jumpy in response to leaked source reports on the OPEC+ output decision, but I suspect the market will take potential turbulence in full stride with current supply-demand imbalances seeming likely to persist.

After all, the US has tapped into crude oil inventories for five consecutive weeks now, drawing down stockpiles by a total of 30-million barrels between May 21 and June 18, according to the latest EIA data.

To be fair, though, it is worth mentioning that relatively low readings of implied volatility can suggest that the market is growing complacent. After all, volatility, much like the economy, behaves in cycles. Relatively subdued volatility levels are likely to eventually mean-revert higher, while comparatively elevated measurements of volatility are likely to normalize back lower.

This brings to light the possibility that the market may be underappreciating COVID-19-variant risks and potential headwinds to demand. That said, if market sentiment deteriorates broadly, that would likely send measures of volatility, like the OVX Index, snapping higher and crude oil price action tumbling lower in accordance with their generally strong inverse relationship.

Disclosure: See the full disclosure for DailyFX here.