Consumer Sentiment Improved In Korea, Posing Upside Risk To Near-Term Growth

Upbeat consumer sentiment suggests better-than-expected first-quarter growth

The composite consumer sentiment index has improved for the third straight month to 101.9 in February from a recent low of 97.3 in November and has been above the 100 neutral level for the second month in a row. Consumer sentiment has been holding up better than expected recently and its sub-item spending plan has also remained at 111 for the fourth month in a row, suggesting private consumption may not worsen as much as expected in the current quarter. This would be an upside risk to 0.4% quarter-on-quarter seasonally adjusted, which is our current forecast for the first quarter. We will check the month-end activity data next week and will probably revise it upward for now.

Inflation path in the last mile to its 2% target is bumpy

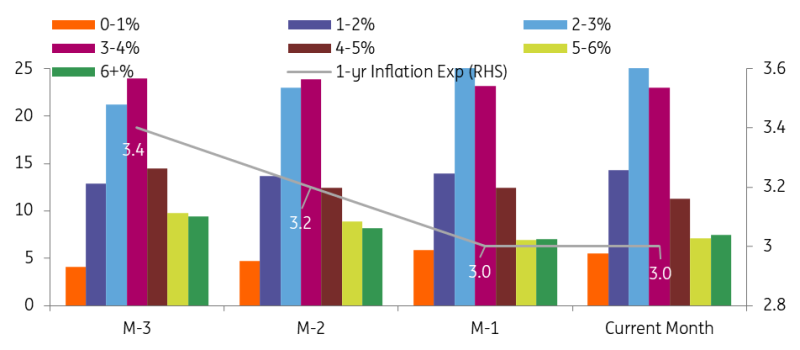

Meanwhile, inflation expectations, closely watched by the BoK, have remained at 3.0% for a second month, and perhaps the BoK hopes this will fall to the 2% level at least months before the central bank makes its first rate cut.

Also, consumer expectations for housing prices have stabilised somewhat after a sharp decline in the fourth quarter of 2023. We believe that the government’s priority housing and special loan programmes for new parents could contribute to the stabilisation. There are some small cases that apply across the entire housing market, but at least it can prevent house prices from falling further. But, this is also a major hurdle for the BoK to start the easing cycle, judging that it could further accelerate household debt growth from February.

Inflation expectations unchanged at 3.0% for the second month

Source: CEIC

Bank of Korea watch

Putting the latest price data together, the inflation path will be quite bumpy in the last mile. Fresh food prices jumped in February during the Lunar New Year holiday and gasoline prices continue to rise. We believe that the BoK won't be comfortable with the recent choppy price movements along with accelerated private debt and uncertainty ahead. Thus, we change our call for the first BoK rate cut from the second to the third quarter of 2024.

The Bank of Korea is expected to keep its policy rate at 3.5% at its meeting on Tuesday. The BoK is scheduled to release its latest quarterly outlook report on the same day. We believe the BoK’s GDP outlook may be revised upward due to recent strong exports, tight labour conditions, and optimistic survey data. For the same reason, the inflation outlook may also be revised upward.

More By This Author:

The Commodities Feed: Risk-Off ModeFX Daily: China Re-Opening Barely Causes A Ripple

Our Top Calls For The Future Of Scaling Up Hydrogen

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more