Commodity Prices Could Soar If The Russia-Ukraine Crisis Escalates

Tough Sanctions Would Rattle Commodity Markets

It appears that a number of commodity markets are starting to at least price in some geopolitical risk around the growing tension between Russia and Ukraine. There is still plenty of uncertainty over how the situation will evolve, but it is still worthwhile to look at what the potential impact could be should tensions boil over to a conflict.

A scenario where the West fails to react with tough sanctions against Russia if it were to invade Ukraine means that the potential impact for commodity markets would be more limited, although the uncertainty would still likely be bullish in the short term. There would still be a risk to Russian gas flows via Ukraine to Europe. While, depending on the scale of any invasion, it could also potentially have an impact on the production and export of Ukrainian agricultural commodities, including corn and wheat.

Reaction to any aggression could have far-reaching consequences for commodities

However, in a scenario where the West reacts strongly with sanctions that target key Russian industries, this could have a far-reaching impact on the commodities complex. It would affect more than commodity flows that go through or originate from Ukraine. It could potentially lead to a significant tightening in energy, metal, and agri markets, which would provide only a further boost to an asset class which already has an abundance of positive sentiment in it.

Even if sanctions are not imposed on certain industries, financial sanctions could still make trade difficult, as it would be an obstacle for making payments.

Energy related sanctions would hit Europe the most

Natural gas would likely receive the most attention, particularly in Europe. The region is already dealing with an extremely tight gas balance. Therefore, any further reduction in Russian gas flows to the region would leave the European market vulnerable. Russia is the dominant supplier of natural gas to Europe, with it usually making up anywhere between 40-50% of European gas imports. Pipeline flows come through several pipelines via Ukraine, the Yamal-Europe pipeline via Belarus, the Nord Stream pipeline and the TurkStream pipeline. Nord Stream 2, which is now complete, is awaiting regulatory approval before Russian gas can flow through it. However, the US has already made it clear that in the event of sanctions, Nord Stream 2 would be targeted.

It would be difficult for Europe to stomach sanctions which effectively cut off Russian gas supply, or at least a large portion of these flows, given the region’s dependency on Russian gas and the ongoing energy crisis.

Gas exports and imports

Crude oil impact

Sanctions would also be a risk for the crude oil and refined product markets. Russia is the second-largest oil producer in the world, with production averaging around 10.5MMbbls/d in 2021. Russia is currently producing below capacity, given that it is taking part in OPEC+ supply cuts. A large part of this crude is processed in domestic refiners, but a sizeable amount of it is still exported, with crude and condensate volumes averaging in the region of 5MMbbls/d. This also makes Russia the second-largest crude oil exporter after Saudi Arabia. Any potential action taken, which impacts a large share of these exports, would likely push the global market into deficit and would be extremely bullish for oil.

Europe would once again likely feel the impact the most, with around a quarter of its imports coming from Russia. While Asia, and in particular China, is a large importer of Russian oil. However, Western sanctions would unlikely have a significant impact on flows to China. In fact, sanctions could lead to increased Russian oil flows to China.

(Click on image to enlarge)

The importance of Russia and crude oil

The aluminum market: Memories of 2018

While a proposed package of sanctions from the US Democrats does not explicitly recommend specific sanctions on the metals' side, it does suggest that the US President could identify and impose sanctions on industries which he feels pose a risk to national security, which includes minerals extraction and processing.

We don’t have to go back too far to see the impact that sanctions on Russian aluminum producer, Rusal had on the global aluminum market. US sanctions against Rusal rattled the aluminum market in 2018, with Russia the largest aluminum producer, after China. Russian primary aluminum production makes up around 6% of global output, and 15% of ex-China output. The global aluminum market is in deficit at the moment and so any disruption to these flows would only push the market further into deficit. Given that Europe is a large destination for Russian aluminum, a move which restricts aluminum flows would be bullish for European premiums.

Sanctions could also possibly have an impact on output from European aluminum smelters. As we are currently seeing, smelting capacity in Europe is having to shut down due to high power prices. In a scenario, where sanctions impact Russian gas flows, this would only drive European energy prices higher, risking even further capacity restrictions in the region.

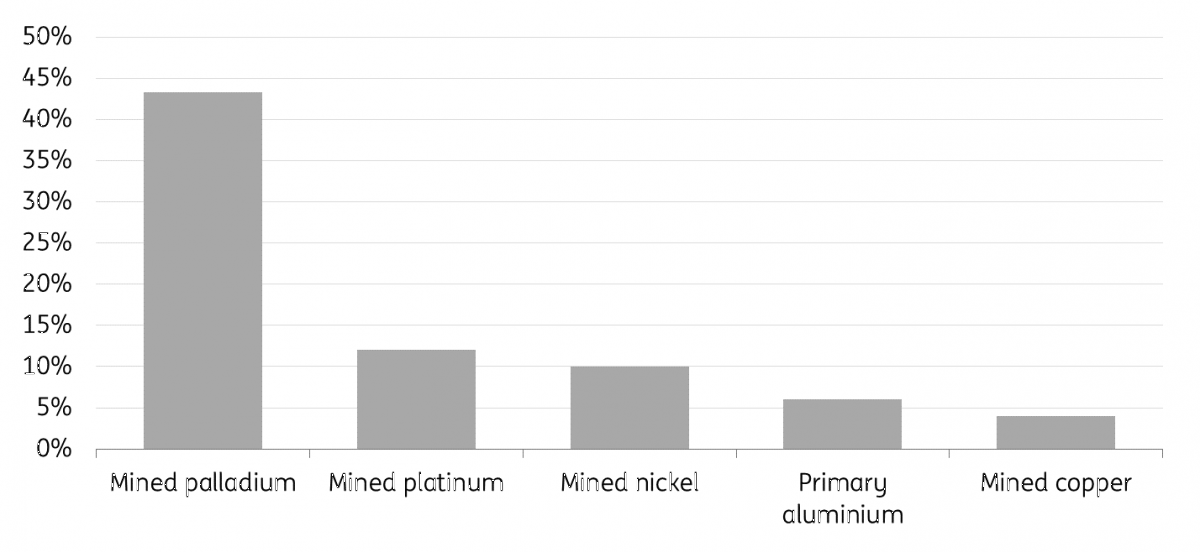

The potential impact in the metals space isn’t limited to aluminum. Russia is a sizeable producer of nickel, copper, palladium and platinum. Therefore, this could tighten up these markets significantly. Russia is the world's largest palladium producer, while it is also an important nickel producer, a market in which there are already concerns over tightness, given the strong demand dynamics.

(Click on image to enlarge)

Russian share in global production for selected metals (%)

Russia is the world's largest wheat exporter

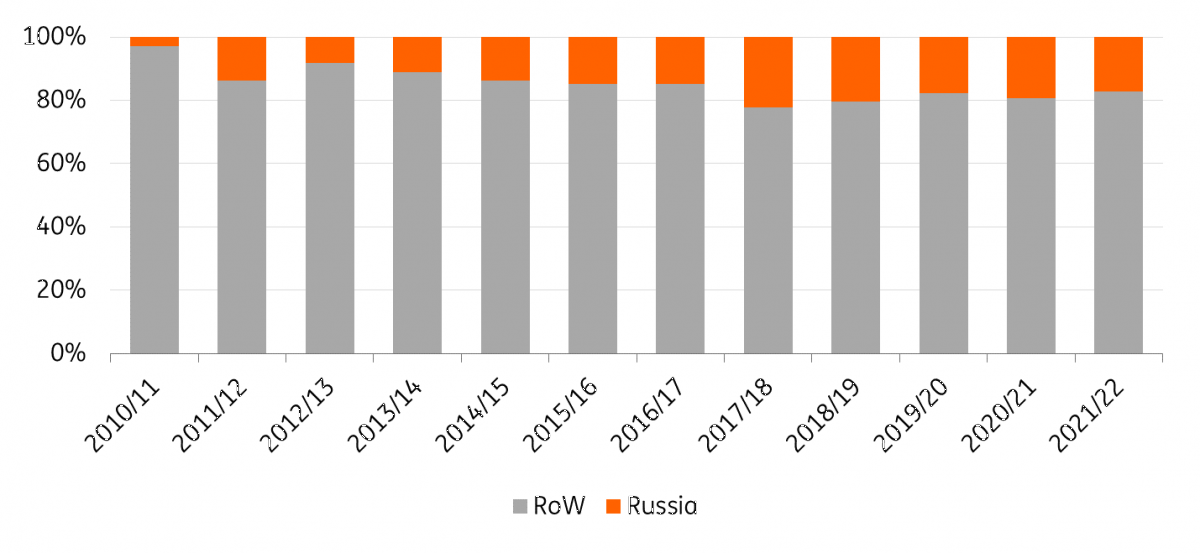

In recent years, Russia has climbed the ranks to become the largest wheat exporter in the world. The country has produced more than 85mt a season in recent years, and annual exports amount to close to 40mt, which makes up almost 20% of global wheat trade. Turkey and Egypt are amongst the largest buyers of Russian wheat, according to recent trade data.

In the proposed sanction package from the US Democrats, the food & agricultural industry is not mentioned. However, sanctions against financial institutions (and possibly even cutting Russia off from the SWIFT system) could make trade more difficult. Therefore, tough sanctions could still have an impact on agri exports, even if they're not specifically sanctioned.

(Click on image to enlarge)

Russia’s share in global wheat trade (%)

As we write this, talks are taking place in Geneva between the US Secretary of State and the Russian Foreign Minister. America has warned Moscow there'd be grave consequences if any of its forces moved into Ukraine. Few people are expecting any major breakthrough today, but at least both sides are talking.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more