Chugging Along

In the last three months, the Canadian equity market climbed another three percentage points, bringing the S&P/TSX Composite Index up to an impressive 20.4% YTD through Sept. 16, 2021. In a strong bull market environment, low volatility indices are expected to lag—and they typically have. But overall, the S&P/TSX Composite Low Volatility Index has held its own, gaining 18.8% YTD, just a 1.6% shortfall.

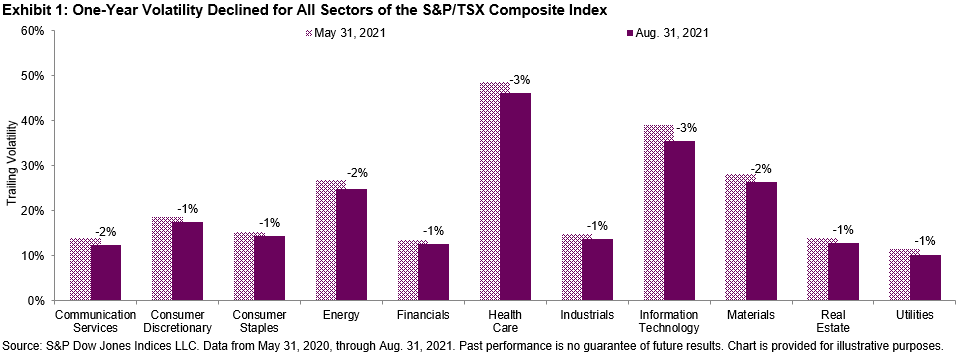

It’s perhaps also no surprise that one-year volatility levels continue to decline (across all GICS® sectors). Health Care remains the most volatile sector, with Information Technology close behind.

The S&P/TSX Composite Low Volatility Index seeks out the lowest volatility at the stock level, but we often look to sector volatility for insights into the dynamics that drive allocations within the index.

The latest rebalance for the S&P/TSX Composite Low Volatility Index was effective following the close of trading on Sept. 17, 2021. Changes in the index were minimal, but that’s not surprising given what we’ve seen in the sector volatility changes. Financials, Real Estate, and Utilities continue to add weight in the index and are the three largest sectors. Most of the increase came at the expense of Industrials, whose weight declined to 7% from 13%. Health Care, which represents 1% of the S&P/TSX Composite, has no weight in the low volatility index.

Disclaimer: Copyright © 2021 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. Please ...

more