Chinese Stocks Tumble After Beijing Vows To Crack Down On Surging Commodity Prices

With tech stocks tumbling in the past week amid surging inflation fears, at least the commodity sector appears safe from the global reflationary risk-off wave that swept across markets. But maybe not anymore: overnight Chinese stocks slumped, tracking losses in U.S. shares on much higher-than-expected inflation data there, as the materials sector tumbled after the government called for measures to deal with “overly fast” commodity price rises.

China will monitor changes in overseas and domestic markets and effectively cope with a fast increase in commodity prices, the state-run Xinhua news agency reported, citing a meeting of the State Council, the country’s cabinet, on Wednesday according to Reuters. According to the report, the state will step up coordination between monetary policy and other policies to maintain stable economic operations, the cabinet also said, as reported by state television.

The verbal intervention took place as prices for commodities such as copper (JJC), coal (KOL) and steelmaking raw material iron ore extended recent rallies to hit all-time highs this week on concerns a post-coronavirus pandemic demand rebound in China is outpacing supply. China is the world’s biggest market for copper, coal and iron ore and consumers face much higher costs as some analysts expect a commodities “super-cycle”.

And while the cabinet did not say how it would cope with the rise in commodity prices, we are confident that the centrally-planned surveillance state can do literally anything it wants or needs, to achieve its goals.

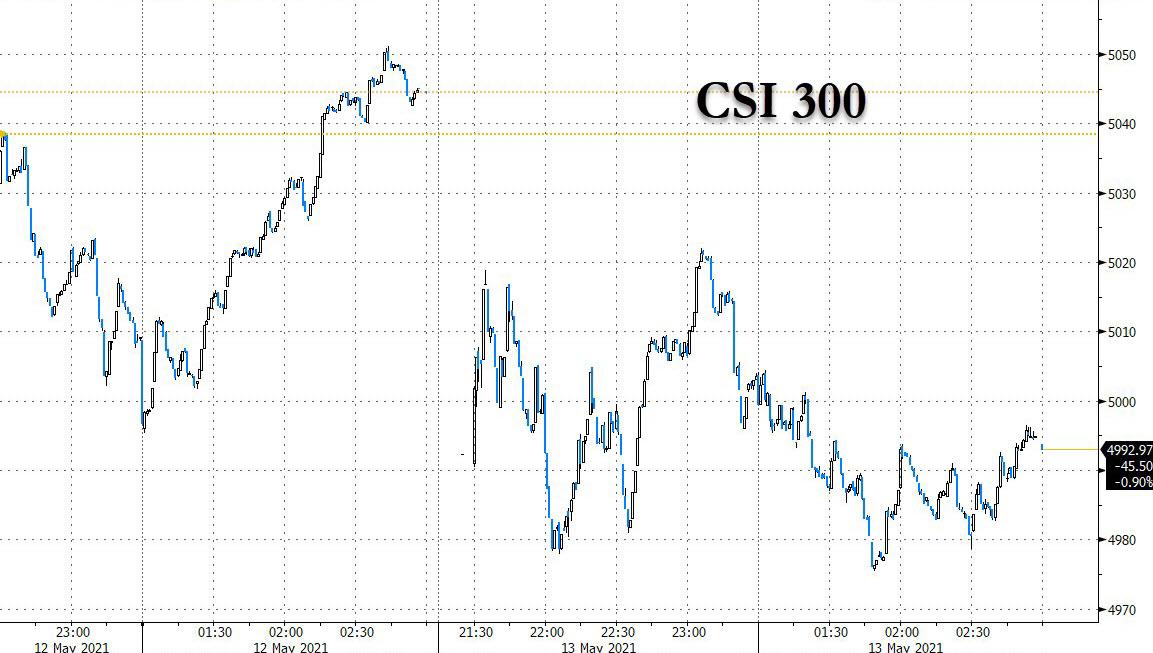

In response to the government warning, the benchmark CSI 300 Index ended 1% lower, dragged by a 4.2% plunge in the materials sub-gauge that was its largest in seven weeks.

The 10 biggest decliners in the main index were all from the materials sector, with Aluminum Corp of China sinking 9.2% to be the worst performer. Consumer discretionary shares were down 2.7%, with Gongniu Group among the biggest laggards after the company said it was under monopolistic probe by a local government.

The news displeased foreign investors who sold a net 5.6 billion yuan (CYB) worth of mainland stocks via the trading links with Hong Kong, the most since March 31, according to Bloomberg.

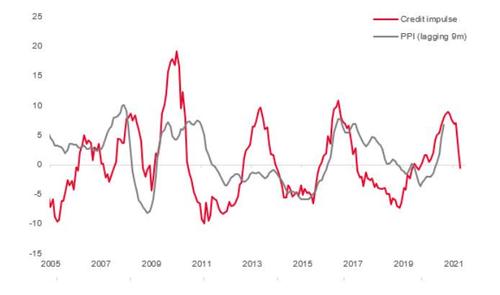

Separately, the government’s tapering of pandemic-related stimulus looks to be showing effect, with growth in total social financing slowing in April to the weakest since March 2020, the latest official data showed, confirming perhaps the most ominous trend in global finance: China's credit impulse is collapsing and is about to drag the global reflationary wave down with it.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more