Chinese PMI Unexpectedly Slows To 19-Month Low In February

Manufacturing activity in the world’s second-largest economy slowed in February due to the Lunar New Year and implemented policies affecting business activities.

The Manufacturing PMI stood at 50.3 in February, lower than the 51.3 obtained in January and 51.2 projected by economists, China’s National Bureau of Statistics reported. The lowest in 19-month.

A reading above 50 indicates expansion and vice versa.

While the bureau official Zhao Qinghe claimed the number was affected by the New Year holidays that slowdown business activity down during the month, some experts believe the Wednesday report still point to a clear slowdown in business activities in the first quarter of 2018. This, they attributed to softening demand and drop in new overseas orders due to China’s credit control policy instituted to curb escalating debt issue.

This was because the services PMI also dropped from 55.3 in January to 54.4 in February, validating economists prediction that crack down on industries to cut extreme pollution amid financial leverage control will slow down Chinese economy in 2018 despite the strong growth recorded in 2017.

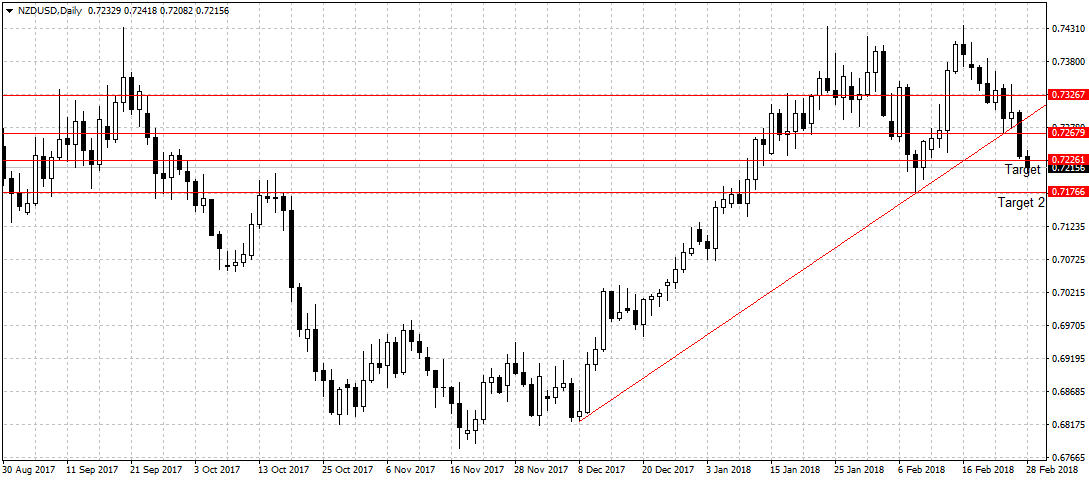

The New Zealand dollar that depends on China’s economic growth dipped against the U.S. dollar as projected in the forex weekly outlook.

Powell must be ignoring all this stuff. Protect the collateral even if inflation is phantom-like.

If Powell failed to adhere to market expectation yesterday. Not just the equity will tumble, fixed income market will do too. Mario Draghi, ECB president situation was different, he has been insisting on stimulus continuity, saying it is necessary to support the economy until inflation reach 2 percent target. Hence, he was able to build on that yesterday to weaken Euro outlook against the dollar for favourable exports. In the U.S. it is different.

Too true.