China’s Weak Credit Growth At Start Of Year Signals More Room For Policy Support

Image Source: Unsplash

Credit indicators showed weak activity in the first two months of the year

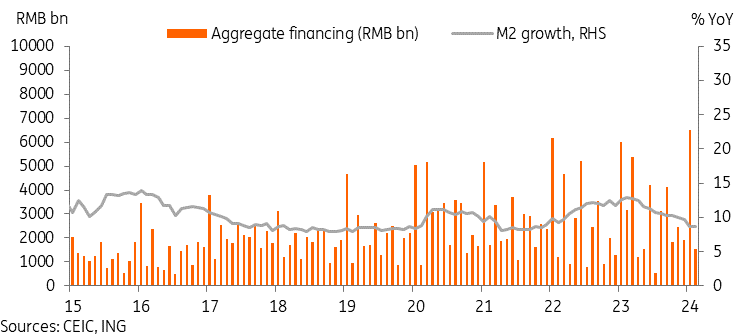

The People’s Bank of China published credit indicators for February after the Friday market close. Unlike the usual monthly release, the PBoC released data in a year-to-date form, likely to avoid the distortion from seasonality. For the first two months of the year, aggregate financing was down RMB 1.1tn or around -12% year-on-year and new RMB loans were down around RMB 930bn or -13.8% YoY.

On the surface, February's data was disappointing, with aggregate financing down from RMB 6.50tn to RMB 1.56tn, and new loans down from RMB 4.84tn to RMB 979.9bn. The sequential decline in February was well expected as January is historically the strongest month of the year, but this data also saw notable declines in YoY terms due to seasonality. Both measures came in weaker than market forecasts. Credit data tends to be a volatile indicator at the best of times, and the noise in the data is usually significant in the first few months of the year. Last year's data may have been stronger than usual due to increased loan demand after pandemic restrictions were lifted. As such, it is helpful to look at the overall trend, which had been recovering in the second half of 2023, before a weaker-than-expected start to the first two months of the year bucked that trend.

By subcategory, the silver linings were seen in foreign currency loans, trust loans, and corporate bonds, all of which were up in the first two months of the year compared to 2023. However, slowdowns in new RMB loans and equity financing outweighed these gains.

Relatively muted credit indicators for February showed that the 50bp required reserve ratio (RRR) cut effective 5 February did not appear to have significantly boosted lending. Although the PBoC has signalled further RRR cuts to come, a lack of high-quality borrowing demand could limit the effectiveness of RRR cuts in stimulating the economy. Next month’s data should be more useful in ascertaining if the sluggish new loans were mostly due to the holiday season or weak borrowing demand, and if the previously strong trend has reversed.

China aggregate financing slowed in the first two months of the year

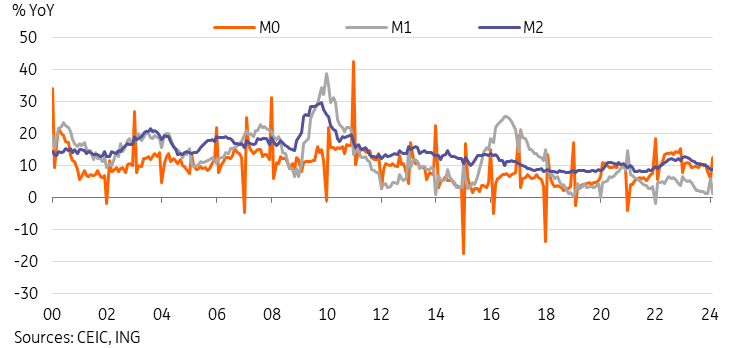

Money supply growth was stable, but breakdown a possible warning sign for consumption

February M2 growth was unchanged from January’s 8.7% YoY. Overall, despite efforts to expand credit supply over the past half year or so, M2 growth has been trending down gradually after peaking in 1Q23, and is currently lower than the long-term averages for the past 5-10 years.

M0 growth fared better on the month, up 12.5% YoY to reach a 14-month high. M1 growth, in contrast, dropped to a 25-month low of 1.2% YoY. A relatively low M1 growth versus M2 growth may indicate consumers have elected to keep more time deposits rather than demand deposits, signalling that consumers may not be planning to spend this money in the near term amid weak consumer confidence.

China money supply growth

Sluggish credit data showed that Chinese banks remained under pressure to start the year

A slow start for lending at the start of the year adds to the pressure on Chinese banks. Commercial bank net interest margins already fell to historical lows of 1.692% at the end of 2023, and the 25bp cut to the five-year loan prime rate in February will likely further pressure margins in the months ahead. Potential further rate cuts to come would likely add to this pressure.

Non-performing loans have also risen significantly in the last several years, and although the official NPL ratio remained low at just 1.6%, this could pick up further as banks offer financing for risky real estate firms; Chinese banks have already and will continue to extend loans to whitelisted property projects to support the stabilisation of the real estate sector, which is of vital importance for overall economic stability.

More By This Author:

Key Events In EMEA For The Week Of March 18Bank Of England To Sit Tight And Await Crucial April Inflation Data

The Commodities Feed: IEA Sees Tighter Oil Market

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more