China’s Recovery Is Not Much Of A Surprise

Strong consumption during the January holidays eased back in February and infrastructure spending is not growing robustly, either. This hints at only a gradual continuation of the recovery in February. We expect this will persist until March, after which, the Two Sessions will provide us with further clues.

Source: Shutterstock / Jabil Wuxi electronics factory in China - 21 Feb 2023

China's recovery is not a big event, yet

China's economic reopening appears to be a gradual one. Consumption was very strong during the holidays in January but was more subdued in February. We have not seen 'revenge' spending. This is especially true in the car market as subsidies for electric vehicles have ended. We also do not expect strong handset sales in February as many people bought new handsets during the recent holidays.

Nevertheless, we believe that consumption strength is increasing following an improving jobs market. After the Chinese New Year, more people landed jobs in the services sector. And wages in factories have generally increased. This should have a positive knock-on effect on the jobs market in the services sector and China could experience a rising wage spiral in the first half of 2023.

Infrastructure is lagging as the second growth engine

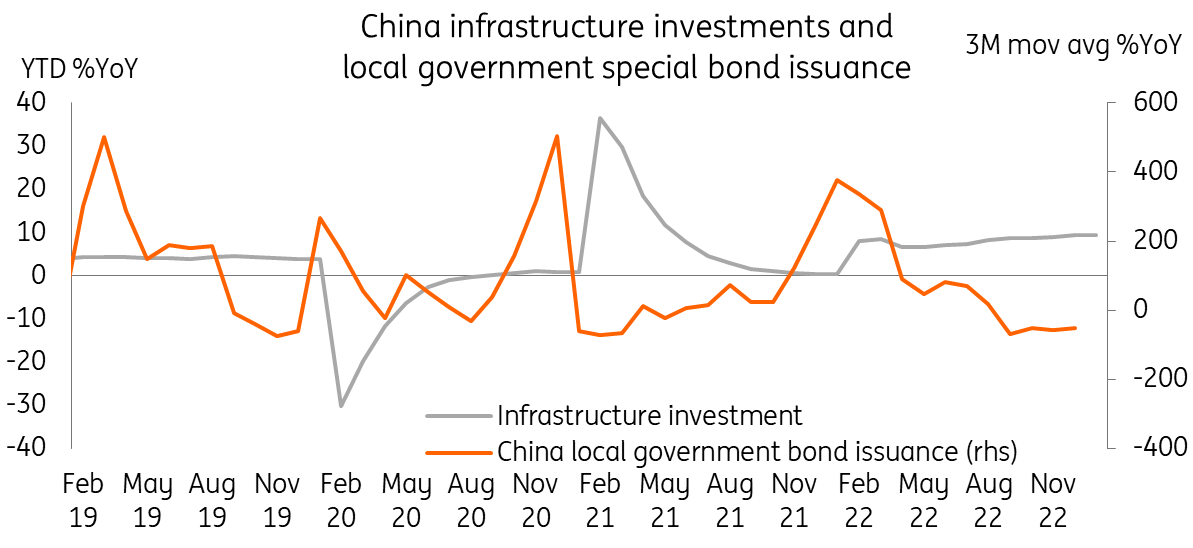

We have not yet seen the infrastructure investment data from the government. But media reports do not suggest a lot of new infrastructure projects from local governments. This might be related to the change of government personnel at the Two Sessions. If so, we should note from the Two Sessions: 1) the scale of new issuance of local government special bonds, which we expect to be CNY4 trillion; and 2) which sub-sectors within infrastructure should receive the most government money.

For the latter, we believe that environmental, social, and corporate governance (ESG) infrastructure and technology research and development infrastructure will be prioritized over brand-new transport infrastructure.

Infrastructure and local government bonds

(Click on image to enlarge)

Source: CEIC, ING

All eyes on the Two Sessions

There will be a lot of attention on the Two Sessions given that it is a year of new government personnel even though President Xi Jinping remains the leader. And the country faces more geopolitical tensions with various parts of the world. In addition, it is a year of recovery. The Two Sessions will give us many hints on policy direction, and how that will affect different sectors.

You can read our Two Session preview here.

Given the gradual pick-up of the economy, we are keeping our GDP forecast for 2023 at 5%.

More By This Author:

The Commodities Feed: US Oil Inventory Increases Further

FX Daily: Caught Between Inflation And A Recovery

Rates Spark: Inversion Stretches Deeper

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more