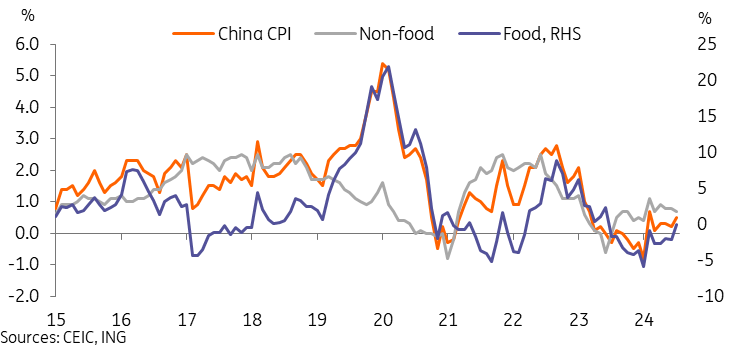

China’s CPI Inflation Rebounded Due To A Smaller Drag From Food Prices

CPI inflation rebounded to 5-month high in July

China's CPI inflation came in at 0.5% YoY, which matched our forecast for the month, but was a little higher than consensus forecasts of 0.3% YoY.

A big part of the increase was due to food prices finally ending deflation to return to a flat 0.0% YoY level thanks to a 1.2% MoM gain. Food inflation had been in negative territory and the main drag on inflation for the 12 prior months. In July, there were still various food products such as fruits (-4.2%), dairy (-1.9%), beef (-12.9%) and mutton (-6.3%) seeing negative YoY growth, but a rise in pork (20.4%) and vegetable prices (3.3%) drove overall prices higher. Pork prices saw the fastest YoY growth since 2022 and high-frequency data show prices still on an upward trajectory.

In contrast, non-food inflation actually moderated slightly to 0.7% YoY. There are three main drags on non-food prices currently: first, transportation facilities (-5.6%) are seeing negative growth due to price competition in the auto sector leading to cheaper vehicles for sale. Second, communications facilities (-2.1%) also declined thanks to falling smartphone prices. Third, rents (-0.3%) are also falling amid continued weakness in the property market. We expect price weakness to remain in the first two categories, while we are in wait-and-see mode on the rent category as policy support for the real estate market continues to roll out.

Conditions are in place to see inflation trend a little higher in the coming months but it should not impede further monetary easing. With low inflation and weak credit activity, domestic factors continue to favour further monetary policy easing. We continue to look for at least one more rate cut this year with the potential for more if global rate cuts accelerate.

CPI inflation recovered due to a smaller drag from food prices

More By This Author:

RBNZ Preview: Hold Now, Bigger Cuts Later?

July Brings A Surplus In The Hungarian Budget

FX Daily: Upside Gaps Filled, Now What?

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more