China Yuan Swaps Soar Amid Fears Evergrande Default Will Lead To Liquidity Crisis

The initial contagion from the upcoming default of Evergrande, which after the company's hiring of bankruptcy advisor Houlihan Lokey is just a matter of days, is starting to emerge.

China’s one-year onshore swap curves surged to the highest in almost four years, signaling market worries over liquidity shortage on potential default by a key property developer Evergrande. Interbank borrowing costs also rise ahead of the central bank’s medium-term lending facility operation on Wednesday.

As Bloomberg notes the 1-year dollar-yuan onshore swap - a gauge of funding costs for the Chinese currency via the foreign exchange market - surged as high as 1,843 pips Tuesday, the highest in almost four years.

"Considering huge uncertainties over the key developer’s bond default and the possible spillover to the property sector, market participants might intend to swap more CNH and CNY liquidity in the FX swap market (sell/buy USD against yuan),” said Ken Cheung, Chief Asian FX Strategist at Mizuho.

While one would be hard-pressed top find any fears in US assets, Cheung notes that traders might be preparing for “the liquidity squeeze in crisis mode” adding that a full-blown bankruptcy would trigger a domino effect of defaults in its bonds and wealth management products, or as he put it in terms so simple even those who were in diapers when Lehamn filed, “the collapse of credit would lead to a liquidity squeeze in financial markets."

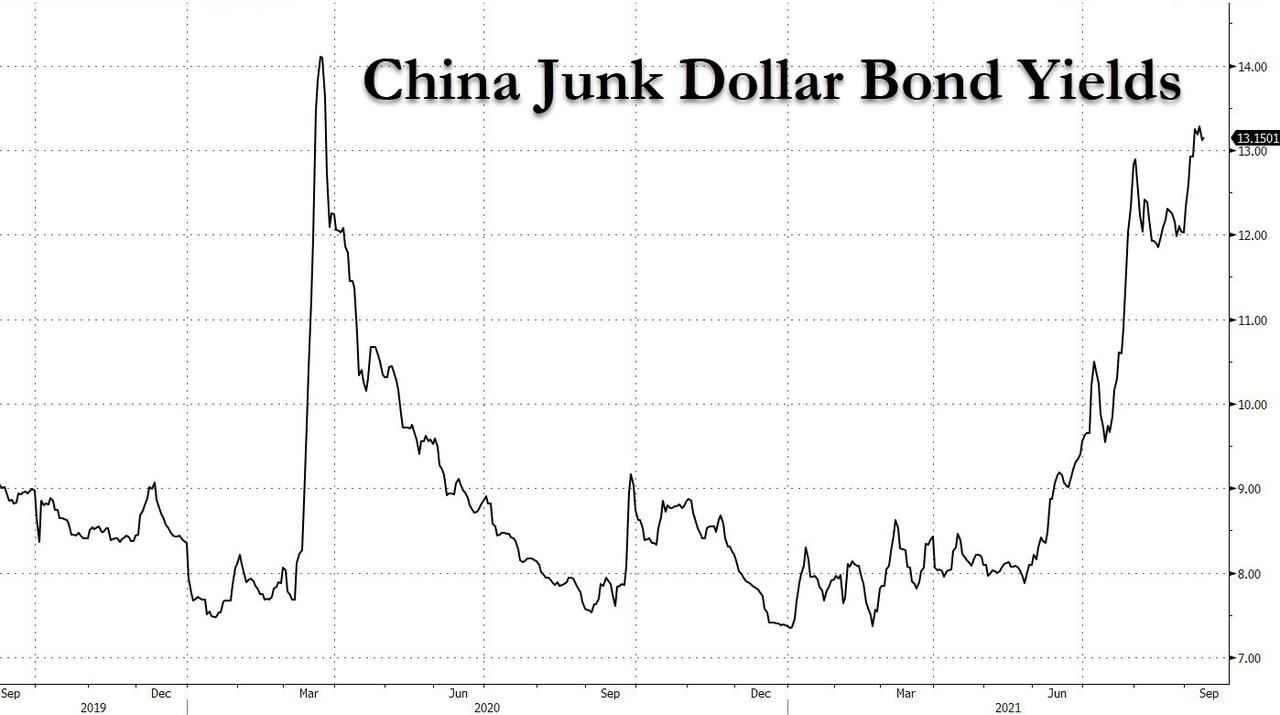

While funding markets are only now starting to reflect Evergrande default fears, the contagion across China's credit market has been visible for weeks, with local junk bond yields surging to the highest since the covid crash.

Not helping market liquidity is traders confusion over how much of the 600BN yuan in medium-term loans maturing on Wednesday will be rolled over by the PBOC, any liquidity drains by the central bank will lead to even tighter funding conditions and could accelerate the collapse in one or more Chinese companies.

“A partial rollover looks likely given that the 7-day repo rate remains pretty stable and the PBOC will only act when the 7-day moves,” said Hao Zhou senior emerging economist at Commerzbank in Singapore, adding that “the central bank will need more weakening signals to move on rates so maybe next month is a better time window with the Q3 GDP report due.”

His conclusion: “Evergrande hasn’t had a big impact on the interbank market yet.” That will change very fast once the company officially files.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more