China To Sell 7.38 Million Barrels Of Crude From State Reserve

As previewed previously, moments ago - as expected - China’s National Food and Strategic Reserves Administration said in a statement that it would auction 7.38 million barrels of oil from state reserve on September 24. The news led to a modest dip in oil which however was followed by an immediate bounce.

(Click on image to enlarge)

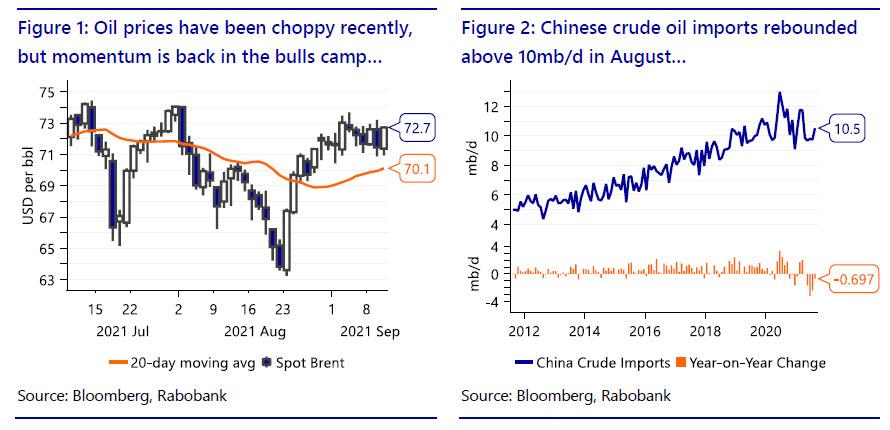

As Rabobank's Ryan Fitzmaurice explained over the weekend, China, the world’s biggest oil importer, attempted to pressure oil prices lower this week by announcing a release of crude oil from its Strategic Petroleum Reserve (SPR). The move signalled political vulnerability to rising commodity price inflation, but even more so, it is not enough physical supply to move the dial.

Some more observations from the Rabo energy analyst:

The oil market was strong in the early part of the week, but came under selling pressure on Thursday as news of China releasing oil from its strategic reserve (SPR) hit the wires. Ironically, the move comes on the heels of President Biden indicating he was also considering releasing crude oil from the US strategic reserve in the wake of Hurricane Ida in addition to pleading with OPEC+ to pump more oil in the weeks before the storm.

In the end, a US release made no sense as a significant portion of refining capacity was also knocked offline along with crude production. Nonetheless, the move by China, the world’s biggest crude oil and commodity importer, was no doubt designed to ease upward price pressures on rising oil import costs, however, it is unlikely to have the desired effect, as we see it.

For starters, it signals political vulnerability to commodity inflation just as Biden’s earlier plea to OPEC+ did, and even more so, it is not enough physical supply to move the dial and only partially offsets the drop in US production since the storm hit. Initial reports are suggesting that about 22mb will be released which is roughly two days’ worth of oil imports for China or just a couple hours’ worth of daily global demand. On top of that, the release reduces the amount of oil available for a true supply-side emergency and, as such, will have to be refilled in the not too distant future and potentially at higher prices.

Finally, large systematic traders have begun rebuilding "long" oil positions as can be seen in the latest market positioning and open interest data and these funds only react to quantitative signals for the most part, so the SPR release is unlikely to slow their buying programs.

Looking forward

Looking forward, we see China’s recent attempt at pressuring oil prices lower as futile and likely to be overwhelmed by financial futures flows given the bullish quantitative market signals and global inflation risks at play. Furthermore, the recent increases in aggregate futures open interest data is encouraging and signals to us that the herd movement of systematic funds is already underway, That being said, we see scope for significantly more speculative buying to occur in the months ahead given the current underinvestment in oil futures, especially in light of all the money that has been pumped into financial markets over the past 18 months. As such, we see more upside risks to oil prices than downside, particularly in the deferred contracts as inflation takes hold.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more

Certainly with all of those refinerys shut down because of the hurricane, the supply will drop and prices would rise. And the China government must be rather desperate to dump their emergency supply in an effort to bring prices back down. And of course our president asking OPEC to sell more oil was a wrong move. Nature will take it's course and the price will rise bit and then production will increase to take advantage of the higher price, which, hopefully, will bring the price back down. I HOPE.