China, The Absolute Master Of The Silver Market

Image Source: Pixabay

I have been studying the silver market for more than 15 years, day after day. The text below blends established facts with hypotheses that today appear increasingly credible.

After the Nixon–Mao meeting in 1972, China reopened its economy and began its modernization. Among the major transformations, it built ultramodern ore ports and refineries equipped with the most advanced technologies. Thanks to a unique combination of extremely low labor costs and cutting-edge facilities, China very quickly offered unbeatable prices for processing ore from world mines into metal. By the late 1990s, Chinese refineries were producing nearly 80% of the world’s silver. Even today, they are believed to account for between 65% and 70% of that production.

In 1950, the U.S. Treasury still held nearly 2,000 million ounces (Moz) of silver. Over the decades, much of this stock was released onto the markets in an attempt to contain the price of a metal that had served for centuries as the global monetary standard. To such an extent that by 2002, the Treasury had only 200 Moz left in reserve… and two years later, they were gone.

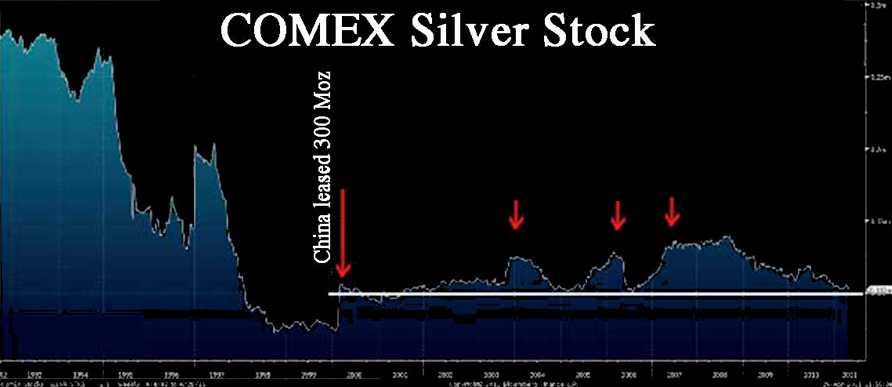

It was in this context that, under the impetus of Timothy Geithner, then president of the New York Federal Reserve, the United States officially borrowed 300 Moz of silver from China — perhaps more, as the exact volume remains unknown — using Treasury bonds as collateral. According to the terms of the agreement signed with the Fed, China could demand the return of these millions of ounces at any time after a four-year period.

As shown in the chart below, this borrowed silver was used to replenish COMEX stocks.

How Did J.P. Morgan Enter the Silver Market?

The hedge fund LTCM was heavily shorting gold, using massive leverage. When Russia defaulted on its debt in 1998, the price of gold surged, triggering the collapse of the fund. To prevent a systemic crisis, the New York Federal Reserve then asked major Western banks to cover LTCM’s losses. All agreed… except Bear Stearns, then the fifth-largest bank on Wall Street. A refusal that would not be forgotten.

Bear Stearns was China’s main partner for offloading physical silver onto international markets, which explained its very large short positions. In 2007–2008, the bank was massively exposed to Mortgage-Backed Securities and thus on the front line of the subprime crisis. The New York Fed allowed Bear Stearns to stumble, precipitating its failure and the sale of its assets to JPMorgan (JPM).

Because Bear Stearns was “long” gold, JPMorgan was able to use that position to cover its own shorts. However, JPM also inherited Bear Stearns’ short positions in silver, which were in reality nothing more than a hedge against China’s silver exports.

The United States Defaults

In June 2009, when China officially requested the return of the 300 Moz (or more) of silver it had leased to the United States, Timothy Geithner — then head of the New York Federal Reserve and China’s direct interlocutor — replied that it was impossible to return the metal. He added: “But you have treasury bonds as collateral, keep them.”

The problem: the original contract explicitly required repayment in physical silver — not in paper.

Through the financial conglomerate CITIC, China asked JPM to sell 300 Moz of silver on COMEX futures, following the usual procedures. Meanwhile, Beijing quietly repurchased the same amount of silver in London via Asian hedge funds, taking advantage of the depressed prices caused by the massive selling in New York.

In London, a buyer may demand delivery 48 hours after purchase. Well informed about incoming shipments of metal into London warehouses, China then launched a series of coordinated raids to recover physically every bar that arrived.

When COMEX authorities demanded that JPM supply the metal corresponding to the futures sales, the bank turned to CITIC to ask it to arrange delivery of the promised silver. This is when CITIC presented JPM with a document proving that the 300 Moz had already been delivered… to the New York Federal Reserve. It was therefore up to JPM to collect the silver from the Fed, which was contractually required to honor its own commitment.

At the same time, on August 31, 2009, China announced that it would allow its companies to default on all Western commodity-linked derivatives. A thunderbolt — and a disaster for JPM.

Caught in an extremely violent short squeeze, JPM saw the price of silver soar from $8.50 to $49.50 in April 2011. With the hidden leverage of derivatives, this price explosion could even have pushed the bank into a systemic collapse, Lehman-style.

These facts are established.

The central question remains: how did JPM’s CEO avoid bankruptcy?

Were there secret agreements with China, similar to those that saved HSBC in 2021? (See here)

Here Are More Facts and a Few Hypotheses

On February 1, 2011, Xia Bin, one of the influential officials of the Chinese central bank, stated that “China must increase its gold and silver reserves,” even specifying that this should be done “by buying the dips.”

Two months later, in April 2011, COMEX abruptly changed its trading rules, massively raising margin requirements on silver. This decision allowed JPM to exit — at least on the surface — a situation that had become critical. This is actually the only element most observers remembered, conveniently forgetting the debt owed to China.

JPM still had to deliver hundreds of millions of ounces of silver to COMEX… yet no one spoke of it again.

Verifiable facts:

- In December 2011, ICBC became the first Chinese bank to join the LBMA.

- In 2013, JPM sold 1 Chase Manhattan Plaza to the Chinese conglomerate Fosun. The building’s basement houses one of the largest vaults in the world, separated only by the width of a street from the New York Fed’s vaults where its gold is stored.

- In early 2016, ICBC took over the vault operations of Deutsche Bank.

- In May 2016, it also purchased Barclays’ vault.

- ICBC then applied to join the London Daily Fixing, alongside JPM, HSBC, Scotia, Barclays and UBS.

In parallel:

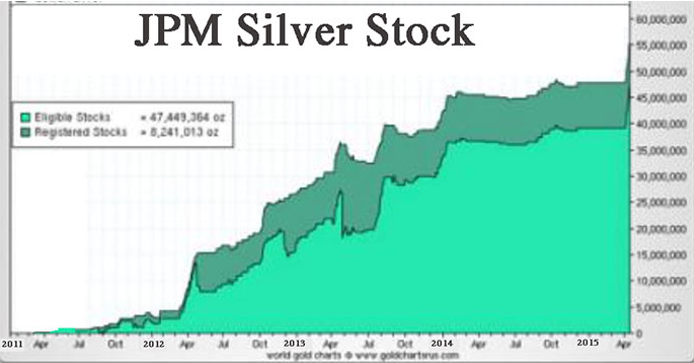

As of May 2011, JPM officially began accumulating massive quantities of physical silver.

Surprising, isn’t it?

In 2025, JPM is credited with a colossal stock of 750 Moz of physical silver.

I believe that JPM is storing this physical silver on behalf of a client — and that this client is, indirectly, the Chinese Treasury itself.

Blythe Masters, then head of global commodities trading at JPM, even stated the following in April 2012 on CNBC:

"JP Morgan Chase is not in the commodities speculation business. It’s not part of our business model. It would be wrong and we don’t do it. The misperception, rampant in the blogosphere, comes from what JPMorgan does for clients.

We store significant amounts of commodities, for instance silver, on behalf of customers. We operate vaults in New York City, in Singapore and in London. Often when customers have that metal stored in our facilities they hedge it on a forward basis through JPMorgan, which in turn hedges in the commodities market.

If you see only the hedges and our activity in the futures market but you aren’t aware of the underlying client position that we’re hedging, then it would suggest inaccurately that we’re running a large directional position. In fact that’s not the case at all. We have offsetting positions. We have no stake in whether prices rise or decline.”

A portion of the silver stored by JPM is leased, notably to the iShares Silver Trust for the SLV ETF. This mechanism allows the silver stock to generate income, which offsets storage and insurance costs.

I have already explained in this article how China pressured HSBC in 2020 and 2021, forcing the bank to push silver prices downward. As soon as HSBC stopped selling, prices surged.

These maneuvers enabled ICBC and the eight other major Chinese banks to acquire, in recent years, massive quantities of silver at rock-bottom prices on the LBMA — even though the market was in a deficit.

I believe that a large part of the silver bought by Chinese banks is still stored in LBMA-approved vaults around London. This creates an illusion of abundance, even though this silver… is not for sale.

The evidence is unmistakable: in October, despite a reported stock of 844 Moz (26,375 tonnes), the LBMA was unable to deliver even 1,000 tonnes to India on October 8. And this caused the entire market to freeze!

It is therefore entirely plausible that most of the silver declared by the LBMA — whether attributed to SLV, allegedly linked to JPM, or stored in the various vaults operated by ICBC — actually belongs to the Chinese.

Today, China appears to be the absolute master of the silver market.

The directives recently published by Beijing — as detailed in this article — clearly show its intention to retake full control of this market and revalue the metal to levels many multiples above its initial price.

In recent days, several major banks — JPM, HSBC, Scotia, BNP Paribas — seem to have withdrawn from the COMEX silver market, leaving the platform in disarray. While 60 Moz are due for delivery, the stocks actually available do not exceed 19 Moz. The 23 Moz that were supposed to be shipped from China in early January have also remained blocked in Chinese ports. To make matters worse, Beijing declined — during an emergency meeting on December 31 between the CFTC, JPM and the SGE in Shanghai — the U.S. request for a 50-Moz loan to stabilize COMEX.

“Fool me once, shame on you. Fool me twice, shame on me,” as the Americans say.

During a virtual emergency meeting held on December 25 — bringing together the chair of the LBMA, the head of the CME, representatives of the CFTC, several major banks, and an emissary from the U.S. Treasury — the latter had already expressed a major concern: the “small” silver market risked becoming the trigger for a systemic monetary crisis.

Since then, everything suggests the situation has deteriorated even further.

More By This Author:

Gold Ratio Charts Suggest Much Higher Prices AheadFinance Celebrates 2025, But Gold Is Already Pricing In 2026

A Yuan Pegged To Gold In 2026?

Disclosure: GoldBroker.com, all rights reserved.