China ‘’Sweeps” The Commodity Market After The Oil, Metals, And Food Prices Plunge

Image Source: Pexels

Ipek Ozkardeskaya, an analyst at Swisspuote Bank emphasizes that the economy will possibly suffer more either because of the endless and meaningless containment measures or because of the health crisis. The international commodity market is reeling, while China is plagued by massive protests against lockdowns and the “zero tolerance” policy against Covid-19. A situation that threatens the economic activity of the country (No.2 economy worldwide) and sinks the demand for energy, food, and raw materials.

It is no coincidence that the price of oil fell on Monday to its lowest level since December 2021, as investors fear the risk of falling consumption in the world’s biggest crude importer. And all this, while the global market is not going through the best days. WTI contracts in the US, for example, slipped to levels of $74 per barrel, while Brent contracts in Europe fell to $80 per barrel, the lowest point in the last year.

(Click on image to enlarge)

Losses are also seen in base metal prices, with copper contracts down 1.7% and iron ore down 2%. Cooking oil, meanwhile, fell 3% in the Asian market, amid concerns about a slump in demand in restaurants and hotels. It should be noted that China is the largest importer of a range of goods, from oil and iron to soybeans and copper. Since the demand had already decreased in the previous period due to the slowdown of the economy, the negative impact of what is happening in the country becomes clear.

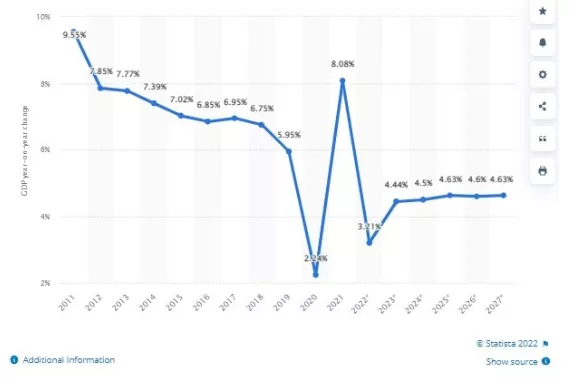

The possibility of a worsening of the health situation in China, combined with the government’s harsh and strict measures, in fact completely “overshadow” the government’s recent fiscal stimulus measures, “neutralizing” any beneficial effect. An easing of restrictive measures could be the solution to the problem, providing a boost to the domestic economy and supporting a recovery in demand for fuels and metals. This development may contribute to the stimulation of the GDP, which is expected to grow this year by significantly less than +5% (from +8% in 2021).

From the Elliot Wave perspective, the CHINA A50 Index can be finishing a complex (W)-(X)-(Y) corrective decline from the highs, but to confirm support in place and bulls back in the game, we have to see broken channel resistance line and 14500 first bullish evidence level.

More By This Author:

AUDNZD: More Weakness After Rally

Gold Miners Show First Bullish Evidence

DAX Is Trading In A Five-Wave Bullish Impulse

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only. Visit www.wavetraders.com for more ...

more