China PPP, Asian Infrastructure Investment Bank & Powerhouse Economics

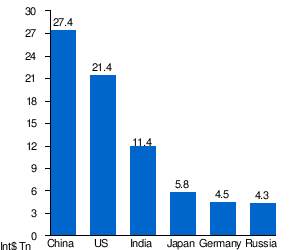

Largest economies by PPP GDP in 2019. According to International Monetary Fund estimates. "Report for Selected Country Groups and Subjects (PPP valuation of country GDP)". IMF. Retrieved 24 October 2017.

Purchasing Power Parity is another way of measuring Gross Domestic Product. This measurement of GDP puts China in the lead as the most powerful economic engine in the world. The chart above was calculated in 2017, and is a projection, which is turning out to be close to accurate, especially in predicting the gap between the US and China PPP. That gap is in the 4 to 6 trillion dollar range for recent estimates from the IMF, World Bank, and CIA.

Adding India to the total PPP for just two nations in the region dwarfs any other region! The chart hints at the rising Chinese GDP and Asian dominance, economically, on the world. As Wikipedia says:

GDP comparisons using PPP are arguably more useful than those using nominal GDP when assessing a nation's domestic market because PPP takes into account the relative cost of local goods, services and inflation rates of the country, rather than using international market exchange rates which may distort the real differences in per capita income.[3]

We know that manufacturing makes up about 40 percent of the Chinese economy. 40 percent of 27.4 trillion dollars is 10.96 trillion dollars of goods being manufactured. While some of these goods are shipped abroad and some of those lose the advantage of PPP, we can see that China's manufacturing base is roughly 5 times the value of US manufacturing.

We know the US manufacturing base produces about 2.0 trillion dollars of goods per year. Compared to 10.96 trillion dollars, it is baby steps. We can see that General Liang of China pegged it pretty correctly when he said that the real economy in the US had a GDP of 5 trillion dollars:

Liang says that only 5 trillion dollars of GDP in the USA is from the real economy, while 13 trillion is from the financialization of our economy. So, we aren't very strong as to our real economy, massively smaller than China. People should be informed of this. Unfortunate that a communist has to tell us!

Everyone knows somebody has to make something somewhere for stocks to be strong. Risk-on clearly comes from good news out of China. Of course, that could be offset by really bad news in the west, but so far that isn't happening. Stocks go up due to buybacks and success in investing in China's growth.

China, then, is crucial to the success of the USA stock market and world growth. That is one reason why a tariff deal may turn out to be tariff settlement light. We must understand that China makes a lot of things, churns out a lot of steel and cement, to survive as a viable nation. The alternative to putting Chinese men to work is chaos.

China PPP in the slowdown of the World Economy

John Rubino is out with a fascinating article regarding the slowdown in China and possible fake numbers in measuring GDP and economic activity there. John says this quoting from Ambrose Evans-Pritchard:

Japan’s manufacturing exports to China fell by 9.4 per cent in March (year on year). Singapore’s shipments dropped by 8.7 per cent to China, 22 per cent to Indonesia, and 27 per cent to Taiwan. Korea’s exports are down 8.2 per cent.

This looks like a slowdown and maybe on one level it is. But we have to apply PPP to this situation because we are talking about exports to China, the big kahuna. This could be a slowdown in purchasing by the wealthy Chinese. It could be a slowdown in middle class purchasing of imports as they substitute homegrown production in place of higher priced foreign goods. It is not certain that it is interfering that much with actual purchasing power of Chinese citizens.

China still may be able to pull the world out of hard times, especially if we don't get in the way with stupid tariffs. A tariff war is the economic equivalent of wrist slitting.

AIIG Funds Belt and Road

This, of course, is why the Belt and Road (BRI) is so crucial to the continued success of an economic feat that has lifted 500 million people out of poverty. By expanding outside of China, that nation can build openings for more trade, as well as for keeping the base industries going. Empty cities are not the intelligent way forward. The BRI is the intelligent way forward.

So, we know that the Belt and Road is an economic necessity for China to grow fast enough to create jobs in a dynamic environment. We know that the Asian Infrastructure Investment Bank (AIIB) was established to fund the Belt and Road as well as other projects in the region. So, we should look at the investor nations that fund the bank.

We can see that there are the regional members like China, India, Pakistan and Israel as listed on the AIIB website. We also can see that there are non-regional members, like most of Europe and the UK that are invested. From the AIIB website we can see that the notable absence is the USA, which is still busy contemplating its own potholes and infrastructure decline.

The many AIIB members that have joined to invest in the bank make it a potentially powerful bank. The website lists news, projects approved and projects considered.

AIIB has an impressive list of Governors of the bank. It appears that most bank business activity is out in the open. Trust or the lack of it, is what will make or break the bank.

The United States government has worried about the size and power of the bank. But the Council on Foreign Relations says it is a medium size world bank, and that the worries from our government are overblown. Do nothing Obama and blowhard Trump (through the National Security Council calling China predatory for bringing on Italy into Belt and Road), have both opposed the bank and the Belt and Road.

But the bank has cooperated with other world banks and is a tenth the size of the World Bank, per employee numbers. The CFR blogger said this:

The AIIB has been highly cooperative with other development banks—to date, two-thirds of the bank’s projects are cofinanced. This percentage is likely to decline over time as the young bank gathers momentum, but will likely plateau around 50 percent, according to a senior AIIB official.

The AIIB intends to branch out to non-regional members with projects under the following guidelines:

The AIIB is not limited to lending in Asia, and its new Strategy on Financing Operations in Non-Regional Members specifies such financing must benefit Asia by supporting cross-country connectivity or renewable energy generation, and in members that are “geographically proximate to and closely economically integrated” with Asia.

The AIIB is not the Belt and Road, but it does intersect with the BRI in many ways. But it also seeks cooperation with the United States. But this nation appears to be so fossilized politically, that it simply is unable to see the obvious benefits of cooperation at this time. But it would likely make for a better, more peaceful world if the USA did throw in with the Asian Infrastructure and Investment Bank.

Disclosure: I have no financial interest in any companies or industries mentioned. I am not an investment counselor nor am I an attorney so my views are not to be considered investment ...

Update 2: If Donald Trump does not grasp the economic concept of purchasing power parity he will embarrass himself and our nation. We trail China in ppp and that is a crucial weakness facing the USA in a trade war with China.

Update 1: purchasing power parity coupled with a manufacturing base 5 times larger than the USA means China can make what it needs. We cannot and therefore, we could lose a trade war.

Unfortunately, it's not a surprise that China is the strongest. America is still a power to be reckoned with, but they are no longer the world leader.

We have lost real security, global respect, and traded it for military hardware.