China Gold Imports Surge To 11-Month High Despite Record Prices

Image Source: Unsplash

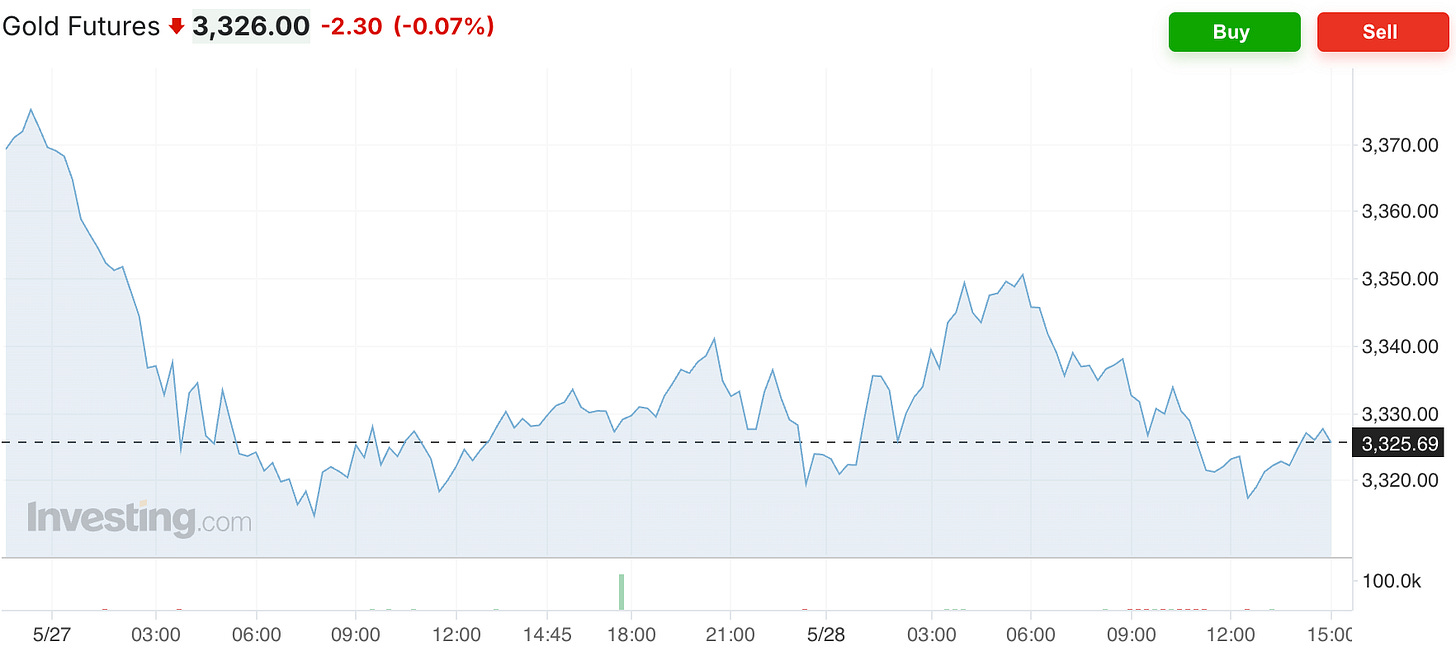

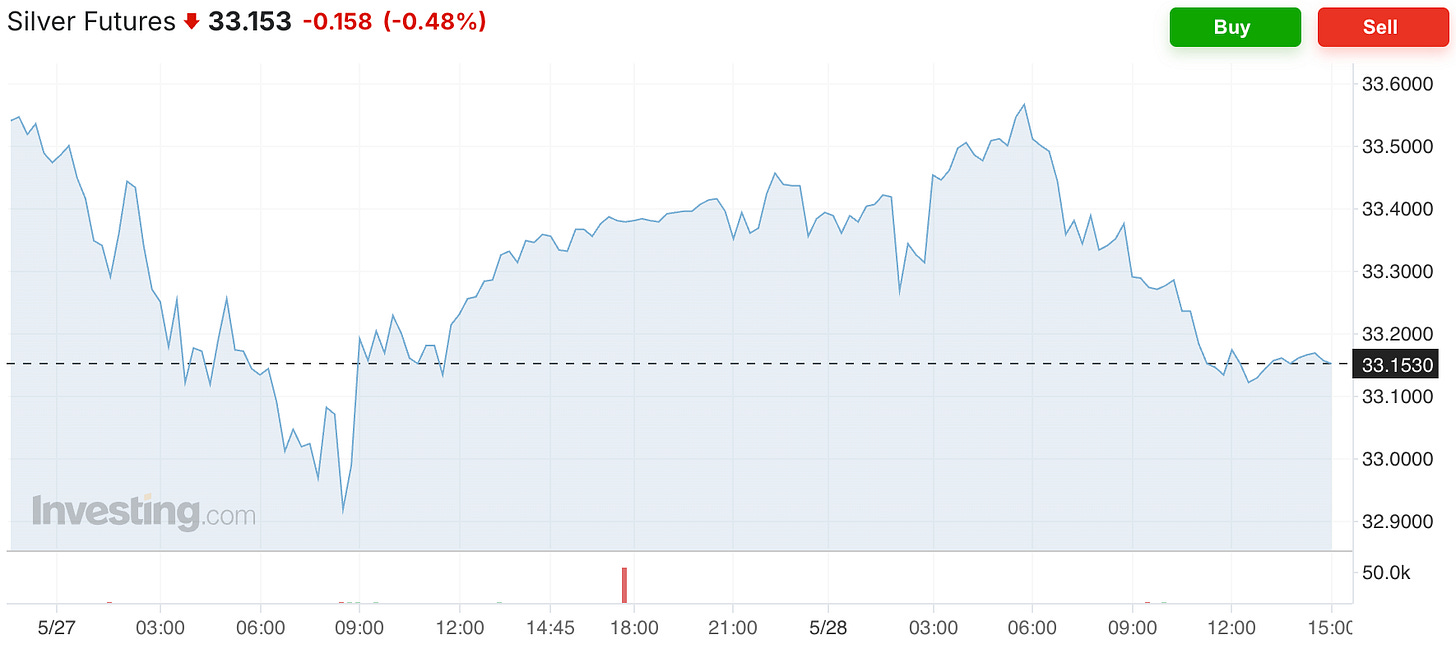

It was somewhat of a quiet day in the precious metals markets on Wednesday, with the gold futures down $2.30 to $3,326, while the silver futures are down 15 cents at $33.15.

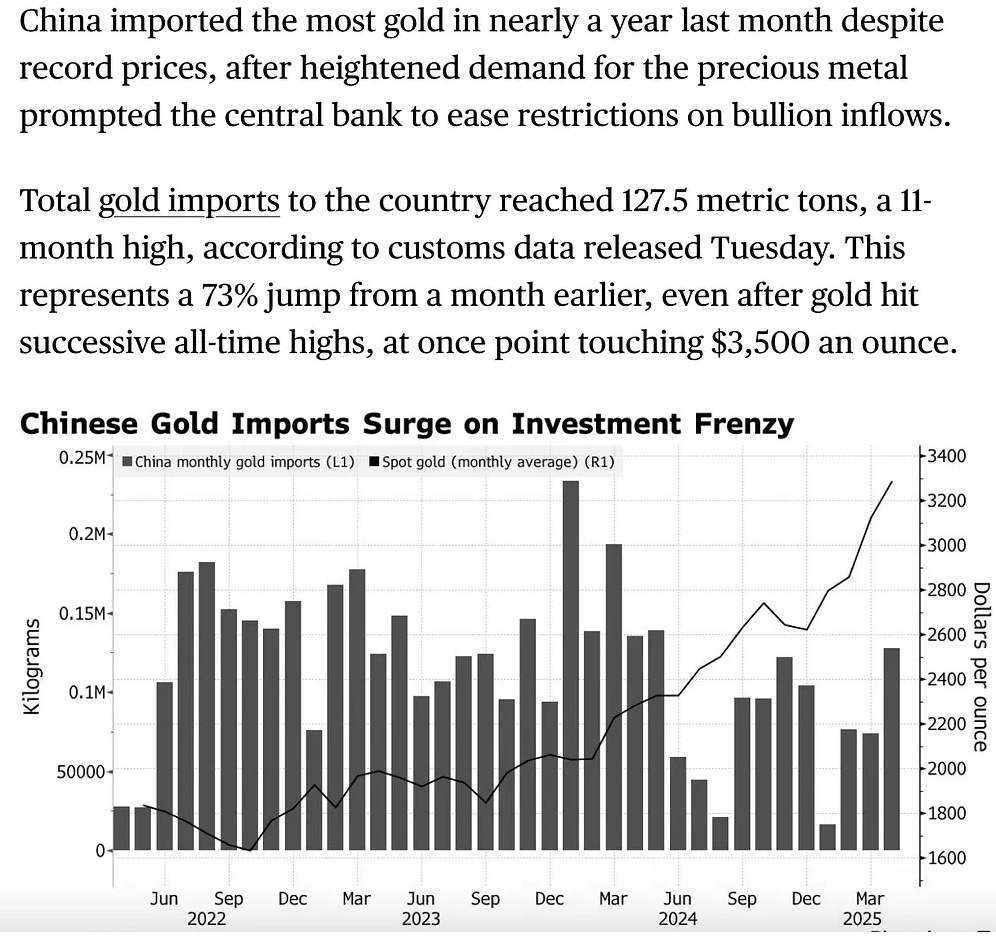

Although as we progress deeper into the trade war, we had another surge in Chinese gold imports.

China has traditionally been a price-sensitive buyer. So to see the surge at a time when the gold price has been over $3,000 takes on an even greater significance.

Investors in China turned to gold to hedge against escalating geopolitical uncertainty, which contributed to the metal’s blistering rally earlier this year.

While gold has retreated in May with hopes for easing trade tensions, continued central bank buying to diversify away from dollar-denominated assets is seen supporting prices further.

If that reasoning is correct, what happens if a trade deal with China isn’t reached soon?

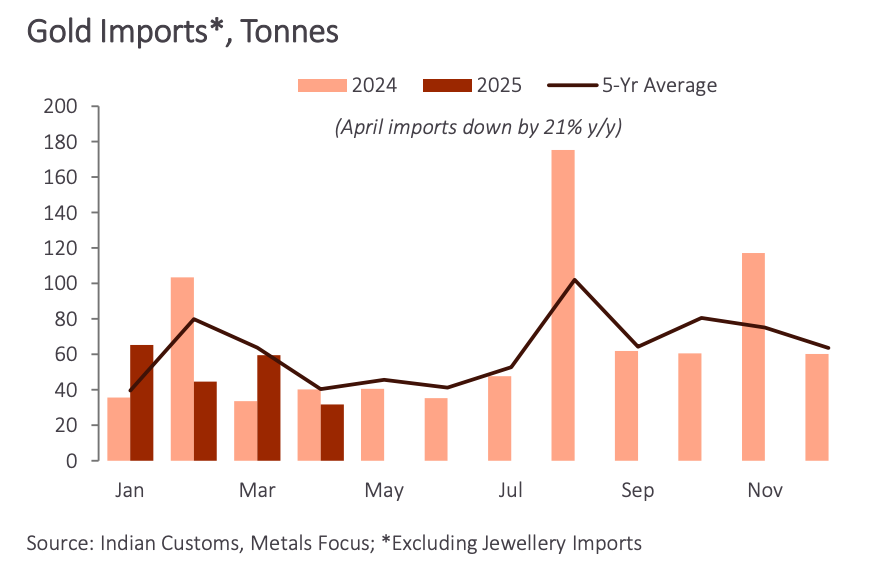

Over in India, we can see that gold imports remain on the lower side so far this year.

India often has a lumpy import distribution, and a history of government policy changes that can affect import levels.

So while next month could always be another surge, so far the data remains on the lower side this year.

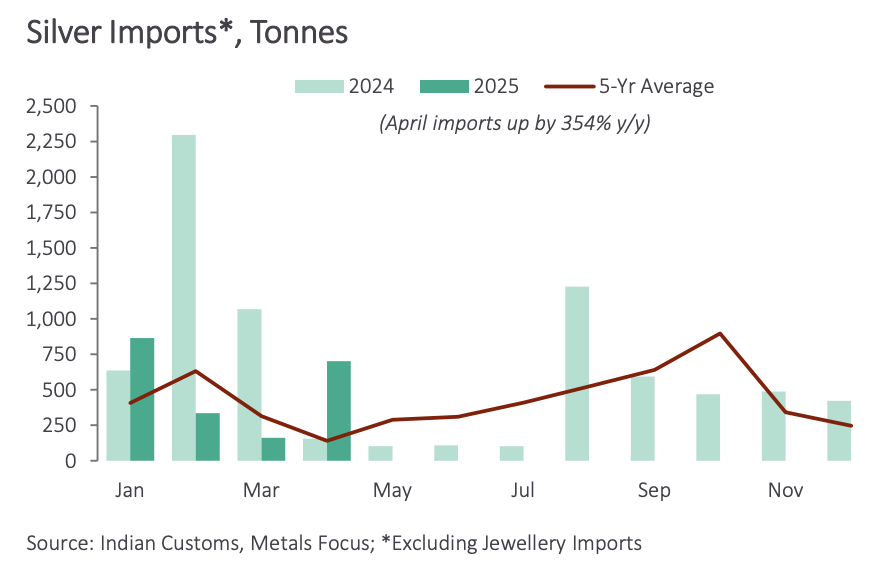

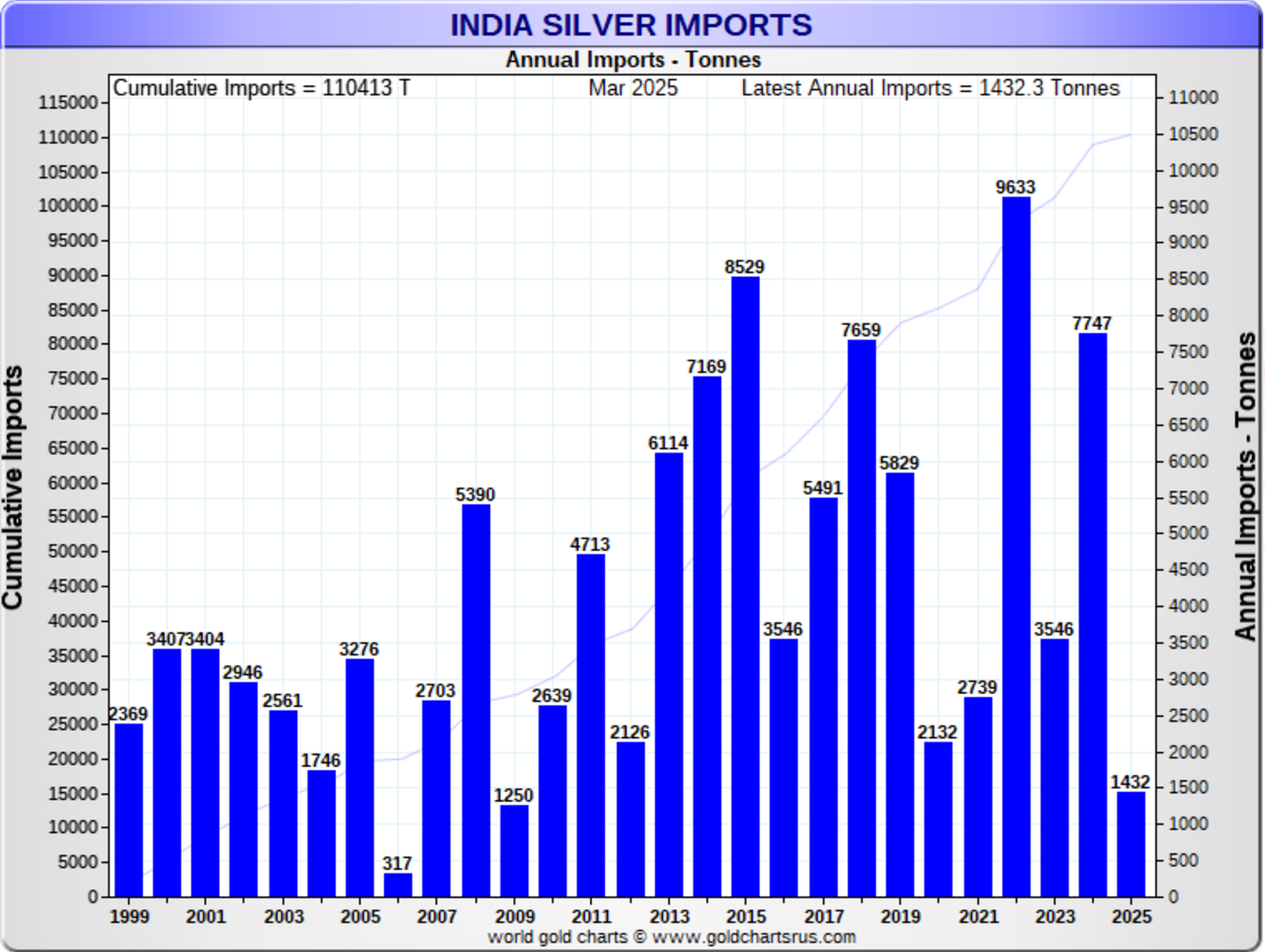

The Indian silver import picture is similar.

Although even without a big spike like the one last February, especially after about 700 tonnes were imported in April, India is on track to have another strong year.

This chart doesn’t include the April data yet. But when you add that in, India is on pace for over 6,000 tonnes again in 2025.

Also, keep in mind that India and the US are still working on a trade deal. And while I have not found any further updates or verification, the Hindustan Times did report in early April that:

‘India is considering importing gold and other high value items, including silver, platinum and precious stones from the US to address Washington’s concern of a significant trade deficit with India, two people aware of the matter said.’

Whether that is actually being considered, and whether or not it does actually happen, perhaps it’s the perfect example of what I mentioned earlier - of how the India gold and silver imports are not steady on a month-to-month basis. But how it will be noteworthy to see if gold and silver are ultimately included as a means to settle the trade imbalance when a deal is finally reached.

But with Japan now considering whether to use its US Treasury position as leverage in their trade deal, Trump mulling additional sanctions on Russia, China turning to gold at an even faster pace in the face of tariffs, and Jerome Powell signaling that the Fed is getting ready to raise its 2% inflation mandate, it’s shaping up to be an active second half of the year in the financial markets, and in particular the gold market.

Lastly, with the possibility of significant price increases and supply chain disruptions growing as the trade war lingers on, we’ll see if we’re not getting closer to an even more significant shift out of treasuries and into gold.

More By This Author:

Banks Cover Gold Shorts, But Silver Position Remains ElevatedBRICS/China Sell U.S. Treasuries Big Pre-Summit

US Mulls Additional Sanctions On Russia