China GDP And Activity Data Show Mixed Recovery From COVID

Third-quarter GDP pointed to faster-than-expected growth against the consensus forecasts. But data breakdown paints a mixed recovery picture, which is still COVID-measure driven.

GDP was better than consensus

GDP grew 3.9% year-on-year in the third quarter of 2022, faster than the consensus forecast of 3.3% YoY and 0.4% YoY in the second quarter. This is mainly a result of more flexible COVID measures after the long lockdown in Shanghai during March to May.

Among all the industries, information and software technology grew the fastest at 7.9% YoY and the financial services industry which grew 5.5% YoY, while real estate contracted 4.2% YoY due to uncompleted projects that almost paused activities from land bidding to housing starts in the industry.

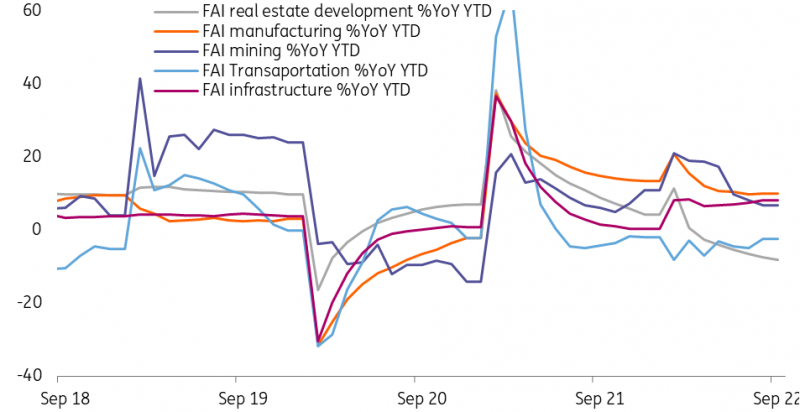

China investments

Source: Bloomberg, ING

Activity data is still affected by COVID

Activity data for September reflects that the partial recovery continues, but this time it was more a recovery in investments (5.9% YoY YTD in September from 5.8% in August) and industrial production (6.3% YoY in September from 4.2% YoY in August). The stronger growth in industrial production should be a result of reduced lockdowns in ports, which increases the speed of logistics and therefore a smoother supply chain delivery.

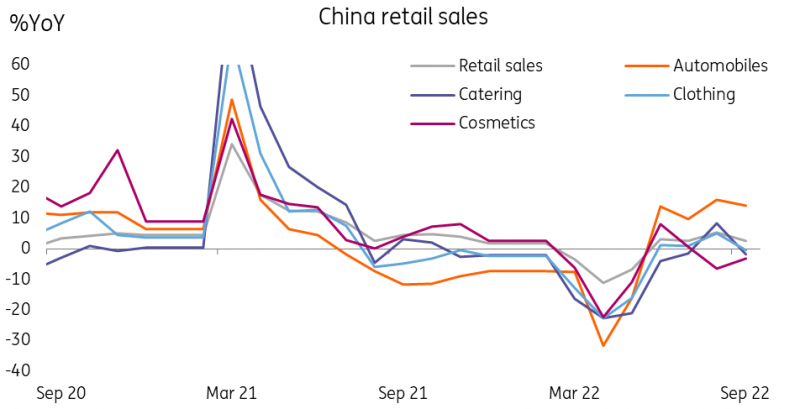

But there was a slower recovery in retail sales, which was affected by more quarantines in some residential and shopping areas in September. This reflected a contraction in sales of catering of 1.7% YoY. COVID measures now depends on the number of COVID cases, which is uncertain. This will continue to affect the job market and has a negative feedback effect on future retail sales.

China retail sales

Source: Bloomberg, ING

This set of data sends an important message that even COVID measures have become more flexible as it depends on the number of COVID cases, lockdowns are still a big uncertainty to the economy with the background of the real estate crisis. This uncertainty means the effectiveness of pro-growth policy would be undermined.

More By This Author:

China: President Xi Has More Say On Economic PolicyAsia Week Ahead: A Series Of Inflation Reports

Key Events In EMEA For Week Of Oct. 24

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more