China Exports And Imports Collapse, Harbinger Of The Global Economy?

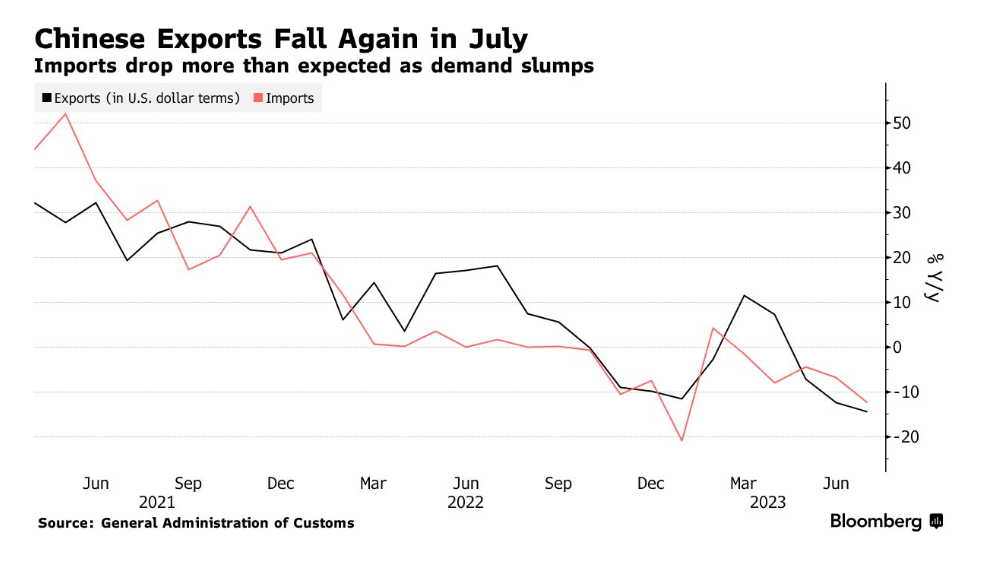

China’s exports are down 14.5 percent year-over-year, and imports are down 12.4 percent.

Trade Collapse

The Chinese export economy isn’t just having a nice little slowdown - it’s absolutely collapsing.

— Don Johnson (@DonMiami3) August 8, 2023

July 2023 exports plunged 14.5% YoY, the steepest dip since Feb 2020, following a 12.4% fall in June, hinting at plummeting global demand. pic.twitter.com/3jem2OVnUk

Consensus Miss

Once again, #China's exports and imports contracted by more than consensus forecasts:

— Mohamed A. El-Erian (@elerianm) August 8, 2023

Exports fell by 14.5% in July (year-on-year), worse than the consensus forecast of 12.5%; and

Imports declined by 12.4%, a lot worse than the expected 5%.

The numbers confirm that the #economy's…

“The numbers confirm that the economy’s mounting growth shortfalls reflect both domestic and external challenges.”

Exports Fall Third Month

China’s exports fall for a third straight month in July as weak global demand adds to pressures undermining economic recovery https://t.co/v6W4FbHsZy

— Bloomberg Economics (@economics) August 8, 2023

China’s exports fell for a third straight month in July amid a slump in global demand, while imports plunged as domestic pressures also undermine the economy’s recovery.

Overseas shipments dropped 14.5% in dollar terms last month from a year earlier — the worst decline since February 2020 — while imports contracted 12.4%, the customs administration said Tuesday. That left a trade surplus of $80.6 billion for the month. Economists polled by Bloomberg had forecast that exports would drop 13.2% while imports would shrink 5.6%.

Shipments to the US plummeted 23.1% in July, according to the customs data. Exports to other markets including Japan, South Korea, Taiwan, Asean, the EU, Brazil and Australia all dropped by double digit percentages, too.

Global Weakness or Something Else?

China disguises some shipments to escape US tariffs by routing the trade through other counties making miniscule improvements.

So, shipments to the US may be down a bit less than stated.

But if that is happening to a huge extent, the trade data will soon show up elsewhere.

I suspect the bulk of this decline is genuine weakness for goods and the service economy will soon crack too, globally.

Flashback Hoot of the Day: When Will China Overtake the US?

In case you missed it, please see Flashback Hoot of the Day: When Will China Overtake the US?

More By This Author:

Wind Energy Projects Suffer From A Multi-Pronged BlowIs GDPplus A Better Version Of GDP?

Congress Ended An IRA Tax Break, How You Can Take Advantage

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more