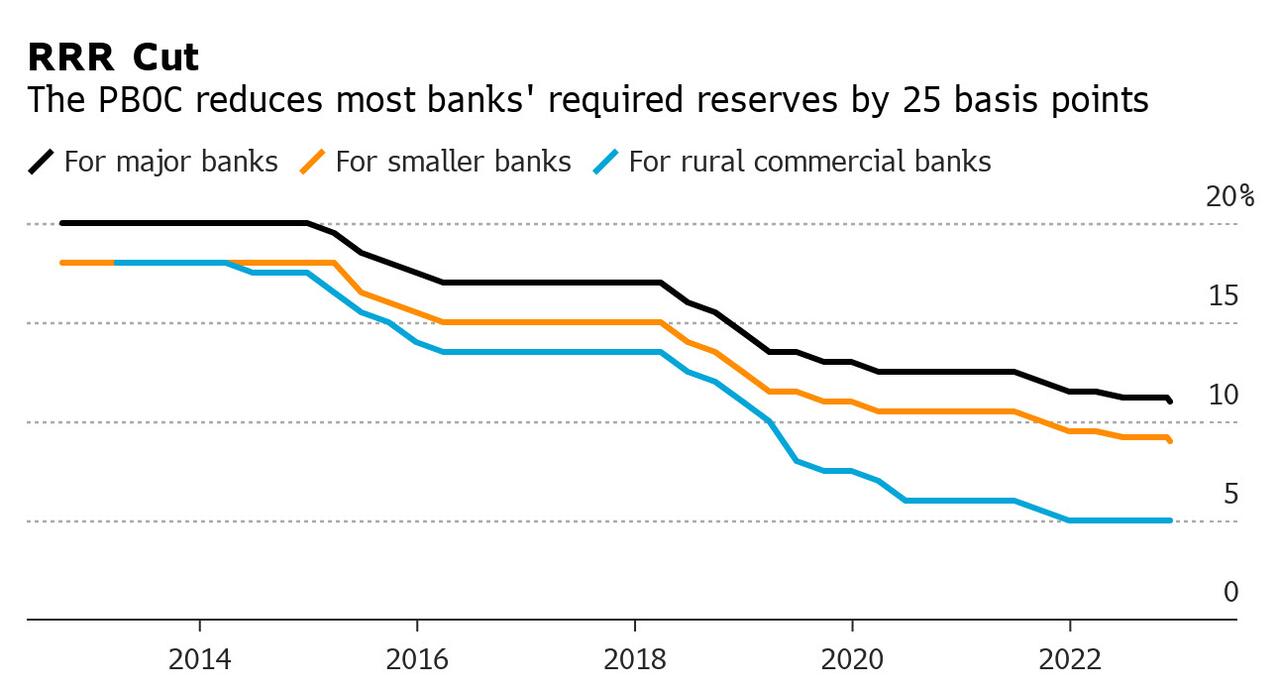

China Cuts Reserve Requirement Ratio By 25bps, Boosts Economy With $70BN In Fresh Liquidity

Confirming recent rumors and media speculation, late on Friday after the close of markets, China’s central bank announced it cut the amount of cash that banks must hold in reserve for the second time this year on Friday to shore up the coronavirus-hit economy, a move which analysts said is “not too late”, but also that Beijing needs to roll-out much more supportive policies to kick start to contracting economy.

The People’s Bank of China (PBOC) said the 0.25% cut of the reserve requirement ratio (RRR) to 7.8% will take place on December 5 and inject around 500 billion yuan (US$70 billion) in long-term liquidity.

(Click on image to enlarge)

The PBOC last cut the RRR in April when the central bank announced a 0.25% point reduction following 0.5% points cuts in both July and December last year. Friday’s announcement followed a State Council meeting on Tuesday chaired by Premier Li Keqiang, who said that it was a “critical time” to consolidate the economic recovery for the fourth quarter.

The PBOC said that the move was aimed at maintaining “reasonable and sufficient liquidity” to support the economy at a “reasonable” growth rate, while reiterating that it would not engage in “flood-like” stimulus.

“[The RRR cut will] increase the long-term stable funding sources of financial institutions, enhance the capital allocation capabilities of financial institutions, and support industries and small, medium and micro enterprises that have been severely affected by the epidemic,” the central bank added.

The widely telegraphed (and in some cases, mocked) decision, comes at a time when the world’s second-largest economy is on the verge of contraction and is facing a new round of coronavirus disruptions, with daily infections having already jumped to more than 31,000.

“The impact of the Covid-19 outbreaks is already quite damaging. The RRR cut is reasonable,” said Iris Pang, chief economist for Greater China at ING, quoted by SCMP. She added that the RRR cut was “not too late”, but that it needs to be accompanied by other less conventional monetary policy to boost its effectiveness, especially when it comes to tackling financing problems for small retailers and companies operating in the catering sector. Pang added that the PBOC could instruct banks to lend more, while the central bank could also increase loan to banks via relending programmes to boost funding to small- and medium-sized firms.

Others were more skeptical: efforts by the Chinese government to support the economy will be encouraging in the short-term for equities as it shifts “expectations in a positive direction,” even though the outlook is cloudy beyond that, said Peter Garnry, head of equity strategy at Saxo Bank.

Chinese central bank’s decision to reduce the reserve requirement ratio for most lenders by 25 basis points will have limited impact on the economy, because it will not be as easy as in the past with the Chinese economy in a “different place” structurally

"The credit impulse does not have the same impact as before because the typical receiver -- real estate -- is dealing with financial stress."

China’s economy has been under pressure since October as exports and retail sales fell amid weak business and consumer confidence. “Epidemic prevention is now the biggest constraint on the economy,” said Larry Hu, chief China economist at Macquarie Group. “But the RRR cut is better late than never. The move may now also encourage banks to lend to the real estate sector.”

The cut will also save around 5.6 billion yuan per year for banks in terms of their funding costs, the PBOC added. But Zhang Zhiwei, chief economist at Pinpoint Asset Management, said the size of the cut shows that China’s monetary policy has been constrained by the US Federal Reserve’s interest rate increases, which have weakened the yuan significantly since the start of the year.

“[The RRR cut] helps marginally, but the main problem for the economy is not the monetary policy,” Zhang said, adding that more action is needed to minimise the impact of China’s virus control measures.

China has eased its containment measures, including cutting quarantine requirements for international arrivals, but there is still no timetable for a complete exit from Beijing’s zero-Covid policy.

“The reduction in the required reserve ratio that the PBOC just announced will help banks follow through on a directive to defer loan repayments from firms struggling with widening lockdown restrictions,” said Mark Williams, chief Asia economist at Capital Economics.

“Market interest rates may also edge down as a result, even if that’s not the main goal. But few firms or households are willing to commit to new borrowing in this uncertain environment. A small fall in interest rates wouldn’t make a difference.”

More By This Author:

Ford Recalls 519,000 Broncos And Escapes Over Cracked Fuel Injectors Sparking Engine Fires

"Retail Hasn't Sold": Despite Crypto Crash, Bitcoin HODLing Hits A Record

Housing Market Obliterated: Pending Home Sales Post Record Drop As Deal Cancelations, Price Cuts Hit Record High

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more