Tuesday, June 13, 2023 5:50 AM EST

Image Source: Pexels

While there has been some speculation about rate cuts, today's cut was not widely expected, and coming just ahead of the monthly activity data suggests that this set of numbers could be very weak.

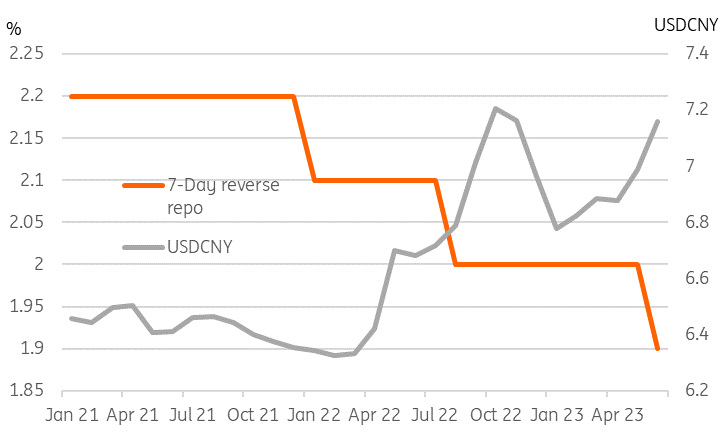

Reverse repo rate cut, 1Y MLF next?

Before today's hike, the received wisdom had been that the People's Bank of China would not use blanket rate cuts as a first resort, but would rather use some of its more focused tools, such as targeted RRR cuts. So the 10bp cut of the 7-Day reverse-repo rate today raises some questions.

The first of which is whether this will be followed by a cut to the 1-Year Medium-Term Lending Facility (1Y MLF) on Thursday. Our first guess on this is, yes, probably. After all, window guidance on deposits was also lowered earlier in the month, so there does seem to be a general easing of policy going on.

The next question is, why now? What has changed? Certainly, China's reopening has been quite tepid, with a catering-led consumer spending surge that already looks to be losing steam and manufacturing still struggling. Activity data on retail sales is also due on Thursday, and it may be no coincidence that rates are being eased only days ahead of this release if it turns out that the reopening is already sputtering.

If the one engine of growth - retail sales - is not delivering what is required of it, and if the other sectors of the economy are failing to pick up the slack, then broader stimulus measures like these would seem appropriate. The consensus forecast for retail sales is for a 13.8% year-on-year rise, which sounds pretty strong. But it translates into about a 1% month-on-month (sa) decline, and the apparent strength is all due to base comparisons.

7-Day reverse repo rate and USD/CNY

Image Source: CEIC, ING

CNY weaker will drag other currencies with it

The Chinese yuan has weakened above 7.16 at times today, adding to the month and a half of weakness it has already experienced. Further stimulus may prompt some short-term reversals, or slow the slide. But it may take a more concerted improvement in the macro data before the CNY turns decisively. Short of a substantial boost from fiscal policy, such as loans from the central government to local governments to spur infrastructure spending, that doesn't look on the cards just yet, though today's move does indicate that the authorities' patience with the weak recovery is wearing thin.

More By This Author:

FX Daily: Jumping On The Inflation Swing

The Commodities Feed: USDA Pushes Up Wheat Supply Estimates

Sticky UK Wage Growth Means No Rate Cuts For The Bank Of England Until 2024

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.