China Cuts 7-Day Reverse Repo Rate And Loan Prime Rates In Move To Support Growth

Source: Shutterstock

China cut its 7-day reverse repo rate and LPR by 10bp

(Click on image to enlarge)

The PBOC made its first major moves since announcing a shift in the monetary policy framework

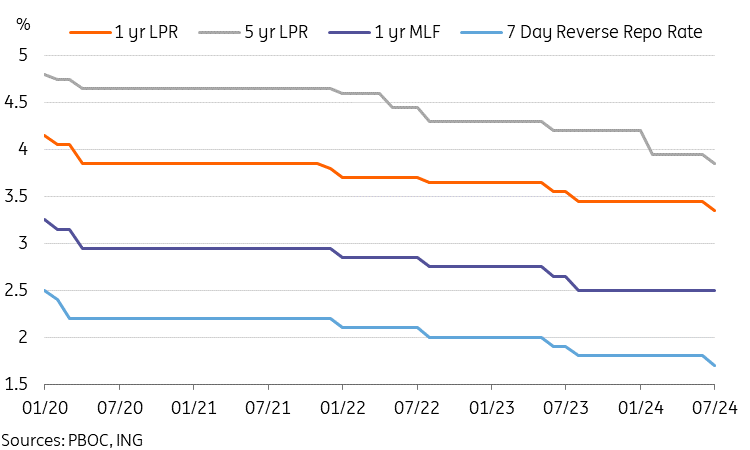

The People's Bank of China (PBOC) cut its 7-day reverse repo rate by 10bp from 1.8% to 1.7%. China's loan prime rates (LPR) also fell 10bp, which came as a surprise as the earlier medium-term lending facility rates remained unchanged earlier this month. The change to the 7-day reverse repo rate will affect short-term market rates, while the change to the LPR reflects actual lending rates to the real economy.

Today's moves mark the first change in rates since February, and also the first major move since announcing a shift in the monetary policy framework in June. As PBOC Governor Pan Gongsheng stated at the Lujiazui forum, the 7-day reverse repo rate would gradually become the main policy rate moving forward, and other policy rates would gradually "soften their role." We will need to see if the other policy rates such as the MLF follow today's rate cut in the coming weeks; if so, today's move could be seen as the PBOC signalling the 7-day reverse repo rate's new status as the primary policy rate.

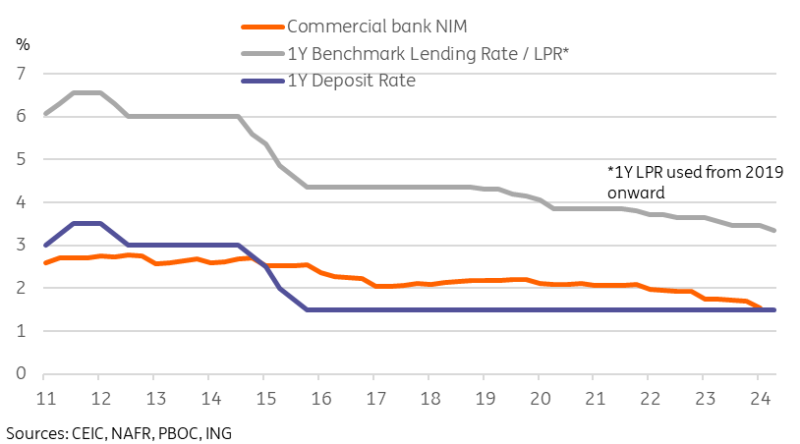

Chinese commercial banks' net interest margins are already at a record lows and non-performing loans have been growing rapidly. Rate cuts will likely add to the pressure on Chinese banks; these pressures could increase further if the MLF is not soon lowered, as many banks still draw upon the facility for medium-term financing needs, with RMB 2.29tn of volume in the first half of the year.

The 7-day reverse repo rate cut was not unexpected. As we have stated multiple times in our reports over the past month, the recent spate of weak data increased pressure for monetary easing. Base effects dictate that even though China managed 5% GDP growth in the first half of the year, China will have a more challenging second half if it is to maintain 5% growth for the full year. We expect there will be room for at least one more rate cut in the coming months as well.

Additionally, the PBOC also announced it would allow firms to apply for a reduction or exemption of collateral to draw upon PBOC facilities. This move is likely to help financial institutions without the requisite collateral to draw from the policy rate. Currently, financial institutions without the proper collateral must draw upon the interbank market, and this demand is one of the factors behind why the interbank rate tends to be noticeably higher than the policy rate. The move should help the market rates trend closer to the policy rate, and should also lower funding costs for smaller banks that may have previously lacked the collateral to draw upon the central bank facilities.

Chinese banks' net interest margins face pressure amid easing and policy lending

(Click on image to enlarge)

Lower short-term rates could widen yield spreads and add to RMB depreciation pressure

We believe the PBOC held back from monetary easing in the past few months in large part due to its priority to maintain currency stability amid a strong dollar trend. The recent dovish developments in the US and the slight softening of the dollar over the past month may have created a suitable window for the PBOC to cut rates.

In a vacuum, the PBOC lowering short-term rates should add to depreciation pressure in the near term, although the actual impact will depend on various factors, including the daily CNY fixings and the transmission effect of the 7-day reverse repo cut on market rates, US-side developments, and capital flow developments. Looking ahead, even if the PBOC continues with gradual easing, it is likely that once the US starts its rate cut cycle, yield spreads should gradually move to favour a stronger RMB as the scale of US cuts is expected to be larger than in China.

Our current forecast is for the USDCNY to end the year around 7.26.

More By This Author:

FX Daily: The Return Of The Magnificent Seven

The Commodities Feed: Further Downward Pressure

Asia Morning Bites For Tuesday, July 23

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more