China Could Derail Japan's Fragile Recovery

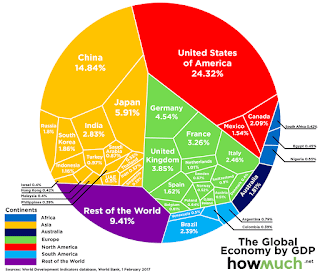

The IMF, the World Bank, and the United Nations all rank China and Japan as the second and third largest economies on the planet. Together they are responsible for around 21% of global GDP. Cutting to the chase, more of what is occurring in the markets should reflect what is happening in China and Japan which are strongly linked economically. It has become clear that China has huge economic problems and many of us feel it is in a full-blown financial crisis.

China And Japan As Part Of Global GDP

A matter that has not garnered enough attention is how economic problems that develop in China will spill over and directly impact Japan. While a strong distrust possibly even a dislike between the people and cultures exists, years ago the two countries joined together in an effort to maximize profits from exporting to America.

Over the years this relationship has morphed into an almost full-blown interdependence. This has intensified as China and Japan became major trading partners with Japanese direct investments surging and Japanese technology playing a critical role in the development and competitiveness of China’s global supply chains. In some ways, the two have become joined at the hip.

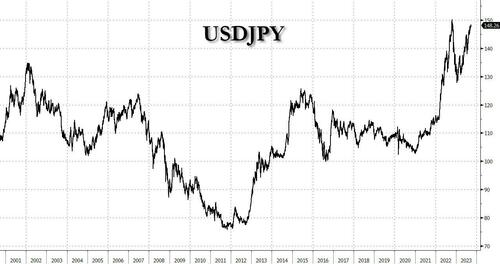

It is difficult to envision how Japan can decouple from the mess now occurring in China. Flowing out of my last posting is an important and unanswered question. how much would the Japanese yen have to fall to put Japan into a good place, or even a reasonable place? This means putting Japan in a position where it could get its budget in order and have the possibility to stabilize its national debt. There is no way to answer such a question. A huge number of variables feed into this issue, the largest are centered around which fiscal pathway Japan chooses going forward.

Reuters recently pointed out that Japanese policymakers were very concerned about China's deepening economic woes. If Beijing fails to rapidly bolster its economy with more stimulus. Looming large is the fact that China's downturn will have a huge effect on Japan's export-reliant economy. This is a double whammy since it comes just as an aggressive Federal Reserve raises interest rates to slow growth in the United States to lower inflation.

- China's downturn has weakened Japan's external support

- The China risks will be debated and are already hitting the yen

- Japanese investments in China are at risk

- The darkening global outlook complicates a BOJ exit path

The latest available country-specific data shows the two biggest customers of products exported from Japan were bought by mainland China (19.4% of Japan’s global total), and the United States with (18.7%). A major concern for Japan is that across the world we are seeing economic momentum fade. As stated in another AdvancingTime article, we should never discount the American consumer's role as a key driver of the global economy. Many people simply don't understand the dire implications America's slowing economy will have on the world.

Other countries manufacture the goods Americans buy, which makes America a key component in their economies. When the American consumer pulls back, factories across the world see orders fall. Japan's economy is struggling, its recovery remains fragile. Core inflation which has been in the range of 3.0-3.5 percent. The BOJ is well aware that developments in financial and foreign exchange markets have a direct impact on Japan's economic activity and prices.

The Yen Is In A Precarious Position

Governor Ueda has indicated that its position on ending negative rates has not changed but he wants to avoid ruling anything out and limiting its options. He also made it clear that when the goal of sustained 2% inflation is in sight, the BOJ will consider ending its YCC policy as well as raising interest rates. The fact is, the BOJ can never stop yield curve control and it is costing the BOJ a fortune. In reality, the BOJ is Japan's long-term bond market. The bank's ownership of the 368th series of 10-year Japanese government bonds is near total, at 97.0% on Jan. 10, This is up from 86.4% on Dec. 22, according to reports by a fixed income strategist at Mitsubishi UFJ Morgan Stanley Securities.

As pointed out in my last article; Japan's Yen, Where It Goes From Here, the main factor currently supporting the yen are comments from Japanese government officials that they are ready to support the currency if it moves lower. While a country's currency and economy are not the same animals, one does affect the other. Considering the close ties noted above, it is not unreasonable to think that debt defaults in China could take a toll on Japan. Also, Japan's automotive sector, the 3rd largest in the world, with 78 factories in 22 regions & employing over 5.5 Mn people, is under pressure. Sure a lower yen helps exports but it increases the costs of imports. With the price of imports continuing to rise and huge investments in China, what could go wrong?

More By This Author:

Japan's Yen, Where It Goes From Here

National Debt Now More Than 33 Trillion And Soaring

The Hard Asset Inflation/Paper Asset Deflation Theory

Disclaimer: Please do your own due diligence before buying or selling any securities mentioned in this article. We do not warrant the completeness or accuracy of the content or data provided in ...

more