China Begins Year Of The Dragon With Weak Economic Momentum

The Chinese economy is stabilizing but the only fireworks will come from the new year celebrations which begin on February11, as momentum remains weak.

Mission accomplished on 2023 GDP as growth stabilizes

You could say it's 'mission accomplished' as data over the past month confirms that the Chinese economy beat its 2023 GDP growth target and growth certainly stabilized. But as people celebrate the Chinese New Year, sentiment seems weak. Key activity data won't be published this month, so expect a period of calm before the much anticipated, annual parliamentary gathering, the Two Sessions, in early March.

China’s GDP growth for the fourth quarter rose from 4.9% year-on-year to 5.2%, bringing 2023 full-year growth to 5.2% YoY, exceeding the 5% growth target set at last year’s Two Sessions.

China 2023 GDP growth managed to beat the 5% target.

Monthly indicators show few signs of growth dynamism.

The property sector remains the largest drag on the economy. Real estate investment slumped to -9.6% YoY at the end of 2023, while the number of buildings sold also dropped 6.5%. Secondary market property prices fell 8.9% from the peak, while 39 of the National Bureau of Statistics 70-city sample saw a more than 10% decline from the peak.

Trade is dragging on growth. Last year, the trade balance was down 3.4% YoY to USD858.6bn, while exports and imports fell 5.1% YoY and 5.6% YoY, respectively. The silver lining is that there have been some signs of a bottoming out in the past several months; December exports fell to the lowest YoY level in eight months, and imports recovered to positive YoY growth.

Consumption was the main growth driver, but while month-to-month volatility has been high, retail sales growth has been trending down overall, ending the year at 7.2% YoY and has yet to reclaim pre-pandemic levels of growth despite a favorable base effect.

The most encouraging sign has been a clear acceleration in credit growth. Aggregate financing had all but stagnated, growing just 1.3% YoY over the first seven months of 2023 before a shift in policy tone in August prompted a 32.2% YoY growth for the final five months of the year.

China activity monitor

PMI data points to a soft start to the year

So, keep in mind that China bundles many January and February indicators for publication in March and, as we said, momentum remains soft.

The January manufacturing PMI came in at 49.2, and that was slightly below expectations. But it did trend in the right direction with a smaller contraction than in December. The Chinese manufacturing sector remains under pressure amid a weak domestic recovery and poor external demand. The manufacturing PMI has been under 50 for nine of the past ten months. Sub-indices pointed to a small recovery in new orders but further deterioration of employment.

China PMI showed manufacturing remains in contraction.

Policy direction remains supportive to start the year.

Growth stabilization has been the key theme for policymakers in the last few months, and we saw many piecemeal supportive policies released both on a provincial and national level. Some of the highlights include discussions of a market stabilization fund, as well as the continued rollout of property market policies such as city-level project whitelists.

While the People's Bank of China (PBOC) refrained from cutting rates in January, it did announce a 50bp cut in the required reserve ratio (RRR) to take effect from 5 February. The cut was the largest since 2021 and provides, in theory, up to RMB1tn of liquidity to markets. The PBOC also broadened access to commercial loans for property developers by allowing bank loans pledged against developers’ commercial properties to be used to repay other loans and bonds until the end of the year. It also cut the refinancing and rediscount rates for rural and micro-loans by 0.25 basis points to 1.75%.

Largest RRR cut since 2021 may be a signal of more policy support to come.

Markets await the Two Sessions to set the tone for 2024.

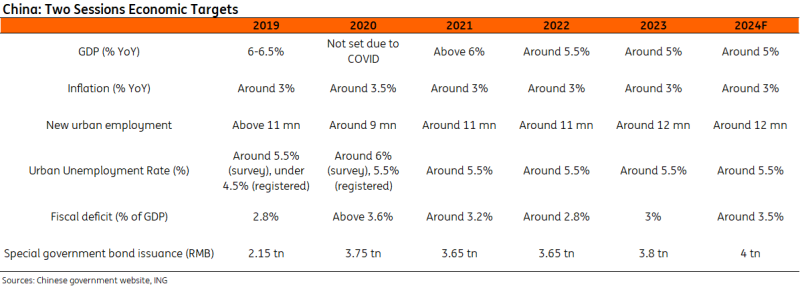

Soon after the Lunar New Year, the Chinese government will hold its annual Two Sessions, which refers to the plenary sessions of the National People's Congress (NPC) and the Chinese People's Political Consultative Conference (CPPCC). The Two Sessions are typically the most important policy meetings of the year and will start on 4-5 March.

This year, there is a higher-than-usual level of uncertainty as the Third Plenary Session (traditionally a fourth-quarter meeting where the economy is the main focus and various reforms and new measures are announced, was postponed. As such, the Two Sessions meetings will be highly scrutinized for any new policy signals.

Regarding economic targets, we feel it is unlikely we will see major movements here. Premier Li Qiang’s comments at Davos and the provincial-level 2024 GDP targets indicate that the country-level GDP target is likely to be set at “around 5%” again in 2024. The fiscal deficit to GDP target is worth watching as a potential signal for stronger fiscal policy support this year. However, an unchanged target does not preclude the government from more stimulus, as it may use special bonds to finance necessary projects.

Two Sessions expected to keep GDP target unchanged.

Provincial growth targets more or less steady in 2024

The provinces have already submitted their 2024 GDP growth targets, which would appear to favour an unchanged 5% target on the national level.

On a provincial level, of the 31 provinces with GDP growth targets:

- 13 targeted higher GDP growth in 2024

- 13 targeted lower GDP growth in 2024

- 5 targeted steady GDP growth in 2024 (within 0.1% from 2023 actual growth)

All but one province targeted growth of 5% or higher. The track record of provinces achieving the growth targets is less pristine compared to the national level targets but are nonetheless important for signaling the general expectations for the year.

2024 growth targets vs 2023 actual growth performance by province

Forecast adjustments.

We are adjusting our 2024 GDP forecast for China from 5.0% to 4.8% ahead of the Two Sessions meetings in March. In our base case scenario, we expect a moderate level of policy support, but given a less favorable base effect, pervasively downbeat sentiment, and property market weakness remaining an overhang, reaching 5% growth this year may be more difficult.

We are also revising our 2024 inflation forecasts for China from -0.2% to 0.9%. While inflation is likely to remain sluggish in the first half of 2024, a combination of a weak base effect, the pork cycle, and the potential impact of supportive policies should drive inflation higher in the second half of the year. We believe that market concerns over Chinese deflation remain overblown.

Finally, in light of recent monetary policy developments, we've pushed back the timing for USDCNY appreciation. We expect the USDCNY pair to see some weakness in the near term but to appreciate to 7.00 by the end of the year.

More By This Author:

FX Daily: Yen Funded Carry Continues To Perform

Asia Morning Bites For Wednesday, February 7

Rates Spark: Holding Pattern, So Edge Up

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more