China Auto Sales Just Posted Their Worst Month Ever

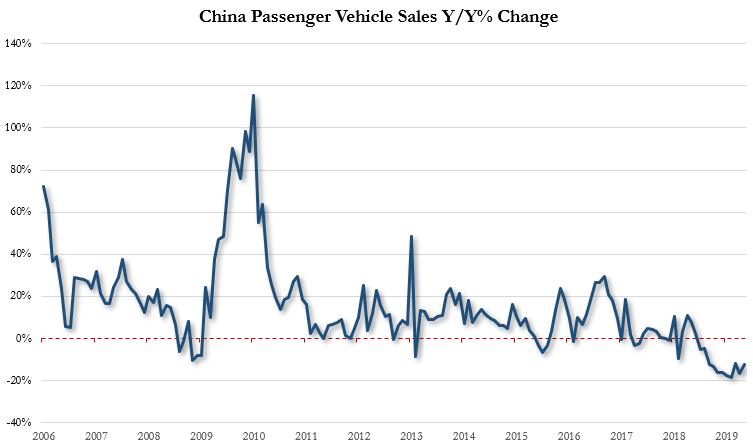

China's automobile market has continued to catalyze the global auto recession, posting its worst sales month in history for May according to the China Association of Automobile Manufacturers (CAAM). The data showed a decline of 16.4% for May, following a decline of 14.6% in April and 5.2% in March. It was the sharpest decline ever for China's auto industry.

Xu Haidong, CAAM’s assistant secretary-general ignored the fact that his country was in the midst of a trade war and instead told Reuters: "One key reason for the drop was provinces implementing 'China VI' vehicle emission standards earlier than the central government’s 2020 deadline, stoking uncertainty among manufacturers."

Or the same reason Europe has been using to explain away its own automotive depression recession.

"We gave the manufacturers too little time to prepare," he continued, also noting that May's drop in demand was attributable to a "decline in purchasing power in the low-to-middle income groups as well as expectations of government stimulus to encourage purchases."

(Click on image to enlarge)

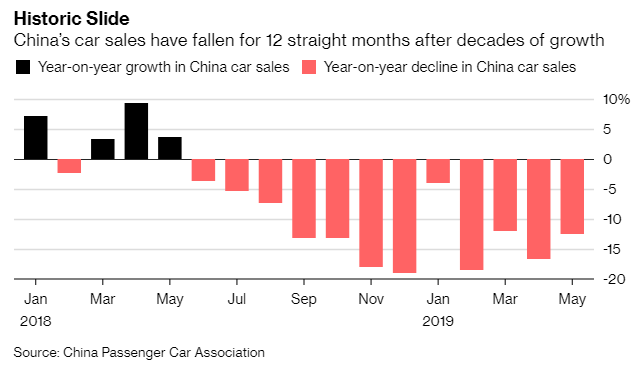

Passenger vehicles were crushed lower for the 12th straight month, according to the Passenger Car Association ("PCA"). May retail passenger vehicle sales were down 12.5% on the year to 1.61 million units. May's data follows a drop of 16.6% in April and 12% in March. Passenger vehicle sales include sedan, MPV, SUV and minivan sales. SUV sales were down 9.6% to 669,395 units.

Turning toward individual brands, Changan's auto sales fell 35% to 113,497 units in May and Great Wall Motor said that their sales had fallen 11.8% to 62,559, according to Bloomberg. Cui Dongshu, secretary general of PCA, told reporters in Beijing: “It is a pretty difficult time for the auto industry.”

(Click on image to enlarge)

Sales by Chinese brands were down 26.5% last month, while initial data for June showed a "slight" increase in total sales from a year prior, as dealers slashed prices and continued to try and lure customers with incentives.

Economic woes in China, partly as a result of the country's ongoing trade war with the U.S., continue to weigh on sales. At the same time, the rise of car-sharing services is reducing demand for purchasing new vehicles.

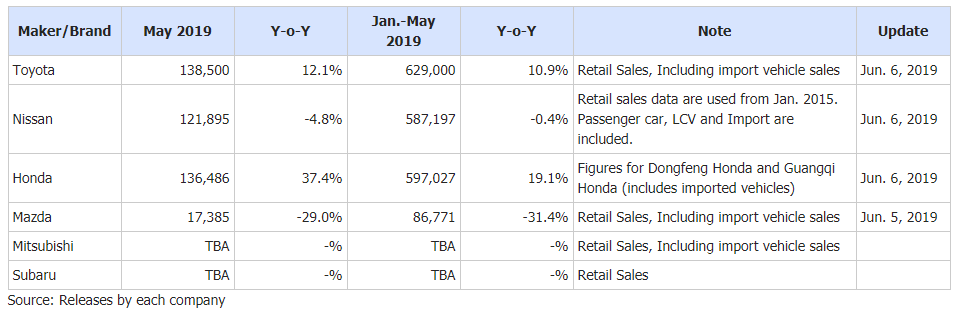

Additional data from Marklines shows that Honda and Toyota were two of the only names that could buck the trend for the month.

(Click on image to enlarge)

Baojun, Dongfeng and Trumpchi are all local brands that have fallen 40% or more this year, through April.

Electric vehicle sales, which have been the sole "silver lining" for the recessionary industry over the last year, also saw a sharp slowdown in May. Sales were up just 1.8% versus 18.1% in April. EV sales were up 62% last year despite the broader auto market slowing.

May's drop now marks an entire year of falling sales. The last time China saw retail auto sales rise was back in May 2018. And so, it is looking like a bloated and overextended global auto market will no longer be able to turn to China for reliable growth, as they have done since the 1990s. This has some automakers delaying expansion plans into China, while others execute global layoffs and restructurings. For example, we reported last month that there had been 38,000 layoffs across the industry over the last 6 months.

(Click on image to enlarge)

The future turned even gloomier when outgoing Daimler CEO Dieter Zetsche said last month that "sweeping cost reductions" are coming to prepare for what he is calling "unprecedented" industry disruption.

Bank of America Merrill Lynch analyst John Murphy said at the same time: “The industry is right now staring down the barrel of what we think is going to be a significant downturn. The pace of decline in China is a real surprise.”

Bank of America had also commented that "the auto cycle has peaked" in a note put out about a week ago.

Global automakers have invested billions, betting that China would continue to grow, even in the face of pronounced slowdowns in Europe in North America. We'd say that this malinvestment would eventually need to be corrected, but in the Central Bank/ZIRP era, we're sure it'll eventually just be monetized and paid for by tax payers somehow.

That or central banks will simply start buying cars in the open market to "collateralize" the dollar. You laugh, but check back in 3 years...

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more