CHF/JPY Perfectly Reacting Higher From Blue Box Area

In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of CHFJPY. In which, the rally from 14 December 2023 low unfolded as an impulse sequence and called for an extension higher to take place. Therefore, we knew that the structure in CHFJPY should remain supported & extend higher. So, we advised members not to sell the pair & buy the dips in 3, 7, or 11 swings at the blue box areas. We will explain the structure & forecast below:

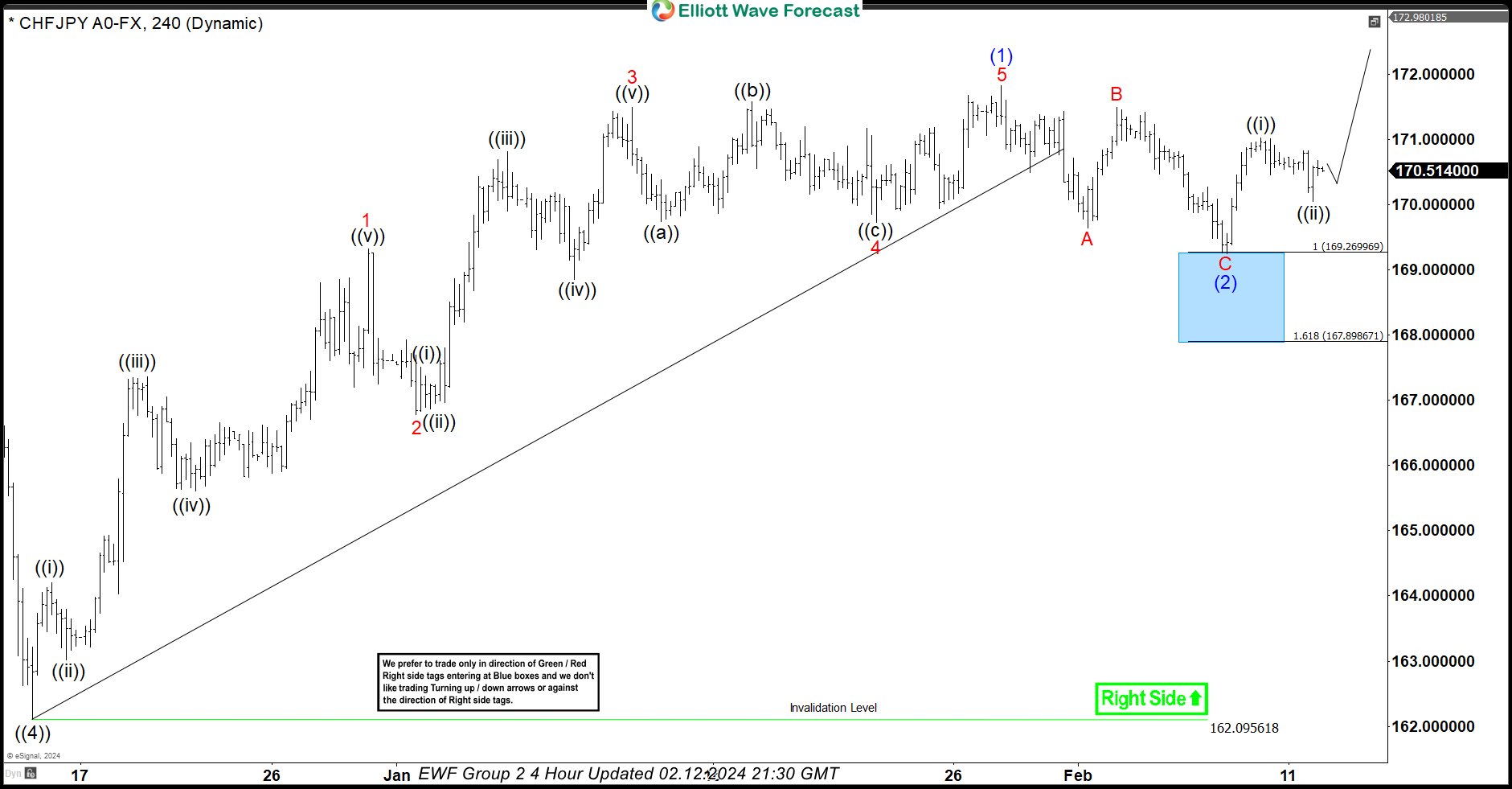

CHFJPY 4-Hour Elliott Wave Chart From 2.06.2024

(Click on image to enlarge)

Here’s the 4-hour Elliott wave Chart from the 2/06/2024 update. In which, the rally to 171.82 high-ended wave (1) & made a pullback in wave (2). The internals of that pullback unfolded as Elliott wave zigzag correction where wave A ended in 3 swings at 169.64 low. Then a bounce to 171.48 high-ended wave B & started the next leg lower in wave C towards 169.26- 167.89 blue box area. From there, buyers were expected to appear looking for new highs ideally or for a 3-wave bounce minimum.

CHFJPY Latest 4-Hour Elliott Wave Chart From 2.12.2024

(Click on image to enlarge)

This is the latest 4-hour Elliott wave Chart from the 2/12/2024 update. In which the pair is showing a reaction higher taking place, right after ending the correction within the blue box area. Allowed members to create a risk-free position shortly after taking the long position at the blue box area. However, a break above 171.82 high is still needed to confirm the next extension higher & avoid further correction lower.

More By This Author:

Visa Inc Nest Structure Signals Further Upside

GBPJPY Looking To Extend Higher In Impulsive Structure

Gilead Sciences Stock Approaches Daily Buying Area

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more