Charted: Six Red Flags Pointing To China’s Economy Slowing Down

(Click on image to enlarge)

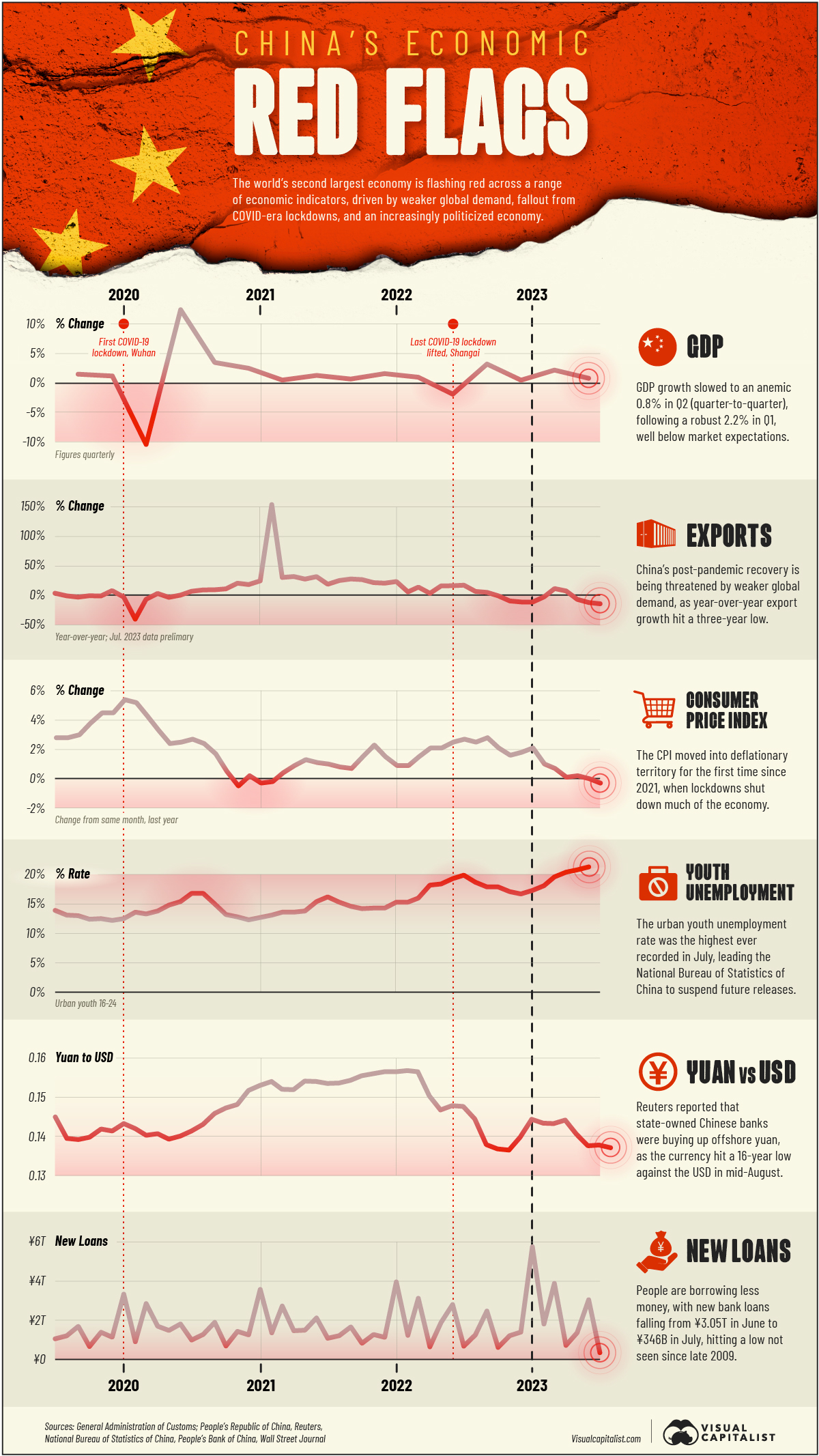

Six Red Flags Pointing to China’s Economy Slowing Down

The People’s Republic of China is the world’s second-largest economy, responsible for one quarter of global GDP growth this millennium—so when the country catches a cold, the world notices.

The past several months have seen an avalanche of bad economic news for China, putting the country’s post-pandemic recovery, and global economic growth, in jeopardy.

In this visualization, we look at six important indicators that point to China’s economy slowing down. Data comes from the National Bureau of Statistics of China, the People’s Bank of China, and the General Administration of Customs, to see what is flashing red.

Six Red Flag Indicators on China’s Economy

1. GDP

China’s annual GDP growth rate has averaged 9% since 1978, when the country opened itself up to the global market under Deng Xiaoping.

However, growth seems to have slowed to a crawl, down to 0.8% (quarter-to-quarter) in the second quarter of 2023 driven by weakness in the Tertiary Sector, which includes retail spending and the troubled real estate sector. This follows a more robust 2.2% figure in Q1, which was driven by pent-up demand released by the end of COVID-era lockdowns.

On an annual basis, China’s GDP expanded 6.3% year-over-year, below the forecasted 7.3% rate.

2. Exports

Exports fell by 14.5% in July, marking the third straight month of declines, and hitting lows not seen since February 2020. Meanwhile, imports fell 12.4%, reflecting the cautious consumer mood.

On a regional basis, exports fell year-over-year to China’s three biggest customers, ASEAN, the EU, and the U.S., by 17.4%, 15.1%, and 20.8% respectively.

There was one bright spot, however: exports to sanction-burdened Russia increased 51.8%, but that wasn’t nearly enough to offset the overall downward trend.

3. Consumer Price Index

The consumer price index moved into deflationary territory for the first time since 2021, with prices falling 3% year-over-year. The decline was led by Household Articles and Services, Food & Tobacco, and Transportation and Communications.

At the same time, the prices that producers paid for industrial products (PPI) fell 4.4% (year-over-year), the tenth month in a row with a negative reading.

4. Youth Unemployment

And while the headline unemployment rate remained steady at 5.3% in August 2023, up slightly from 5.2% the month before, it papers over serious weakness for urban youth, aged 16 to 24.

In July, the urban youth unemployment rate reached 21.3%, the highest ever recorded in the country, leading the National Bureau of Statistics of China to suspend future releases.

5. Yuan vs. USD

Given the stream of economic bad news, it’s no surprise that the yuan (CNH) fell to a 16-year low against the U.S. dollar (USD) on August 16, 2023 in offshore trading.

In an effort to stabilize the currency, major state-owned Chinese banks were seen buying up yuan in offshore money markets. At the same time, the spread between the fixed exchange rate set by the People’s Bank of China and the offshore rate, rose to more than 1,000 basis points.

6. New Loans

Adding to the dismal economic mood, people borrowed less money according to the most recent figures provided by the government.

New bank loans fell to ¥346 billion in July, down from ¥3.05 trillion in the month before. This was the lowest reading since late-2009, and less than half of the ¥780 billion economists had forecast.

What’s Next?

Foreign Affairs recently published an article with the provocative title “The End of China’s Economic Miracle,” arguing that China’s troubles could be a U.S. opportunity.

And while this may be somewhat premature, the Middle Kingdom has some serious structural issues to contend with, many of them of their own making. Some of the top challenges include crackdowns on the tech sector, a collapsing real estate market, a larger debt crisis, and a shrinking population.

But large-scale government intervention does not appear to be in the offing, beyond exhortations for consumers to spend more and blaming Western media for engaging in “cognitive warfare.”

It’s no wonder that consumer confidence has plunged so low. At least we think so: the Chinese government stopped publishing that too.

More By This Author:

Charted: Youth Unemployment In The OECD And China

The Monthly Cost Of Buying Vs. Renting A House In America

Mapped: The Richest Billionaires In U.S. States