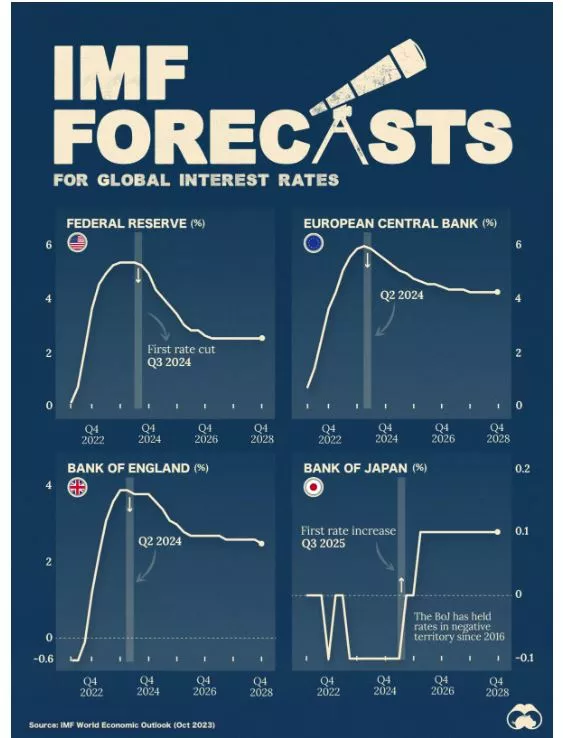

Charted: IMF Forecasts For International Interest Rates

With inflation impacting markets and international interest rates for more than a year, how are different central banks expected to act in the future?

Charted: IMF Forecasts for International Interest Rates

With inflation impacting markets and international interest rates for more than a year, how are different central banks expected to act in the future?

Although the outlook on inflation remains uncertain, the International Monetary Fund (IMF) expects most advanced economies to begin gradually easing interest rates by mid-2024.

These charts show the IMF’s projected central bank policy rates for four major economies through 2028, using the World Economic Outlook forecast data as of October 2023.

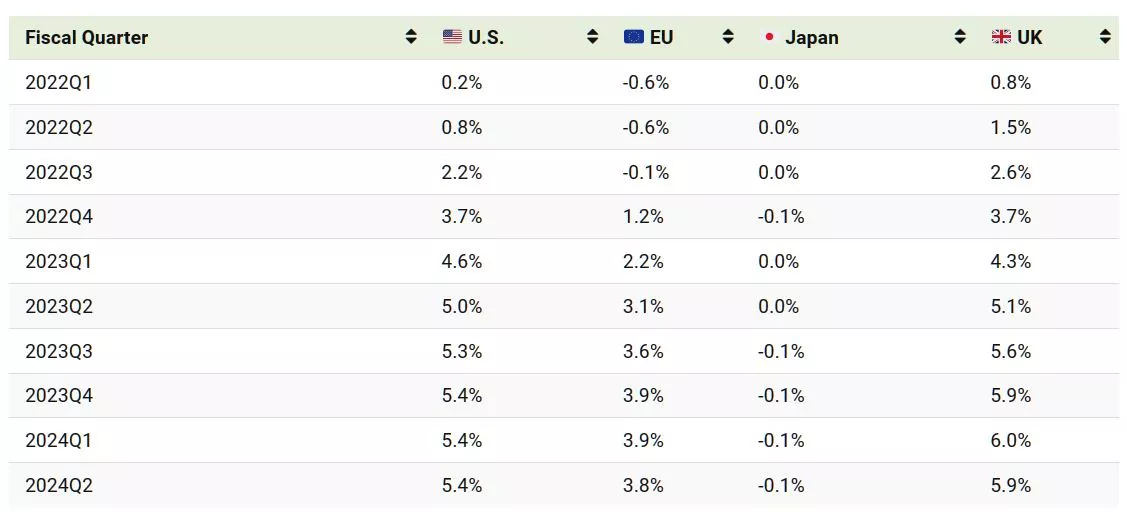

Interest Rates Forecasts for 4 Major Economies (2024‒2028)

Since 2022, interest rates have climbed in the EU, the UK, and the U.S. by at least 4 percentage points.

In 2023, rates have continued to climb at a slower pace and are expected to peak at the start of 2024. The U.S. Federal Reserve, for example, is expected to see interest rates peak around 5.4% before beginning to implement rate cuts in Q3 2024.

On the other hand, Japan has held interest rates at 0% or slightly lower since 2016.

Despite the Japanese yen falling and inflation (and prices) in the country continuing to climb, the Japanese economy as a whole has struggled over the past few decades with weak consumer demand. There are worries that raising interest rates will make economic recovery tougher in the long run.

And as other central banks plan to start cutting rates, Japan is poised to do the opposite. In 2025, the country is forecasted by the IMF to see its first positive interest rates in nine years.

It’s important to remember that future rate cuts will largely depend on whether inflation in countries continues to decelerate. Major developments, such as the Israel-Hamas war, can also disrupt global markets and force central banks to change course.

More By This Author:

Visualizing Portfolio Return Expectations, By Country

Visualizing $97 Trillion Of Global Debt In 2023

Visualizing The Rise Of The U.S. Dollar Since The 19th Century

Disclosure: None