Central Bank Watch: BOC, RBA, & RBNZ Interest Rate Expectations Update - Thursday, Nov. 18

RISING INFLATION PUSHING CENTRAL BANKS

In this edition of Central Bank Watch, we’re examining the rates markets around the Bank of Canada, Reserve Bank of Australia, and Reserve Bank of New Zealand. Policymakers are facing increasingly difficult decisions as the global economy moves out of the coronavirus pandemic, leading to volatile swings in rate hike pricing.

Both realized and expected measures of inflation are reaching record highs, provoking acceleration in rate hike odds implied by markets for the BOC and RBNZ in recent weeks. Meanwhile, policy officials at the RBA are continuing to downplay the odds of a rate move in 2022, even as markets are still pricing in the first hike by July 2022.

BOC’S MIXED SIGNALS

Canadian inflation rates jumped to 20-year highs in October, but the BOC has already been cautioning that the data don’t mean that a rate hike will arrive any sooner than what markets had already been discounting. Earlier this week, BOC Deputy Governor Lawrence Schembri said that “there's a lot of uncertainty about the timing of the closing of the output gap, so one should be careful not assuming it's necessarily going to be the second quarter. It's a range of six months -- that's our best estimate.”

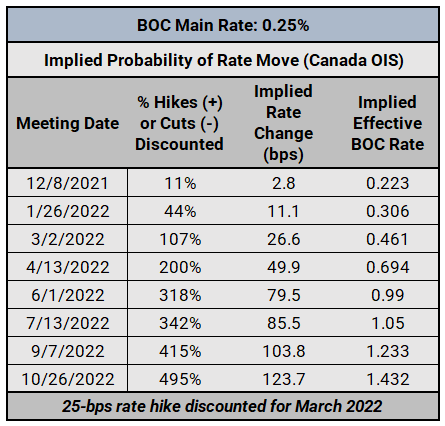

BANK OF CANADA INTEREST RATE EXPECTATIONS (NOVEMBER 18, 2021) (TABLE 1)

In light of comments from BOC policymakers and the October Canada inflation report, rates markets are expecting March 2022 for the first-rate hike (100% chance for a 25-bps rate hike, 7% chance for a 50-bps rate hike). This is a slight difference from a week ago, when markets were anticipating March 2022 for the first 25-bps rate hike, but the odds of a 50-bps hike were higher at 31%.

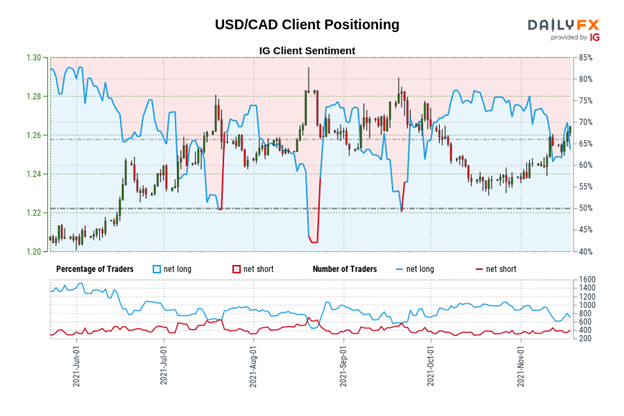

IG CLIENT SENTIMENT INDEX: USD/CAD RATE FORECAST (NOVEMBER 18, 2021) (CHART 1)

USD/CAD: Retail trader data shows 60.91% of traders are net-long with the ratio of traders long to short at 1.56 to 1. The number of traders net-long is 3.74% lower than yesterday and 2.04% lower from last week, while the number of traders net-short is 19.69% higher than yesterday and 16.08% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/CAD price trend may soon reverse higher despite the fact traders remain net-long.

RBA WARNS ON HIKES

We’ve seen Australian economic data disappoint in recent weeks, and as a result, RBA policymakers have been cautioning that rate hikes may not arrive as quickly as markets are anticipating – even as measures of Australia inflation continue to move higher. RBA Governor Philip Lowe said that “the economy and inflation would have to turn out very differently from our central scenario for the board to consider an increase in interest rates next year.” Rates markets still think otherwise, however.

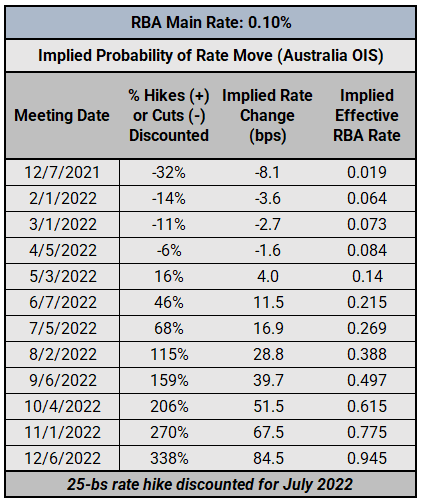

RESERVE BANK OF AUSTRALIA INTEREST RATE EXPECTATIONS (NOVEMBER 18, 2021) (TABLE 2)

Even as RBA Governor Lowe has warned that rate hikes aren’t coming in 2022, traders believe that economic data will improve to the point that the Australian central bank will raise rates early in the second half of 2022. While Australia overnight index swaps (OIS) were pricing in a 58% chance of the first 25-bps rate hike to arrive by June 2022, July 2022 is now favored for the first rate move with an implied probability of 68%.

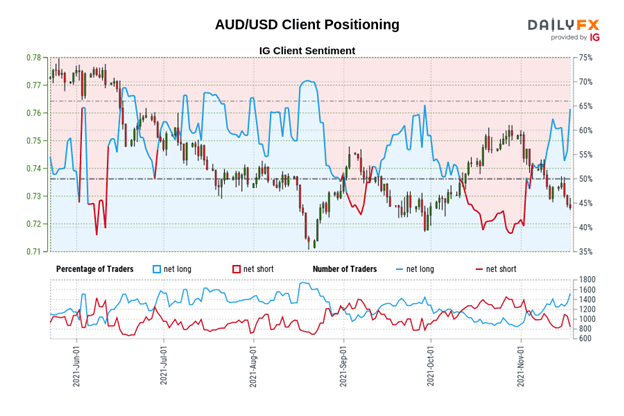

IG CLIENT SENTIMENT INDEX: AUD/USD RATE FORECAST (NOVEMBER 18, 2021) (CHART 2)

AUD/USD: Retail trader data shows 64.74% of traders are net-long with the ratio of traders long to short at 1.84 to 1. The number of traders net-long is 6.07% higher than yesterday and 14.66% higher from last week, while the number of traders net-short is 5.10% lower than yesterday and 4.04% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/USD-bearish contrarian trading bias.

RBNZ LOOKING MORE AGGRESSIVE

Rates markets are pricing in the most aggressive rate hike cycle by a major central bank in the post-Global Financial Crisis era over the next year for the RBNZ. The 4Q’21 New Zealand inflation expectations data earlier this week bolstered the narrative, with the 2-year inflation expectation jumping to +2.96% from +2.27%; the 1-year inflation expectation surged to an 11-year high of +3.7%. In the wake of the data, rates markets are on the verge of pricing in 50-bps worth of hikes when the RBNZ meets next week.

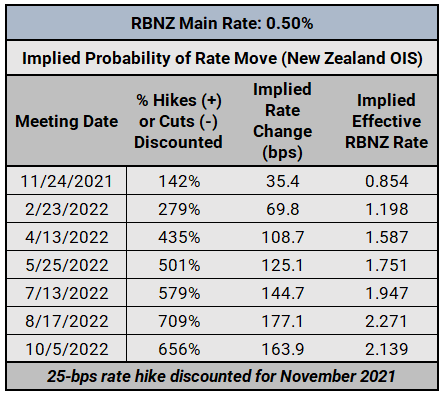

RESERVE BANK OF NEW ZEALAND INTEREST RATE EXPECTATIONS (NOVEMBER 18, 2021) (TABLE 3)

Last week, New Zealand OIS were implying a 140% chance of a hike at the November meeting (100% chance of a 25-bps rate hike; 40% chance of a 50-bps rate hike). After the New Zealand inflation expectations figures, there is now a 142% chance of a hike (100% chance of a 25-bps rate hike; 42% chance of a 50-bps rate hike). If the RBNZ only delivers a 25-bps rate hike, however, this could represent a disappointment relative to expectations, leading to weakness in NZD-crosses. It may be the case that RBNZ rate hike pricing is an albatross around the Kiwi’s neck for the foreseeable future.

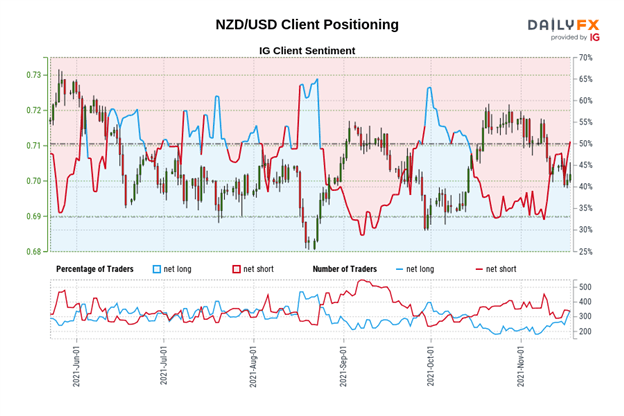

IG CLIENT SENTIMENT INDEX: NZD/USD RATE FORECAST (NOVEMBER 18, 2021) (CHART 3)

NZD/USD: Retail trader data shows 50.85% of traders are net-long with the ratio of traders long to short at 1.03 to 1. The number of traders net-long is 0.91% lower than yesterday and 26.15% higher from last week, while the number of traders net-short is 3.06% lower than yesterday and 7.85% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZD/USD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZD/USD-bearish contrarian trading bias.