Cellnex Expands Further With Major Acquisition

The main European operator of wireless telecommunications infrastructures, Cellnex, has announced that it is continuing its process of European expansion, following the acquisition of the Polish company Polkomtel Infrastruktura.

It is the telecommunications infrastructure subsidiary of Cyfrowy Polsat Group. With this acquisition, Cellnex will add another 7,000 towers to its portfolio. The news comes just days after the company completed the acquisition of 9,100 towers from CK Hutchison in Italy.

The purchase makes Poland one of the company's main markets, where Cellnex is expected to invest another €600 million in the next 10 years for the deployment of 5G networks in the country.

The total cost of the operation amounts to €1.6 billion, which the company will finance with its excess liquidity. This acquisition is expected to have a positive impact of €330 million on the group's EBITDA.

The positive results of the company have not gone unnoticed by investors. The company has presented in the last 8 reports of results, with advances close to 10% in its quarterly revenue.

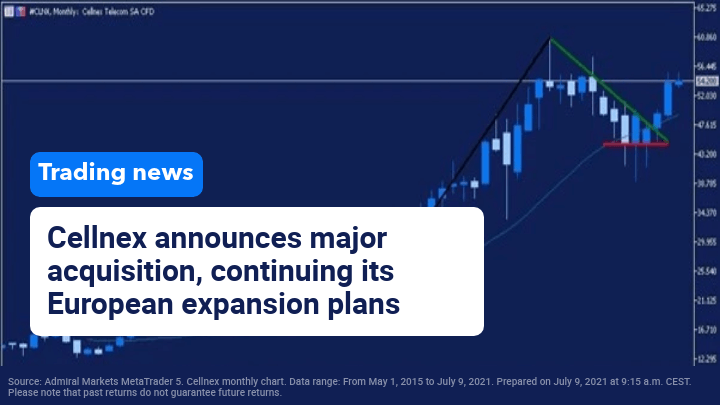

Source: Admiral Markets MetaTrader 5. Cellnex monthly chart. Data range: From May 1, 2015 to July 9, 2021. Prepared on July 9, 2021 at 9:15 a.m. CEST. Please note that past returns do not guarantee future returns.

Evolution in the last 5 years:

- 2020: 37.32 %

- 2019: 94.40 %

- 2018: - 2.13 %

- 2017: 37.63 %

- 2016: -20.77 %

In Cellnex's monthly chart, you can clearly see the formation of a pennant pattern.

This continuation figure is characterized by the fact that after a prolonged upward period, some traders opt for a profit-taking, before resuming the march.

During this profit collection, a symmetrical triangle is usually formed, although on this occasion the buyers have not let the value close below €44.72. In their latest bullish momentum, buyers managed to break the resistance of this downward triangle, so according to this formation, in the coming months we could see a bullish rally that could take Cellnex's stock up to €83.10.

This level is obtained by adding the mast of this pennant to the place of breaking the triangle support with the mast.

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter ...

more