Canadian Equity Market: High Capital Risk Amid Falling Earnings

Canada’s TSX index has rebounded 6%, year-to-date, while its corporate earnings have contracted. As of today, the S&P/TSX Composite is expected to report a Q2 (year-over-year) earnings decline of -20.4%, compared to the estimated (year-over-year) earnings decline of -17.4% on June 30 and the estimated (year-over-year) earnings decline of -12.5% on March 31. See Canada Earnings Season Preview: Q2 2023:

If -20.4% is the actual decline for the quarter; it will mark the largest earnings decline reported by the index since Q3 2020. It will also mark the third straight quarter in which the index has reported a year-over-year decline in earnings.

…At the sector level, eight of the eleven sectors recorded a decline in estimated earnings during the quarter, led by the Materials (-11.7%), Energy (-10.2%), and Utilities (-8.7%) sectors.

…Looking ahead, analysts expect a decline in earnings of -7.9% in Q3 2023 but growth in earnings of 2.9% in Q4 2023. For all of CY 2023, analysts are predicting a decline in earnings of -9.6%.

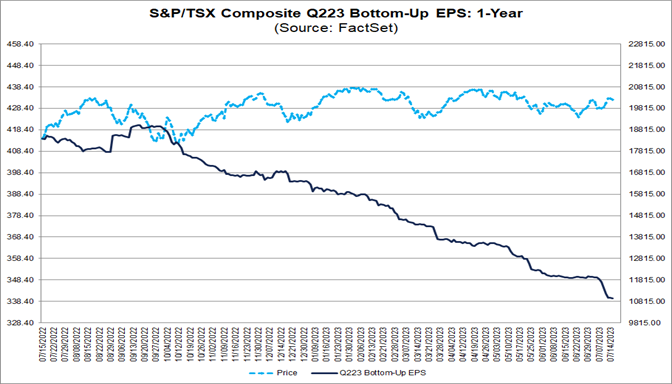

Offering less for more: the TSX price is shown in blue below since July 2022, with one-year earnings per share estimates in black. Either earnings need to surprise to the upside over the next few quarters, or prices have more downside work to do. With cash alternatives able to earn 5% and recession odds at 100%, over-valued equities remain unattractive.

More By This Author:

Fat Pitches And Market CyclesThe Elevator Pitch For Capital Preservation

Those Who Overlook History