Canadian Equities Go The Way Of Global Equities

There has been no shortage of macroeconomic headwinds in 2022. Canadian equities were an exception in posting gains for the first three months of the year, but they have since fallen in step with most global equity markets. The S&P/TSX Composite Index lost 12.07% since its last rebalance on March 17, 2022. Uncommonly, the S&P/TSX Composite Low Volatility Index underperformed slightly, losing 12.34% in the same period.

With the market’s decline, volatility has, unsurprisingly, increased for all sectors of the S&P/TSX Composite Index, with the Information Technology notching the biggest jump (see Exhibit 1).

(Click on image to enlarge)

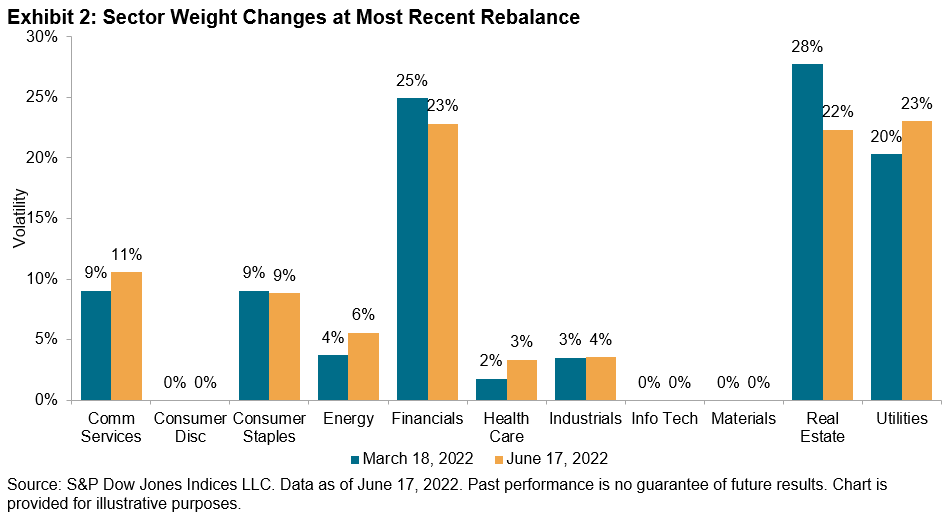

The impact of these changes on the S&P/TSX Composite Low Volatility Index was limited since the index had already eliminated all holdings in the Consumer Discretionary, Information Technology, and Materials sectors. As of the latest rebalance, effective at the close of trading on June 17, 2022, Low Volatility continues to hold just eight sectors, with the largest concentrations in Financials, Real Estate, and Utilities (despite Real Estate having been pared back 6%). Communication Services, Energy, and Utilities all added to their weights.

(Click on image to enlarge)

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.