Canadian Dollar Holds Steady As Markets Await The Next Leg

Photo by Michelle Spollen on Unsplash

- The Canadian Dollar middled on Tuesday, treading water in familiar territory.

- A mid-tier economic data docket this week has very few Canadian talking points.

- Global markets are waiting to see how the latest segment of the Trump tariff story unfolds.

The Canadian Dollar (CAD) stuck close to familiar levels on Tuesday, spinning a tight circle as investors take a breather following a sharp correction in forward expectations late last week. The US Dollar (USD) took a hard hit last Friday after US labor data faced sharp downside revision, and despite a sharp upstep in hopes for an impending rate cut from the Federal Reserve (Fed), recession fears are back on the rise.

Key US Services Purchasing Managers Index (PMI) figures missed the mark on Tuesday, adding further weight to concerns that the US economy may not be as hot as most expected through the first half of the year. Investor expectations are currently parked in a sweet spot where weakening economic data will force the Fed into fresh rate cuts, but remain firm enough that the US won’t backslide into an outright recession.

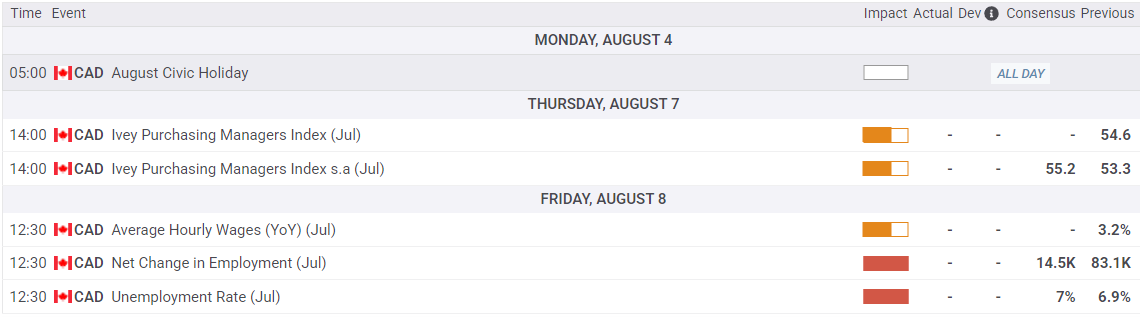

The Canadian data docket is largely empty this week, leaving Loonie traders in a lurch as trade and tariff headlines rule the roost. Canadian labor data is due on Friday, and is expected to show much of the same as the US’s latest net jobs numbers. Canadian Ivey PMIs for July are also expected on Thursday, but are unlikely to move the sentiment needle much.

Daily digest market movers: Canadian Dollar moves drop off as markets await structural shifts

- The Canadian Dollar is up 0.75% from last week’s 11-week low against the US Dollar.

- Greenback weakness has sparked a fresh bounce in Loonie flows after a near-term one-sided decline.

- US ISM Services PMI figures for July slumped to 50.1 on Tuesday, slumping back toward the 50.0 contraction level once again.

- The Canadian Ivey PMI for July is expected to tick up on Thursday, with median market forecasts anticipating a step up to 55.2 from 53.3.

- Canadian Net Change in Employment is also expected to drop off sharply, to 14.5K from 83.1K.

- The Canadian Unemployment Rate is also expected to tick up to 7.0% from 6.9%.

Canadian Dollar price forecast

The Canadian Dollar caught a headline-fueled break from one-sided US Dollar flows late last week, capping off a sharp turnaround in USD/CAD momentum. The Loonie has pared away some of the Greenback’s recent gains, pushing the pair back below the 1.3800 handle, but USD/CAD remains caught in a technical trap between the 50-day and 200-day Exponential Moving Averages (EMA) near 1.3740 and 1.3860, respectively.

USD/CAD daily chart

More By This Author:

GBP/USD Looks Upwards Ahead Of Looming BoE Rate CutDow Jones Industrial Average Claws Back Ground After A Week Of Declines

Canadian Dollar Snaps Losing Streak On Volatile NFP Friday