Canada Jobs Revival Justifies Another Taper

Canada's economy is showing real signs of improvement with today's jobs data reinforcing the more upbeat outlook. The Bank of Canada are set to taper their QE program again next week and with interest rates set to rise next year, the outlook for CAD remains bullish.

Bank of Canada Governor Tiff Macklem takes questions from reporters on the phone as he participates in a news conference at the Bank of Canada

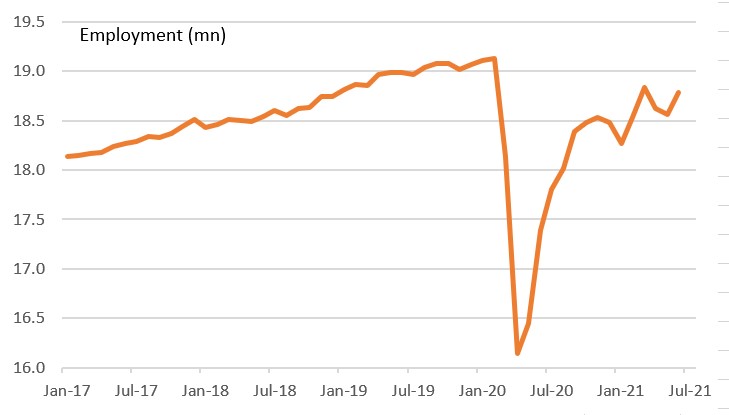

Jobs surge back, but only part-time for now

Canada added 231,000 jobs in June, which was well above the 175,000 consensus estimate. The disappointing aspect was that they were all part-time with full-time employment actually falling 33,200. This likely reflects issues over ongoing Covid restrictions and the gradual re-opening process, but as the chart below shows, the really encouraging thing is that the economy is getting close to having fully recovered all of the lost jobs caused by the pandemic.

Canada employment levels (mn)

Source: Macrobond, ING

The majority of gains were in the accommodation and food sector (+100,900) with construction (-23,400), the main drag. Meanwhile the unemployment rate fell to 7.8% from 8.2%, which was in line with expectations.

With employment now down only 340,000 on February 2020 levels and the gradual re-opening of the economy set to gain more momentum in the next couple of months, we expect employment to be fully recovered by the end of the current quarter.

Bank of Canada to taper again

40% of Canada’s population is now fully vaccinated with a further 29% partially so (requiring a second dose), which puts it close to the top in the Covid vaccination rankings. It also leaves Canada well ahead of the US and most of Europe and with the number of cases plunging and hospitalisation numbers remaining low this is allowing a gradual re-opening of the economy.

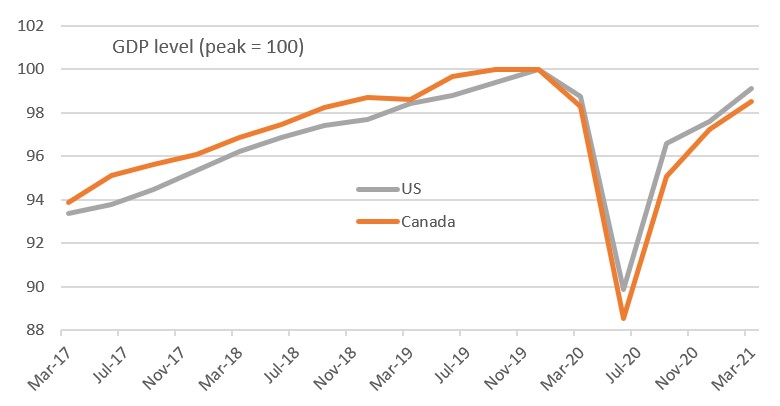

In any case, Canada’s economy hasn’t been hit as hard as feared by the third wave of infections while the BoC’s latest Business Outlook Survey showed sentiment hitting a record high on optimism that the economy can swiftly return to normality. With fiscal policy continuing to provide support to the economy, inflation already above target and jobs prospects looking strong we believe that the Bank of Canada will announce a third taper of its QE asset buying next week, reducing it to C$2bn per week from C$3bn.

Canada and US GDP level comparison (indexed to peak = 100)

Source: Macrobond, ING

With worries mounting about the implications of Canada’s booming housing market and with government bond yields having dropped sharply since mid-May, we think the BoC will look to conclude the QE purchase program before the end of this year. There is questionable need for such stimulus in the current environment.

We also expect the BoC to re-affirm its statement that they will look to hold “the policy interest rate at the effective lower bound (0.25%) until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. In the Bank’s April projection, this happens sometime in the second half of 2022”.

We expect the language to gradually harden in coming months and expect the BoC to raise interest rate twice in the second half of 2022 with the risks skewed towards even earlier policy tightening.

CAD: BoC and economic recovery offers reasons to stay bullish

The strong jobs data for June likely fuelled expectations that the BoC will taper asset purchases again at the July meeting. Still, this does not appear to be fully priced in and the loonie has been a key underperformer lately due to the unwinding of carry trades and the re-rating of the global reflation story, so we think that another round of tapering can have a meaningful positive impact on CAD next week.

What the June jobs report also did was to provide evidence that the set of grim data for Canada caused by the spring flare-up in Covid-19 cases is past us, and that the economy is indeed back on an encouraging growth path. This, in tandem with a still supportive growth outlook for the US (to which Canadian assets are highly sensitive) continue to offer an additional help to CAD, in our view.

In line with our view that market sentiment will increasingly stabilize in Q3 and that global reflationary trades should once again prevail, CAD is set to offer a very attractive set of fundamentals that should fuel a sustained recovery to the 1.20 level in 3Q and a move below 1.20 in 4Q.

A key risk to this profile is surely related to a potential fully-fledged break-up in the OPEC+ deals, which is however not our commodities team’s base-case scenario, as they continue to forecast no material slump in oil prices for the rest of the year.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more