Canada: Cutting Growth Forecasts

November GDP data is likely to slow Canada’s economic performance, ending 2018 in a pretty disappointing fashion. Is this more than just a soft patch? We think so, and are revising down our growth expectations for this year.

Source:pexels

After a few months of subdued Canadian growth, a much-needed boost arrived in October (0.3% month-on-month), but we aren’t expecting any upside surprise in November. Our monthly GDP forecast is -0.1%, which would bring the annual figure to 1.6%.

Signs of an economic soft patch are creeping through. The majority of major economies are set to undergo a similar slowdown this year – including the US. But Canada will slow possibly more than we expected due to the below-par performance of the energy sector, and this weaker outlook will likely linger. This forms a large part of why we’ve revised down our 2019 growth expectations from 2.1% to 1.8%.

Oil extraction and exports suppressed due to energy sector issues

Canada’s energy sector has suffered from transportation constraints and inventory build-ups, which is suppressing oil extraction and exports. This can be seen in the November trade data. The deficit widened even further, largely due to a decline in exports (-2.9% MoM). These factors holding the oil industry back also contributed to Western Canada Select (WCS) trading at a deep discount to benchmark oil prices back in late-2018.

the outlook for the energy sector is fragile and it will likely contribute less to growth this year

Since then, the Alberta government announced oil production cuts, which will take effect from January this year. Nevertheless, the reduction in output – despite lifting oil prices in Western Canada, has left the outlook for the energy sector fragile and it will likely contribute less to growth this year.

Robust manufacturing sector should support growth despite November knockback

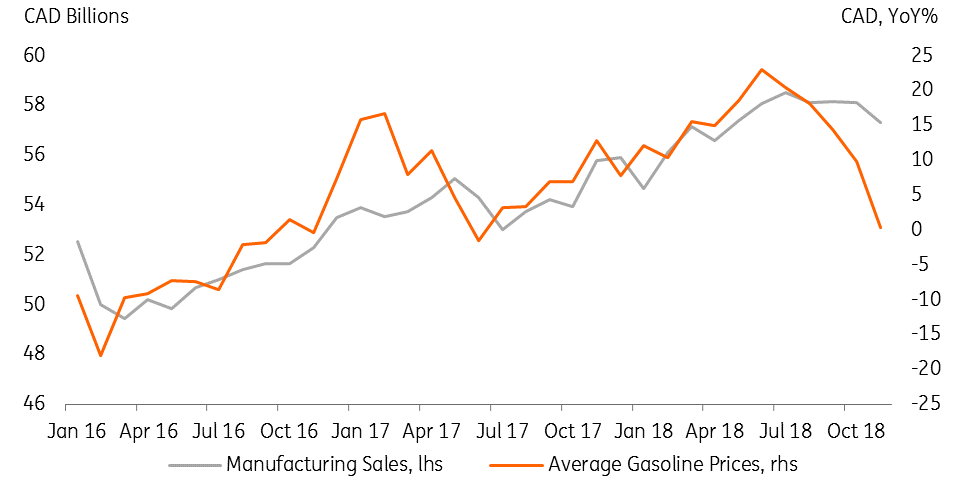

The temporary shock to oil prices, which intensified in November, appears to have fed through to manufacturing. November saw significant month-on-month declines in wholesale, retail and manufacturing sales (-1.0%, -0.9% and -1.4%, respectively), with the latter, reportedly dragged down predominantly by lower petroleum prices.

Manufacturing sales dragged down by lower gasoline prices

Source: Macrobond

These results reinforce our view that growth will be muted in November but that’s not to say everything is bad. Signals that wage growth will pick up are starting to emerge, which should help to hold up domestic demand. And although the US government shutdown has limited economic data releases, up to now, the underlying story is good. The US is still showing resilience – particularly in the labor market, and we see this continuing to support Canadian exports. Going forward, the manufacturing sector should help keep growth figures relatively healthy.

Bank of Canada still in hiking mode

Economic fundamentals still look good. The unemployment rate is at four-decade lows, core inflation has remained around the central bank's 2% target and we expect business activity (outside the energy sector) to improve. This is all good enough, in our view, to keep the Bank of Canada in hiking mode. For now, we see two rate hikes this year in the third and fourth quarter, though the risks are clearly skewed to the downside.

This year won’t be without turbulence, but this shouldn’t come as a surprise – nor should it be extensive. See here for a more detailed outlook on why Canada's slowdown is set to be mild, not major.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does ...

moreComments

No Thumbs up yet!

No Thumbs up yet!