Can China’s Real Estate Market Survive Evergrande?

Image Source: Unsplash

The collapse of Chinese real estate giant Evergrande is being called, by some, China’s “Lehman Moment”. Whether or not it will be enough to trigger a cratering of China’s broader economy, it’s a massive reality check for a country that has transformed itself over the decades with unprecedentedly massive urbanization and economic growth. Evergrande, since its creation in 1996, has been at the forefront of that rise.

Not unlike America’s housing market before 2008, real estate in China has been viewed as a “can’t lose” investment for Chinese home buyers; a vehicle for guaranteed wealth preservation at worst and, at best, massive returns. This, of course, was as much a fiction in China as it was in the States. However, the reason for this ongoing implosion is more from being over-leveraged and overborrowed, rather than hyper-securitized, as was the case for Lehman. But other factors existed in both cases, like rampant money printing to fund the illusion of growth.

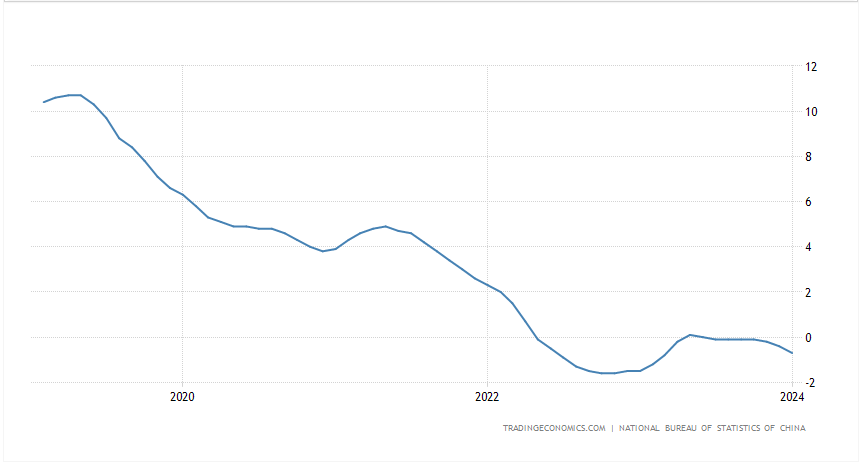

Newly-Built Chinese House Prices Year-Over-Year Since 2019

source: tradingeconomics.com

Evergrande’s implosion doesn’t necessarily need to be China’s Lehman for the country’s economy to be in serious trouble. Country Garden, another one of the largest developers, has failed to repay its loans and is now facing liquidation demands from creditors. It’s another significant domino signaling that China’s real estate crisis is far from over — in fact, Bloomberg Intelligence claims that Country Garden has four times as many pending real estate projects than Evergrande.

Meanwhile, after failing to make a restructuring deal and being ordered to liquidate, Evergrande is suing audit firm PwC on the pretense that it harmed creditors. This is a now-common method for desperate multibillion-dollar companies facing insolvency, as one expert said to the Financial Times earlier this month:

“In the last decade, suing the auditor has become somewhat normalised as a way of recovering value…something a liquidator looks at as a matter of course when you’ve got a multibillion-dollar case”.

Chinese lawmakers are scrambling to “fix” a problem they can’t repair because the country’s (mostly real-estate-based) growth was always fueled by years of unsustainable economics: among other factors, like central bank monetary meddling, Chinese real estate developers were in the habit of “selling” unbuilt properties in order to finance the completion of other properties that had already been promised to previous buyers. In other words, a Ponzi-like game of real-estate hot potato where new investors are harvested for properties that don’t even exist yet, in order to fund unfulfilled promises to previous investors.

Whether it’s enough to collapse China’s economy and contribute to a global downturn, is an unanswered question. But regardless of what happens financially, the perception change among the Chinese is a tectonic shift: Rocketing real estate values had all the durability of a paper dragon. Investing in properties is far from safe, and was never anywhere near the guarantee they thought. In a place like China where collectivist thinking rules, this could have broad-reaching implications for how the people of China view their leadership, global economic status, and overall place in a world where for decades, their rise has been seemingly unstoppable.

As for broader implosion, the contagion is spreading. Financial firms like trust companies that have heavy real estate exposure are missing payments of their own. Evergrande itself also wasn’t just a real estate company — its businesses included other sectors like healthcare, automotive, and financial products. In Hong Kong, officials are starting to make efforts to curb rampant speculation in apartment buildings, in what is most likely another “too little, too late” effort.

The Chinese government is also trying to rescue distressed properties to lessen the impact — but with what financing? The plan needs lenders. At the end of the day, it’s another lesson in the obvious: if the money doesn’t exist, and the houses don’t exist, the growth isn’t sustainable. Debt-dependent economic expansion doesn’t create sustainable prosperity, especially when the “product” being sold doesn’t even exist yet. If all of this leads to a broader credit crunch across Chinese markets, it will cause more dominos to fall and the crisis will become likely to spread globally.

And other countries, like the US, don’t have a solid enough foundation or monetary policy tools to weather a collapse of the world’s second-largest economy.

More By This Author:

Money Supply Growth Continues To Support The Stock MarketInflation’s Impact: The Penny’s Plunge Into Irrelevance

A Byte-Sized Bubble?