CAD/JPY Surges On Strong Canadian Jobs Data, Bank Of Canada Hike Speculation

Image Source: Unsplash

- The CAD/JPY currency pair rose 0.72% to 108.38 after the Canadian jobs report beats expectations, adding 15,000 jobs and pushing the unemployment rate to 5.5%.

- Odds for a Bank of Canada rate hike by year-end jumped to 44% from 36%, following a 5.2% wage increase in August.

- Japanese Q2 GDP growth fell short of estimates at 4.8% year-over-year, and it failed to bolster the yen as Canadian data took center stage.

The Canadian dollar posted solid gains versus the Japanese yen on Friday after an upbeat Canadian jobs report sparked speculations the Bank of Canada (BoC) would increase rates at a subsequent meeting. That and investors’ risk appetite weighed on the yen’s safe-haven status. The CAD/JPY pair was recently seen exchanging at around 108.38, up 0.72% or +77 pips.

Loonie Gained Ground Against the Yen as Upbeat Employment Figures Fueled Rate Hike Expectations, Overshadowing Japan’s Sluggish GDP Growth

Statistics Canada revealed that the Canadian economy created more jobs than foreseen at 15,000 in August, with 39.9,000 people adding to the workforce, while the unemployment rate stood at 5.5%. The labor market has remained resilient, even though the Bank of Canada has lifted rates ten times since March 2022.

Digging deeper into the data, a measure of wages rose by 5.2% in August from 5% in July, increasing the chances the BoC would step in and lift rates. Of note, the BoC kept rates unchanged on Sept. 6 at 5%, but after the data release, the money market futures showed odds at a 44% chance of another BoC rate hike by the year’s end, from 36% before the employment report crossed the screens.

The data came one day after BoC Governor Tiff Macklem said that interest rates may not be high enough to bring supply and demand in balance, bringing inflation down.

Aside from this, data from Japan witnessed the economy growing slower than expected, with Q2’s GDP at 4.8% year-over-year, below the 5.5% estimated. Although it was negative, a risk-off impulse benefited the yen during the Asian and European sessions. Nevertheless, as Japanese authorities remained mute about a possible Forex intervention, it was outpaced by Canadian data.

Therefore, further CAD/JPY upside could be expected, though caution is warranted on intervention threats and overextended price action.

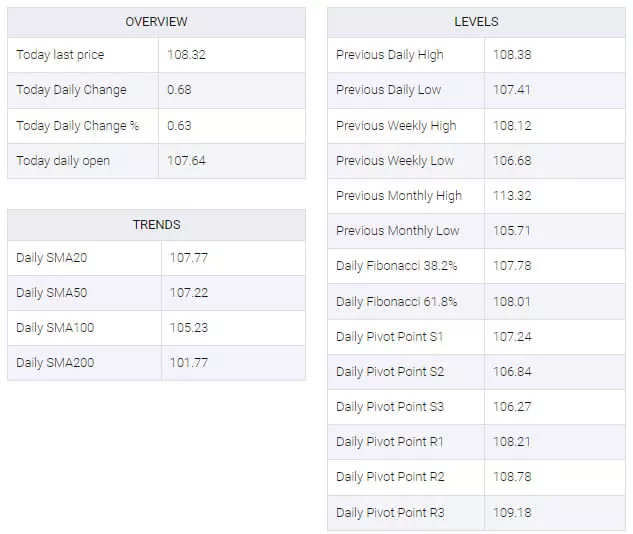

CAD/JPY Price Analysis: Technical Outlook

From a technical perspective, the CAD/JPY currency pair maintained a neutral-to-upward bias, remaining above the Ichimoku cloud (Kumo) but failing to reach the year-to-date high at 109.50. A decisive break would expose the 110.00 psychological level before testing last year’s high of 110.52.

Failure at the 109.50 level could cause sellers to outweigh buyers and drag prices toward the Tenkan-Sen line at 107.61 before extending the pair's losses to the Senkou-Span A at 107.39. A break below could cause the pair to dive towards the Kijun-Sen at 107.18.

CAD/JPY Technical Levels

More By This Author:

Gold Price Forecast: XAU/USD Closes The Week Near $1,920, Above The 200-Day SMASilver Price Forecast: XAG/USD Displays Volatility Contraction Near $23

USD/CAD Price Analysis: Defends 1.3650 Resistance-turned-support Ahead Of Canadian Jobs Data

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more