BYD Company Limited: Stick With This EV Giant Amid Tariff Turmoil

Image Source: Pexels

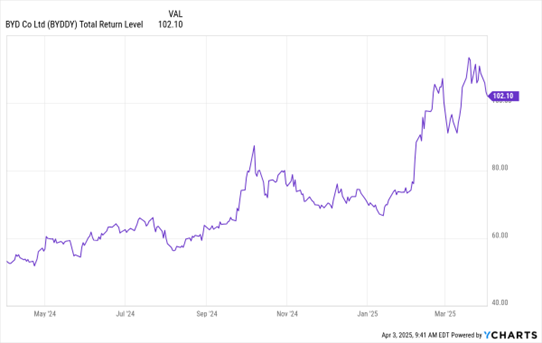

It was interesting to be in Tokyo and meeting for lunch this week with a former Japan Ministry of Finance official as new tariffs of 24% on Japan were announced. Meanwhile, BYD Co. Ltd. (BYDDY) shares have been impacted by trade tensions. But they are still up around 42% so far in 2025 as the company continues to gain market share at home and abroad, counsels Carl Delfeld, editor of Cabot Explorer.

BYD projects total vehicle sales for 2025 of 5.5 million and boasts of technology that can charge almost as fast as it takes to refuel a regular car for nearly 300 miles of driving range. Stick with it.

BYD Co. Ltd. (BYDDY) Chart

Data by YCharts

As for Japan, it is just one of the countries on the expanded tariff list with the largest bilateral trade surpluses with the US. The list has an overlap with some of the biggest foreign holders of US Treasuries. Based on Treasury Department data, Japan held $1.06 trillion in US Treasuries, China $759 billion, Luxembourg $424 billion (on behalf of European investment funds), and Canada $379 billion.

My Japanese host was an old friend and always polite, but he was a bit perplexed about the harshness of the tariffs given that Japan only accounts for 4% of US total imports. Not to mention that Japan is America’s most important ally and a big investor in America.

We will see how the tariff issues work out. This stock market may seem a bit difficult to navigate. But take steps to keep some powder dry and keep in mind that maximum pessimism breeds maximum profits. The financial media likes to use phrases like “markets tumble” for declines of 2%, which is obviously quite an overstatement.

My recommended action would be to consider buying shares of BYD Company Limited.

About the Author

Carl Delfeld is chief analyst of Cabot Explorer published by Cabot Wealth Network. He is also the managing editor of Far East Wealth and chairman of the William H. Seward Center for Economic Diplomacy. Over the past three decades, he has held senior positions in business, finance, and government, was a Forbes Asia columnist and author of Red, White & Bold: The New American Century.

More By This Author:

Could The US See An Argentina-Style "J-Curve" Recovery?AI Stocks: What's Next After Microsoft's Data Center News?

BMY: A High-Yielding Drug Stock With Great Growth Potential

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more