BYD & Buffett: Why Sometimes Doing Nothing Is The Better Choice

Image Source: Unsplash

I’ve recently written about Warren Buffett and his sale of Costco Wholesale Corp. (COST) – and how it lost him $1.3 billion in foregone profits. That was far from Buffett’s only flub. Let’s talk about BYD Co. (BYDDY) and why “doing nothing” might have been the better choice, writes Nicholas Vardy, editor of The Global Guru.

In the middle of the 2008 financial meltdown, Buffett made a move that most investors wouldn’t dare consider. Buffett bet on China. Not just any Chinese company — but BYD, a little-known electric vehicle and battery maker.

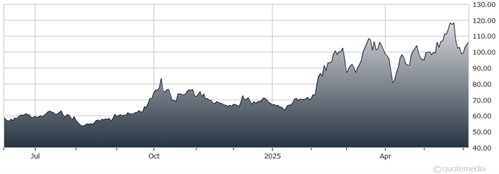

BYD Co. (BYDDY) Chart

Charlie Munger had convinced Buffett to invest. He had called the CEO “a combination of Thomas Edison and Jack Welch.” Through Berkshire Hathaway Inc.’s (BRK-A) MidAmerican Energy, Buffett invested $232 million for a 10% stake in BYD. He did so at a bargain-bin HK$8 per share.

Today, that 10% slice would be worth about $15.4 billion. That’s a 66-bagger. But what did Buffett actually do? He sold.

Yes, he still has a stake valued at about $2.8 billion. But that move cost him billions more. What are the lessons to take away?

1. Let Your Winners Run

Buffett could’ve turned a $232 million stake into a Top 10 Berkshire holding. Instead, he trimmed aggressively — mitigating China-specific risk. He diversified into safer ground, like Japanese trading houses and US Treasuries.

The lesson? It’s okay to let multi-baggers run. But always know your “why.”

2. The Power of Compounding Is Real

BYD delivered a 28.6% CAGR for more than 16 years. That’s the miracle of compounding. It’s also what too many investors abandon in search of the next big thing.

3. Context Matters More Than Valuation

For Buffett, this wasn’t a textbook value “sell.” It was a geopolitical one. Concerns over Chinese transparency, regulatory unpredictability, and handing over the reins at Berkshire drove the decision.

Had Buffett sat on his hands and “done nothing,” though, Berkshire would be looking at a $15 billion trophy today. And that may be the ultimate lesson: Sometimes, sitting tight and doing nothing is the best thing to do.

About the Author

Based in London, Nicholas Vardy is a widely recognized expert on global investing, financial history, and trading psychology. A former global emerging markets portfolio manager for Janus Henderson, Mr. Vardy is currently portfolio manager at VFO asset management, a family office. He has been a regular commentator on CNN International and Fox Business Network.

Mr. Vardy has been an invited speaker to Cambridge University's Judge Business School, the University of Chicago's Booth Graduate School of Business, NYU Stern Business School, and the Corvinus Business School in Budapest, Hungary. He is currently completing a forthcoming book: This Time It's Different': A History of Financial Manias.

More By This Author:

As Tariff Saga Unfolds, Where Will Bond Yields Head?EPD: A Sterling Dividend Stock For The Long Term

Argan: A Construction Play With Momentum, Technical Support On Its Side

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more