Buy USD/CAD – September 13, 2021

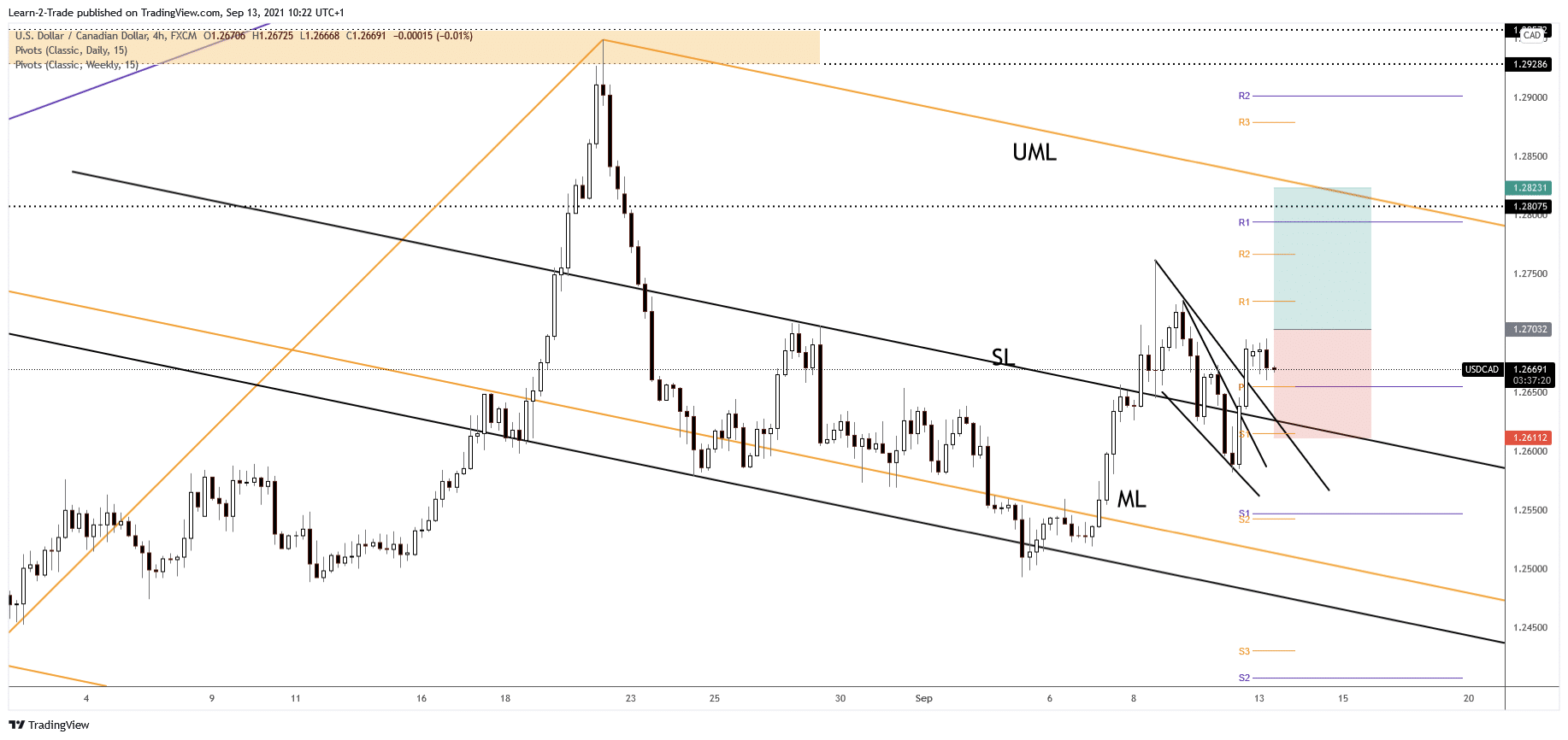

We kick off the week with the USD/CAD pair, which is currently trading in the red, at 1.2669 level below today’s high of 1.2695 (FXC, UDN).

At this juncture it could come back to test and retest the immediate support levels before climbing higher. But having said that, the pair could resume its climb higher if the Dollar Index (DXY) begins to challenge for new highs.

Technically, the pair has escaped from a continuation pattern, and this leads us to believe that the outlook is bullish in the short term, despite the minor retreat.

The Federal Budget Balance will be released later today, but this indicator is unlikely to have much of an impact on the USD/CAD pair, although this is not to dismiss the fiscal bomb that is approaching for the federal government which – unless Congress steps up to the plate – will run out of money in November unless the debt ceiling is raised.

All Eyes On US CPI Inflation Data Tuesday

Tomorrow, the United States inflation data could really shake the markets. The Consumer Price Index (CPI) could increase by 0.4% month on month in August, while the Core CPI is expected to rise by 0.3%. The annual rate is forecast to fall back from 5.4% to 5.3%.

Any overshoot on inflation could strengthen the dollar as forex traders would see it as bringing forward tapering and the date of interest rate lift off.

Canada is set to release its inflation figures on Wednesday as well, so the volatility could be high around these releases.

The USD is still strong after the US PPI and the Core PPI numbers came in better than expected data. On the other hand, the Loonie has tried to appreciate following the Canadian Employment Change and the Unemployment Rate indicators both beating expectations.

From a technical point of view, USD/CAD slips lower and could make successive tests of the 1.2654 weekly pivot point. Stabilizing above that level and making a new higher high with an upside breakout could signal further growth.

The descending pitchfork’s upper median line (UML) is seen as an upside target if the price resumes its growth.

USD/CAD Free Forex Signals September 13, 2021

Instrument: USD/CAD

Order Type: BUY STOP

Entry price: 1.2703

Stop Loss: 1.2611

TP1: 1.2823

Our Risk Setting: 1%

Risk / Reward Ratio: 1:1.3

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more