Bullish Japanese Yen - Peak Rates And Oil To Benefit Battered JPY

Image Source: Pixabay

First off, a quick note about my Q2 top trade, which was short GBP/USD, looking for 1.2750-1.2800 from circa 1.3200. The rationale behind this view was that the market pricing of monetary tightening was far too aggressive relative to a reluctant hike in the Bank of England.

As it stands, the GBP/USD pair is on course to post its worst quarterly performance since the 2016 Brexit vote, having also dipped below the psychological 1.20 level. There is an argument to be made that I was not ambitious enough in my target.

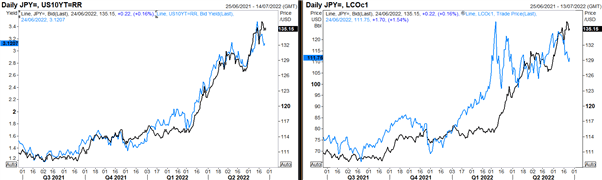

Looking ahead to Q3, I am of a bullish nature on the Japanese yen. There are two factors as to why: US bond yields and commodities, in particular oil prices, are both off their highs. These have been the key reasons why the Japanese yen has been among the worst-performing currencies this year. Now that these two factors are correcting, so can the Japanese yen, as the charts below highlight.

USD/JPY (Black) vs. US 10-Year Yield + USD/JPY (Black) vs. Brent Crude Oil

Source: Refinitiv

My view on USD/JPY is that the pair will most likely linger around 1.30 before 1.40, although a reassessment of this view would be necessary if bond yields and oil prices return to their highs. The risk with the USD/JPY pair is the fact that the Bank of Japan (BoJ) remains the monetary policy outlier.

The BoJ has doubled down on yield curve control after purchasing a record amount of bonds in a week, while central banks in the rest of the world are tightening monetary policy aggressively. What’s more, the BoJ’s actions are in spite of Japanese officials doubting the merits of an extremely weak currency.

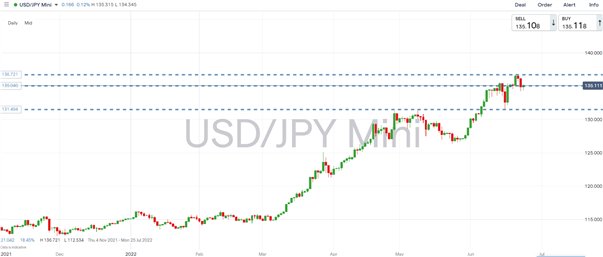

Levels to Watch

- Downside: 131.50 (BoJ reaction low), 130.00 (psychological level/round number), 126.36 (May 2022 lows).

- Topside: 135.00-20 (2002 peak), 136.71 (2022 peak).

- Bias: Lower USD/JPY from 1.3600, eyeing a move towards 131.55. This view would be wrong if oil and yields return to highs and USD/JPY breaks the 138.00 level.

USD/JPY Chart: Daily Time Frame

Source: Refinitiv

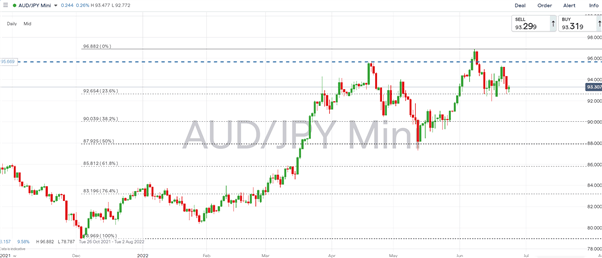

Elsewhere, the recent slew of soft survey data in the form of US and Eurozone PMIs have prompted markets to increase the probability of a recession, more so in Europe.

Moreover, should activity data show a marked drop-off, an aggressive re-pricing of recession risks is likely to push cross-JPY, which is a good hedge in such an environment. This would be particularly evident across commodity crosses, such as AUD/JPY, which has room for a sub 90.00 move.

AUD/JPY

Source: Refinitiv

Disclosure: See the full disclosure for DailyFX here.