BOE & ECS Rate Hikes To Further Catch Up With Inflation

European Central Bank (ECB) and Bank of England (BoE) made predictable rate hikes; let’s take a look at what it means for the markets.

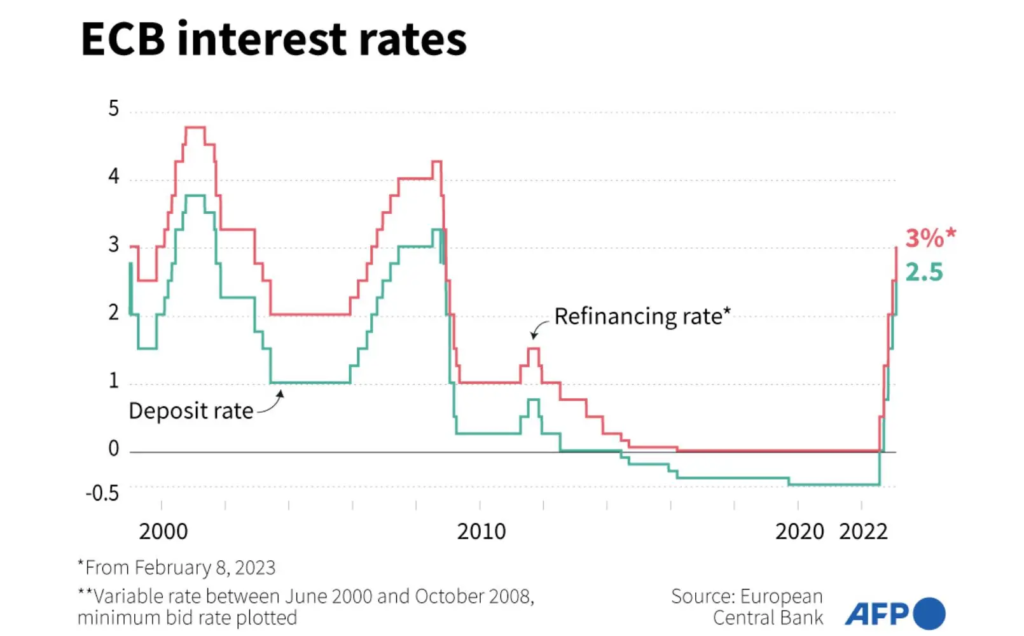

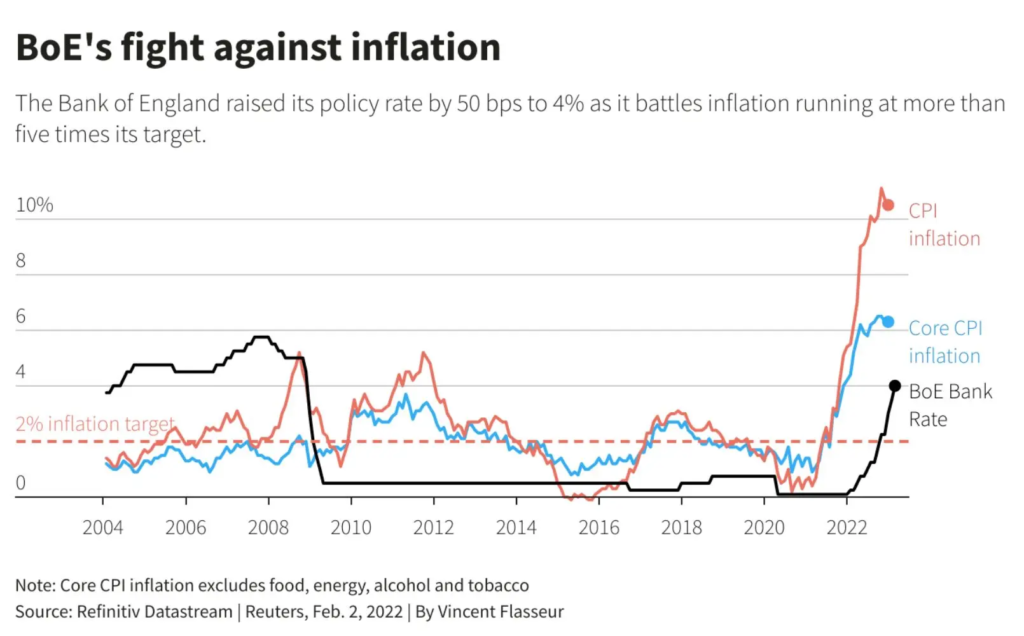

This week, the Federal Reserve upped its interest rate a smidgen of 0.25 percent, but the Bank of England and the European Central Bank followed with more drastic hikes of 0.5 percentage points, raising the UK rate to 4% and the Eurozone’s to 2.5% – the highest since the financial crisis.

Though their strategies for the future differed drastically: the Bank of England declared that interest rates would only rise if inflationary trends failed to improve, yet the European Central Bank took a far more assertive stance, proclaiming the necessity of substantial hikes with the assurance of yet another substantial raise in the following month.

What’s Important About This Insight?

The BoE’s remarks indicated that rates could remain steady at 4%, far from the 4.5% peak that the markets were anticipating. With higher interest rates making a country’s currency more appealing to global investors and savers, the news caused the British pound to plummet against the euro when it was announced. This bearish development could potentially extend, as the ECB is expected to raise rates at a faster rate than the BoE in the following months.

Bigger Picture

Interest rates in the UK and US might not be permanent fixtures, with traders anticipating that the BoE and Fed will slash them in the near future.

Ultimately, inflation should start to decrease by then, and bolstering weakening economies might become a major concern once again.

More By This Author:

Seven Signs That US Inflation Has PeakedThree Favorite Indicators To Look At When Catching The Next S&P 500 Rally

Weekly Waves: EUR/USD, GBP/USD And Gas - Monday, Jan. 9

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more