Blue Chip Jackpots: A Tale Of Two Puzzles

“It doesn’t matter if the cat is black or white, only that it catches mice”-

Deng Xiaoping

I always like to think of investment strategies and decisions as a Texas poker game. In my humble opinion, there is a big difference between playing poker and gambling. In gambling, an investor is not quite familiar with the stocks fundamentals or technical analysis. He doesn’t know which cards to play with, so ultimately he can’t differentiate between winning and losing cards. Hence, he can’t spot the potential intrinsic value of stocks.

When gambling, an investor places his bets on any stock based on a herd mentality criteria. In other words, an investor will allocate his funds on the stocks longed by the big boys or the institutional investors or even use a crystal ball, it doesn’t really matter. By doing so, an investor may incur losses because following the big boys' strategy may not suits his portfolio specifications or risk appetite.

On the other hand, playing a lucrative poker game entails the knowledge of an informative decision making process. An investor explores his winning probabilities based on an informative calculated risk. Understanding the stock direction and intrinsic growth are key ingredients to a successful timing recipe.

In today’s investment game, two blue chip stocks are playing to hit the jackpots. The two stocks are Apple, and Alibaba through its subsidiary Ant group. Apple already hit the USD$2 Trillion valuation jackpot and is aiming at another historic level of USD$3 Trillion, while Alibaba is predicting an IPO jackpot for its subsidiary to surpass USD$30 Billion upon launching the dual offering in Shanghai and Hong Kong stock markets. Comparing the two jackpot stories, there is a common puzzle. How could this happen in 2020, the COVID-19 year? The jackpot stories also raise another subset of puzzles related to each blue chip stock individually. Is the USD$3 trillion valuation attainable for Apple? Is Apple overvalued by reaching a share price of USD$500/Share? Why did Jack Ma choose Chinese cities this time instead of NY for an IPO?

First of all, let’s try to answer the common puzzle question for Apple. Such valuation could almost be impossible in light of Q1-2020 financial results ending March 2020. The results depicted a negative impact of COVID on the company’s bottom line resulting in a decrease of around 2.7% if compared to the same period in the previous year. So How did Apple hit the USD$2 Trillion jackpot in a COVID year? The obvious answer is mentioned in the question. It is also because of the COVID era. This is stemmed from the company’s investment and marketing strategies countering the COVID impact on its activities. As per Q2-2020 financial results ending June 2020, the company was flexible enough in following a series of lucrative strategies. It brilliantly took advantage of COVID consequences in expanding its sales of products and services by shifting markets from China to Europe and America. It successfully bargained better suppliers terms and condition with a new Chinese company to counter any supplier disruptions. This enabled Apple to effectively manage its production costs with the same quality. Moreover, Apple launched its COVID card and boosted its line of business cooperation with health care business. Finally, Apple was smart enough to tackle investment strategies beside its marketing strategies to ensure a successful safe landing at appropriate timing. In June 2020, it continued its shares buyback / share repurchase program embarked few years ago. Not only this, but it is also intending to conduct a 4-to-1 stock split on August 24th.

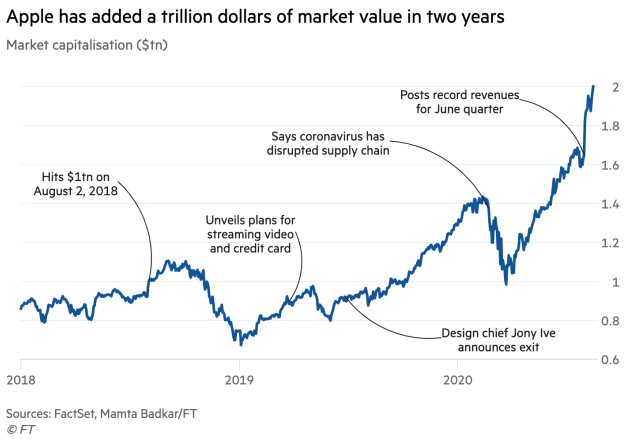

But this is not the main story. All reasons mentioned above were unknown factors to Apple investors prior to Q2 results announcement on July 31st. As Figure 1 depicts below, Apple market capitalization and ultimately stock price witnessed an increasing trend after a brief dip resulting from disrupted supply chain news. If combining such news with Q1 negative results, the stock price should have witnessed a declining trend till July and not only a brief dip. So what fueled the stock price growth? The shares buyback, maybe, but this alone couldn’t be the main reason. Simply, it’s Apple investors’ belief in the company’s intrinsic potential.

Alternatively, what I like to call the “Investors Elasticity of Stock Price”. Think of it as something similar to the famous economic terminology: Price elasticity of demand. Simply, regardless of Apple stock price changes or negative news, investors will continue believing in the company’s long term intrinsic potential no matter what. Hence in liaison with behavioral finance, one could think of Apple’s investor elasticity to be less than 1 representing a defensive stock in investors’ decisions. Investors elasticity concept could be more applicable to retail / individual investors more than institutional ones. This idea could be further analyzed in the context of Apple decision regarding August stock split. Pre Splitting, an expensive stock price of $500 / share could discourage a wide range of retail investors from considering Apple in their portfolio. Reaching a P/E and PEG multiples of 37.5 and 3 respectively if compared to NASDAQ P/E multiple of 22 could make Apple appear as an overvalued stock if it weren’t for its solid financials. Nevertheless, investors continued purchasing at such expensive levels. Now imagine the stock long positions post the split from a pool of retail investors that will increase the company’s liquidity besides achieving capital gain for Apple’s defensive investors whom pushed the stock price upwards no matter what. Under such dynamics, one could think that the road to the required $3 trillion will be easier.

Image Source via isabelnet.com

That being said, let’s move on to Alibaba. Jack Ma desires a jackpot from the Ant IPO. How this could be possible in the COVID year? and why not in NY? The obvious answer is China economic recovery recording an expected growth of around 1.3% during 2020 besides US- China trade disputes. In my humble opinion, that is not quite the case. This is stemmed from two reasons. First reason is justified by the famous Chinese equities paradox. Second reason is stemmed from potential arbitrage opportunity enticing Jack Ma to take the same investment decision even if US settled its trade disputes with China.

As for Chinese equities, the legendary paradox states that sometimes China’s stock market return is disconnected from China’s economic growth. This paradox occurs from two main market dynamics. First dynamic is the high volatile and speculative stock market resulting in P/E multiples in consistent with the Chinese companies strong earnings. Hence, sometimes Chinese equities appear overvalued and most of the time undervalued if compared to its international peers. This could also be attributable to the inefficient utilization of short selling mechanism or limiting it only to index futures that further stimulate speculative bubbles rather than curbing it. The latter could be viewed as the main reason for the Chinese government to ban such mechanism during COVID.

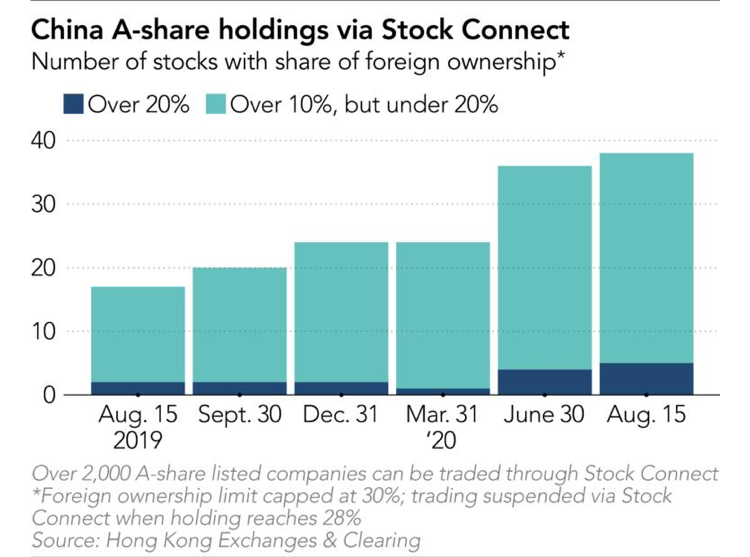

Second dynamic is China’s pegged exchange rate system where any Yuan depreciation could partially erode some Chinese equities positive return gained by foreign investors. The latest news announced by Chinese government regarding its intentions to ease the short selling restrictions in August could lead to minimizing the paradox negative impact on equities. As part of the contemplated structural reform, short selling will be allowed to both institutional and retail investors trading in Chinese Share (A) equities. It will be used in a more efficient manner for hedging purposes rather than speculations to ease the Chinese stock market volatility. Such reform enhanced foreign appetite towards Chinese equities evidenced by Figure (2). If that is the case, Ant Group could benefit from such lucrative reforms as well. In addition, Ant Group investors could find it a lucrative strategy to have dual listing in Shanghai and Hong Kong. Any loss on Yuan equity resulting from currency depreciation could be partially compensated through its Hong Kong equity and vice versa.

Alibaba stock price in NYSE and HSI could be another reason for Jack Ma decision. Trading in NY at USD$265.80 / Share which is equivalent to USD$33.22 / Share if adjusted to 8-to-1 stock split. On the other hand, the same stock trades for HKD 252.80 / Share in Hong Kong which is equivalent to USD$32.62 / Share according to USD/HKD exchange rate. Hence, the stock is trading at premium in NY and at a discount in Hong Kong with around 1.8% arbitrage opportunity. In other words and from investment perspective, it is better to long Alibaba stock in Hong Kong and short it in NY, and that is exactly what Jack Ma is intending to do regardless of US-China negotiation results.

Finally, what Tim Cook and Jack Ma are doing is quite brilliant and creative in the sense of investment strategy alteration and opportunity timing. Both are applying this article opening quotation in a lucrative manner. The strategy or stock location does not really matter whether east or west, what really matters is generating excess alpha. Regardless of what lies ahead in the future, so far Tim Cook and Jack Ma are playing an investment poker game as the book says entailing investment strategies that are quite informative.

Good article.

Thanks for your feedback..