Bloomberg: 'Investor Demand For Silver Is Now Even Higher In India Than In October'

.webp)

Photo by Zlaťáky.cz on Unsplash

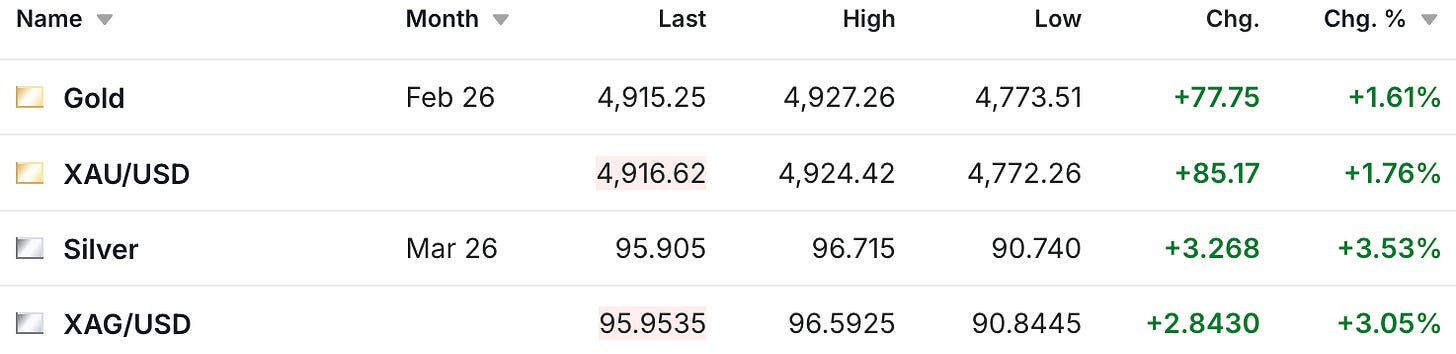

We’re witnessing yet another record-setting day on Thursday, as both the gold and silver prices are sharply higher again, and have set new all-time record highs.

The silver futures hit a low of $90.15 yesterday afternoon after the sharp selloff that began just before 2 PM Eastern, but are currently up $3.26 to $95.90, and surged as high as $96.72 earlier this afternoon.

As silver trades at $95.90 in New York, it’s currently trading at $108.64 in Shanghai.

The gold price is also experiencing another record setting day, with the futures currently up $79 to $4,916. The latest all-time high is currently $4,927, set earlier in today’s session.

In terms of the ongoing silver rally, just in case the price movement itself wasn’t evidence enough that there remains an ongoing situation in the Chinese industrial silver market (much as we’ve been suggesting over the past few weeks), then just wait until you hear what Bloomberg reported about conditions in the silver market in both China and India (we’ll leave London aside today, where they had their own crisis this past October).

China shipped around 5,100 tons of silver overseas last year, according to customs data, the highest volume of exports in at least 16 years and a level that suggests market fears of tightening controls may be overblown for now.

China has had a licensing regime in place for silver since 2019. However, a document issued in October by the Ministry of Commerce to extend that policy into this year and 2027 rattled investors, with some seeing it as a sign of new or increased restrictions.

Versions of that interpretation, during a period of market tightness, have helped fuel a rally that has lifted the white metal alongside gold — pushing it to a record above $95 an ounce.

We posted a video on our Arcadia channel a few months ago when it was announced titled, ‘China Restricts Silver Exports,’ and I’ve commented on that in this column as well. But for clarification on exactly what the change was, here’s one writeup I found:

Concerning China’s silver export policy, it is important to clarify that it is not a case of ‘export restriction’ or ‘policy change’. Instead, it is a transition to stricter export licensing management.

Exporting silver from mainland China always requires a license. And export quota management was abolished a few years ago.

Looking at the attached, latest approved exporter list, you will find there are 44 approved silver exporters for 2026-2027 (compared to 42 for 2024-2025). Comparing the names with the previous version, we found that they have only changed slightly, as expected, since they align with the requirements announced by China’s Ministry of Commerce in October.

The main requirements include:

Existing qualified exporters: exported silver in every single year from 2022 to 2024

New applicants: annual silver production of over 80 tons in 2024 (threshold may be lower to 40 tons for refineries located in western regions).

Therefore, this announcement should have little impact on global silver trade flows or on market tightness. However, there seems to have been a misunderstanding that led to this being interpreted as a positive signal for the price.

I think what is said here is reasonable, and the author described it as a transition, ‘to a stricter export licensing management.’ I agree that it’s not necessarily a statement that exports are being banned, although I would also introduce the possibility that this might not be the last move by China to further control critical mineral exports.

Yet back to Bloomberg’s article, while in the first paragraph they pointed out how China exported a large amount of silver last year, and is likely to continue to do so this year, what they didn’t mention was that China’s silver supply was already running low back in November of last year after they sent silver to help address London’s silver supply crisis.

The Bloomberg article also mentioned that ‘versions of that interpretation, during a period of market tightness, have helped fuel a rally that has lifted the white metal alongside gold — pushing it to a record above $95 an ounce.’

I’m not saying that a lot of people weren’t reading that headline, but when China’s trading at a $12 premium to New York, that sounds a lot more like a supply issue rather than Chinese industrial manufacturers misunderstanding what they saw on Twitter.

The Bloomberg article also had some interesting comments about India, and we’ll begin with a reminder about what happened just this past October.

Back in October, Indians loaded up ahead of the Diwali festival. Along with tariff fears that kept supplies locked up in the US, that drained liquidity in London and pushed benchmark silver prices to the highest since the 1970s.

India went into a shortage on October 8th that included Indian silver ETFs halting new additions because they were unable to source any more silver for a period of weeks.

Then a few weeks ago, we reported how a silver miner was contacted by one Indian solar panel manufacturer who wanted to buy his production. The miner also said that this person told him, ‘China is soaking up all the silver and making it difficult for India to get the raw materials they need for manufacturing.’

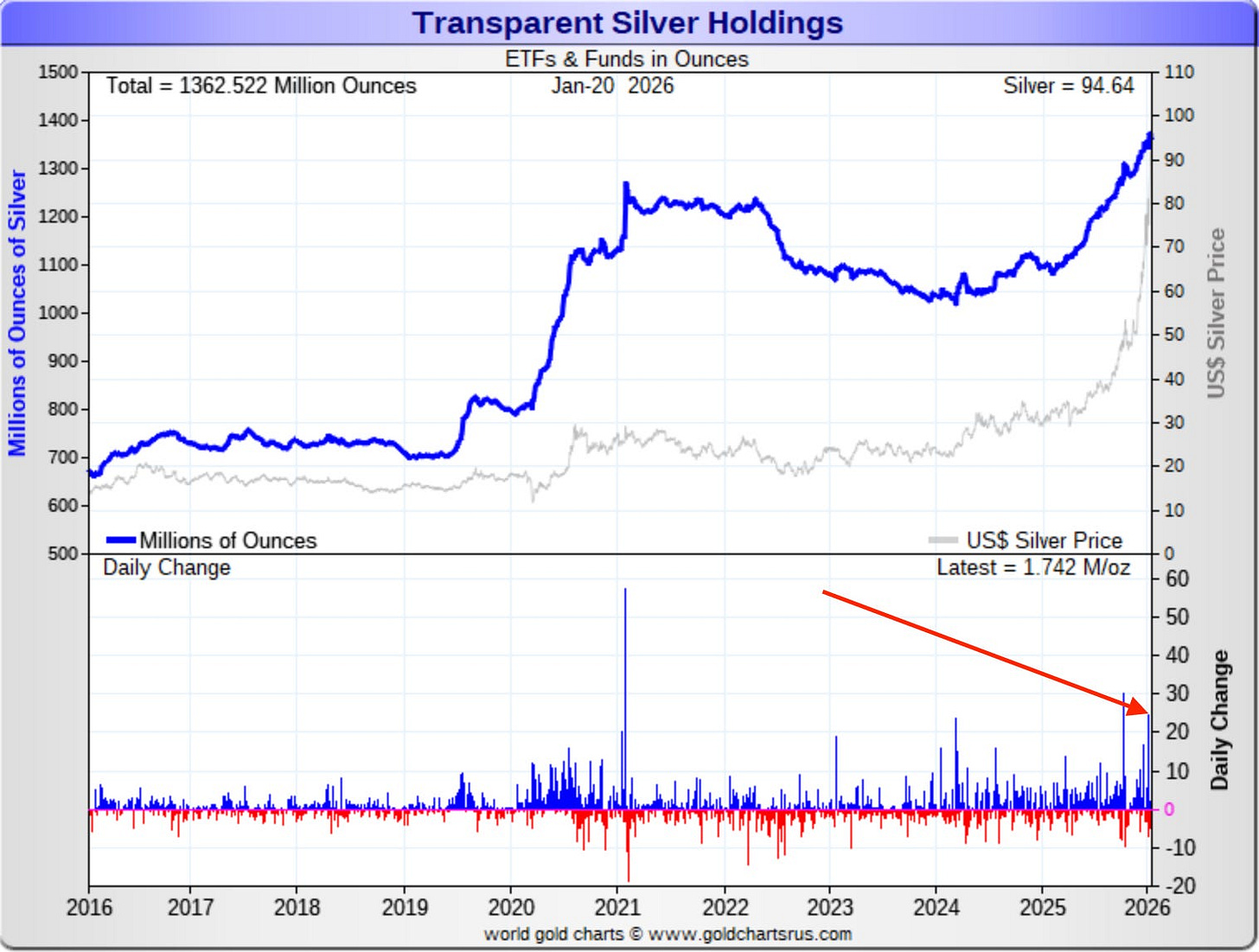

Now take a look at what Bloomberg is reporting regarding today’s level of Indian investment demand for silver.

Investor demand for silver is now even higher in India than it was in October, with smaller bars and coins in vogue, according to Samit Guha, the CEO and Managing Director of MMTC-PAMP India Pvt., the country’s largest precious metals refiner.

The company’s silver dore imports have more than doubled between October and December from last year, but it’s struggling to keep up with domestic demand and is also getting unusual requests to refine metal for customers in South Korea, the United Arab Emirates, Vietnam, and Malaysia, he said. “Whatever we manufacture, we sell. We could supply 25% more coins and bars and the market would absorb it.”

Precious-metals refiners typically produce larger silver bars — of around 1,000 ounces or 15 kilograms — which are the standard delivery sizes for major markets and exchanges. That’s worsening the shortage of coins and smaller bars popular in the retail market.

“It doesn’t make sense for refiners to ramp up production and invest in new lines” to raise kilobar supplies, because they have little visibility on where demand will head next, said Sunil Kashyap, managing director of bullion trader FinMet Pte Ltd., which supplies silver feedstock to refineries.

Keep in mind that on January 11, India just added 23.5 million ounces to their ETFs, which is the 4th largest single day ETF addition in the history of the silver trusts.

Reuters is also reporting that the premiums in India have surged over the past week.

Bullion dealers charged a premium of up to $112 per ounce over official domestic gold prices – inclusive of 6% import and 3% sales levies – the highest since May 2014. Last week, dealers offered a discount of up to $12.

Silver premiums surged to $8 per ounce, surpassing the previous peak of $5 scaled in October.

These are the reasons why I don’t think what we are seeing in the silver market right now is just a short squeeze or speculation on the Comex. We continue to see evidence of tight market conditions, again with the $12 premium in Shanghai being the most glaring example.

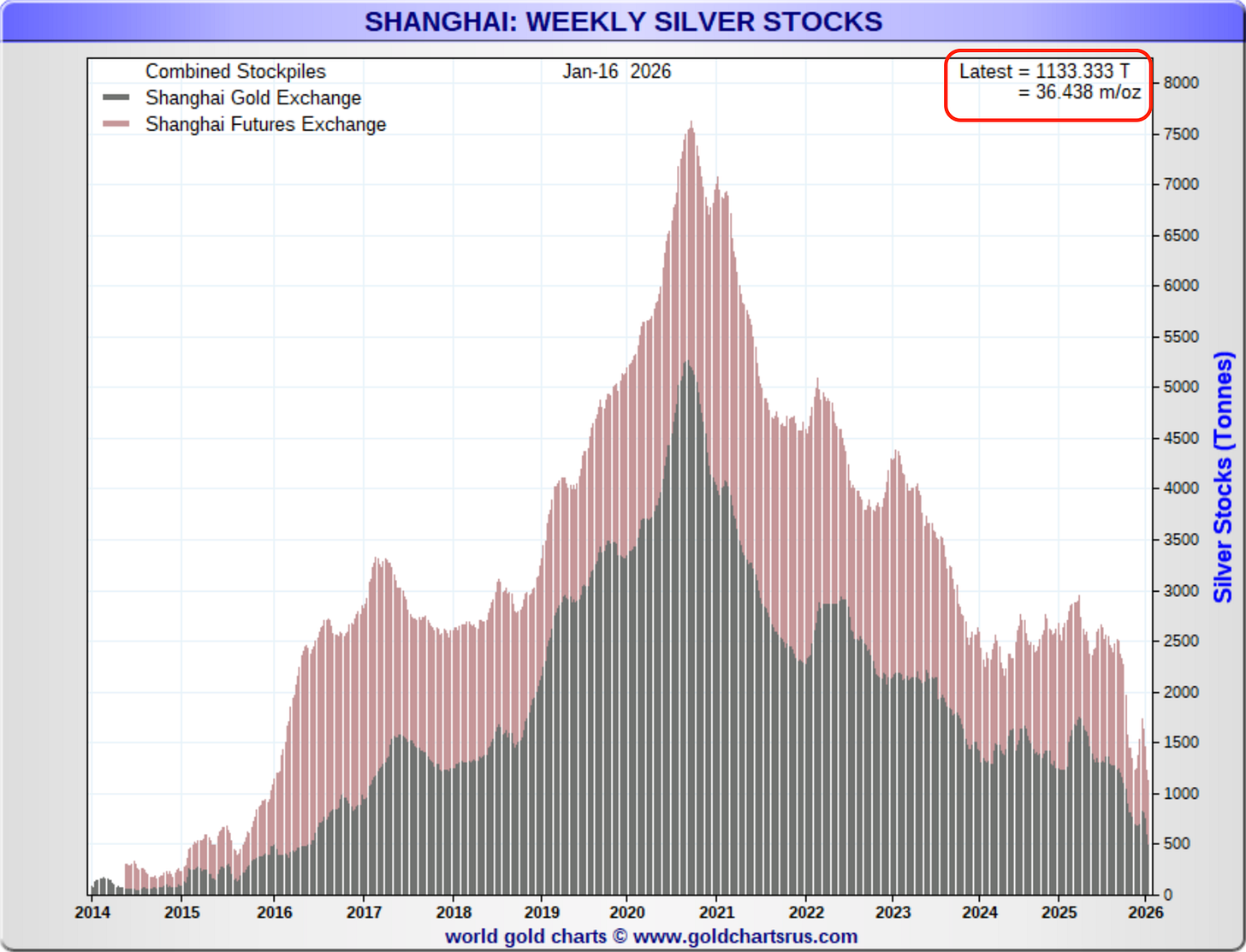

Also worth considering, is what happens if India or London goes back into a shortage? Or if the Chinese supply crisis worsens even further, which really isn’t out of the realm of possibility when you look at how their inventory stockpiles continue to hit new lows, where they’re now down to 36.4 million ounces.

Ultimately, as stunning as it is that silver is currently trading at $96, there’s a very real scenario where the price could accelerate from here. That’s not to guarantee that such an outcome will happen, but with the evidence available, there’s a good case to be made that it’s above an even money bet.

Sadly, there’s only one more trading day this week. But I’ll check back in with you tomorrow as we see if we end the week with a $100+ silver price in the U.S. as well.

More By This Author:

Silver's Now Up Almost 100% In Just The Past 2 Months, & That's After It Broke The $50 LevelAs Silver Breaks $94, Here's Why It Might Still Be Early

Thoughts On Rick Rule Selling His Silver