Bloodbath On Dalal Street: 6 Reasons Why Sensex Slumped 1,688 Points Today

Indian share markets witnessed negative trading activity throughout the day today and ended deep in the red.

Benchmark indices slipped nearly 3% on the back of a global sell-off following the emergence of a new variant of Coivd-19.

At the closing bell, the BSE Sensex stood lower by 1,687 points (down 2.9%).

Meanwhile, the NSE Nifty closed lower by 510 points (down 2.9%).

Cipla and Dr. Reddy's Lab were among the top gainers today.

JSW Steel and Tata Motors, on the other hand, were among the top losers today.

The SGX Nifty was trading at 17,039, down by 500 points, at the time of writing.

The BSE Mid Cap index and the BSE Small Cap index ended down by 3.2% and 2.6%, respectively.

On the sectoral front, realty, metal, and auto stocks were among the hardest hit.

Shares of Escorts Limited and KEI Industries hit their respective 52-week highs today.

US stock futures are trading deep in the red today with the Dow Futures trading down by 740 points.

The rupee is trading at 74.87 Against the US$.

Gold prices for the latest contract on MCX are trading up by 1.4% at Rs 48,089 per 10 grams.

Here are 6 Factors Why Indian Stock Markets Crashed Today

Fresh covid worries: The World Health Organisation (WHO) has flagged a new variant of virus, which is heavily mutated, in South Africa.

It is expected to convene an emergency meeting to discuss the rapidly spreading strain, which could make vaccines less effective. The WHO said it is 'closely monitoring' the reported coronavirus variant and will determine if it should be designated a variant of 'interest' or of 'concern' in the technical meeting today.

Weak global cues: The surge in coronavirus cases in Europe once again threatened to disrupt trade and travel, which spooked investors and dragged Asian markets lower today.

While the Japanese Nikkei 225 was down 800 points or 2.7%, the Hang Seng was down over 550 points or 2.2%. The Shanghai Composite Index lost 0.6%.

US markets were closed on Thursday for a holiday.

More lockdowns: European countries expanded covid-19 booster vaccinations and tightened curbs overnight.

Slovakia announced a two-week lockdown, the Czech government will shut bars early and Germany crossed the threshold of 1 lakh covid-19-related deaths.

FIIs continue to sell: As covid risks rise and the dollar continues to strengthen, foreign investors are moving their money back to the safe haven market of the US.

On 25 November, FIIs net sold Rs 23 bn in the Indian equity cash market, taking the total so far in November to over Rs 253 bn.

In the last four sessions alone, FIIs have sold shares worth Rs 150 bn.

Moreover, the annual rate of inflation in the US hit 6.2% in October, the highest in more than three decades, as measured by the consumer price index, which gave rise to expectations of faster rate hikes by the US Federal Reserve.

Financial, realty, and metal stocks under pressure: The Nifty Metal index was down 5%, with all the components in the red.

Financials, which make up for the highest weightage on the Nifty, also saw heavy selling, with the Nifty Bank index trading 3.6% lower today.

While the BSE Realty Index witnessed heavy selling pressure and ended the day down by 6.4%.

Oil on the boil: Crude oil prices slid more than 1% on concerns that a global supply surplus could swell in the first quarter following a coordinated release of crude reserves among major consumers, led by the US.

Moving on to the stock-specific news, Tata Group stocks were among the top buzzing stocks today.

India's Tata group is in talks with three states to invest up to US$300 m to set up a semiconductor assembly and test unit, two sources familiar with the matter said, as part of the conglomerate's push into high-tech manufacturing.

Tata is talking to the southern states of Tamil Nadu, Karnataka, and Telangana and scouting for land for the outsourced semiconductor assembly and test (OSAT) plant.

While Tata has previously said it would likely enter the semiconductor business, this is the first time news about the group's foray into the sector and its scale has been reported.

OSAT plant packages assemble and test foundry-made silicon wafers, turning them into finished semiconductor chips.

Tata has looked at some potential locations for the factory.

Tata's push will bolster Indian Prime Minister Narendra Modi's 'Make in India' drive for electronics manufacturing, which has already helped turn the South Asian nation into the world's second-biggest maker of smartphones.

Potential clients of Tata's OSAT business include companies such as Intel, Advanced Micro Devices (AMD), and STMicroelectronics.

The factory is expected to start operations late next year and could employ up to 4,000 workers.

How this pans out remains to be seen.

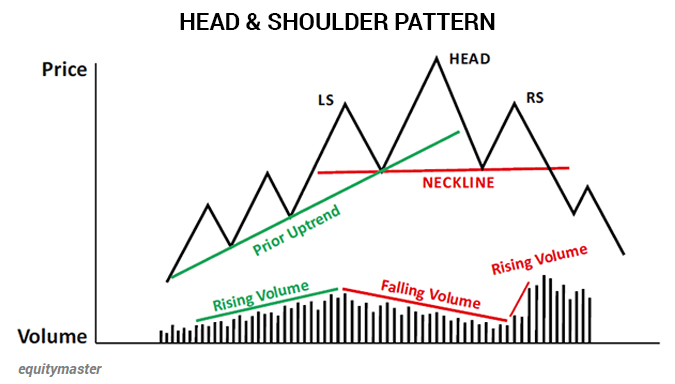

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while. Spotting this correctly can help you save money.

Moving on to news from the IPO space...

Tarsons Products Shares Make Lukewarm Debut

Life sciences company Tarsons Products saw a tepid debut on the bourses as the stock was listed with a 5.7% premium today. This is the 52nd company to list on the mainboard in 2021.

Tarsons Products stock opened at Rs 700 on the BSE, while the opening price on the NSE was Rs 682.

The labware products maker's maiden public offer had a strong subscription of 77.49 times. Non-institutional investors had bought shares 184.58 times the portion set aside for them and qualified institutional investors put in bids 115.77 times their quota.

The portion set aside for retail investors was booked 10.56 times and that of employees was subscribed 1.83 times.

The company mobilised Rs 10.2 bn through its public offer that was composed of a fresh issue of Rs 1.5 bn and an offer for sale (OFS) of Rs 8.7 bn by promoters, and investors Clear Vision Investment Holdings.

The fresh issue proceeds after issue expenses will be utilized for repaying debts and capital expenditure for the new manufacturing facility at Panchla, West Bengal. The offer had a price band of Rs 635-662 per equity share.

Tarsons manufactures a diverse range of labware products used in research organizations, academic institutes, pharmaceutical firms, diagnostic laboratories, and hospitals.

It supplies products to over 40 countries in both developed and emerging markets, which accounted for 33% of its revenue from operations in the financial year 2021.

Tarsons Products' share price ended the day up by 20% over its listing price of Rs 700.

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity research ...

more