Berkshire Boosts Mitsubishi Stake, Increases Investment In Japan

Image: Shutterstock

Key Takeaways

- Berkshire Hathaway raised its Mitsubishi stake to 10.23% from 9.74%, marking further expansion in Japan.

- Its total Japan stake cost $13.8 billion and was valued at $23.5 billion by the end of 2024, showing strong growth.

- Berkshire expects $812 million in 2025 dividends versus $135 million in interest costs from yen-denominated bonds.

Berkshire Hathaway (BRK-B - Free Report) recently increased its stake in the Japanese trading house Mitsubishi Corp. to 10.23% per media releases. This recent move marks Berkshire's continued expansion in Japan.

The insurance behemoth earlier held a 9.74% stake in Mitsubishi. Apart from Mitsubishi, Berkshire has stakes in four other Japanese firms — Itochu, Marubeni, Mitsui, and Sumitomo. The company has been steadily increasing its stakes in Japanese firms since initiating investment in July 2019.

Per an annual filing in February, Warren Buffett stated that, “these five Japanese companies operate in a manner somewhat similar to Berkshire itself.” He also stated that, “from the start, we also agreed to keep Berkshire’s holdings below 10% of each company’s shares. But, as we approached this limit, the five companies agreed to moderately relax the ceiling. Over time, you will likely see Berkshire’s ownership of all five increase somewhat.”

By the end of 2024, Berkshire’s aggregate investment cost was $13.8 billion, while the market value of its stakes had grown to $23.5 billion.

Notably, corporate governance reforms have enhanced transparency and capital efficiency, making Japanese companies more attractive to foreign investors. Meanwhile, Japanese companies trade at relatively modest valuations compared to U.S. companies, making them an attractive pick.

Also, by issuing yen-denominated bonds, it has limited currency exposure while capitalizing on Japan’s low-cost debt environment. In 2025, Berkshire expects about $812 million in annual dividends, while incurring only $135 million in interest expenses. Favorable yen-dollar movements have provided a further boost, delivering billions in after-tax gains.

Increasing investment in Japanese firms thus creates opportunities for more exposure in the growing economy of Asia.

What About Other Insurers?

MetLife (MET - Free Report), a major U.S. insurer, has built a strong, long-term presence in Japan. MetLife’s most transformative move was acquiring Alico in 2010, positioning MetLife as a leading force in Japan’s life insurance sector and reinforcing its strategic growth ambitions in Asia.

Aflac Incorporated (AFL - Free Report) established Aflac Ventures Japan in 2019 to invest in cancer care, HealthTech, and InsurTech startups, fostering innovation for Aflac Life Insurance Japan. In 2018, Aflac converted its Japanese branch into a subsidiary. Today, Japan remains a vital revenue driver, underscoring Aflac’s strategic commitment.

Berkshire Hathaway Stock Price Performance

Shares of Berkshire have gained 11.3% year-to-date, outperforming the industry.

Image Source: Zacks Investment Research

Berkshire Hathaway Stock's Expensive Valuation

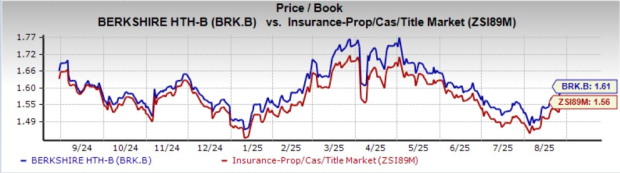

Berkshire Hathaway trades at a price-to-book value ratio of 1.61, above the industry average of 1.56. It carries a Value Score of D.

Image Source: Zacks Investment Research

Estimate Movement for Berkshire Hathaway

The Zacks Consensus Estimate for Berkshire Hathaway’s third-quarter 2025 EPS has witnessed no movement over the past seven days, while that for the fourth quarter moved 14.1% higher in the same period. The consensus estimate for full-year 2025 EPS rose 0.9%, while the same for 2026 declined 1.5% over the past seven days.

Image Source: Zacks Investment Research

The consensus estimates for Berkshire Hathaway’s 2025 and 2026 revenues indicate year-over-year increases. While the consensus estimate for the stock's 2025 EPS indicates a year-over-year decline, the same for 2026 suggests an increase.

Berkshire Hathaway stock currently carries a Zacks Rank #3 (Hold) rating.

More By This Author:

5 Non-Ferrous Metal Mining Stocks To Watch In A Challenging IndustryHere's Why It's Time To Revisit Consumer Staples ETFs

3 Dividend-Paying Transport Equipment & Leasing Stocks To Watch

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more