Banxico Cuts Rates By 50-Basis Points As Expected, To 8.50%

Photo by Alexander Schimmeck on Unsplash

On Thursday, Banco de Mexico (Banxico) reduced interest rates by 50 basis points from 9% to 8.50% on an unanimous vote.

Key highlights of Banxico's monetary policy statement:

The Board estimates that looking ahead it could continue calibrating the monetary policy stance and consider adjusting it in similar magnitudes.

It anticipates that the inflationary environment will allow to continue the rate cutting cycle, albeit maintaining a restrictive stance.

It will take into account the effects of the country’s weak economic activity and the incidence of both the restrictive monetary policy stance that has been maintained and the stance prevailing in the future on the evolution of inflation throughout the horizon in which monetary policy operates.

The Mexican economy exhibited weakness again during the first quarter of 2025. It registered a low seasonally adjusted quarterly growth rate of 0.2%, after having contracted in the previous quarter.

An uncertain environment and trade tensions poses significant downward risks.

Although headline and core inflation figures came at 3.93% in April, for the longer term remained relatively stable at levels above target.

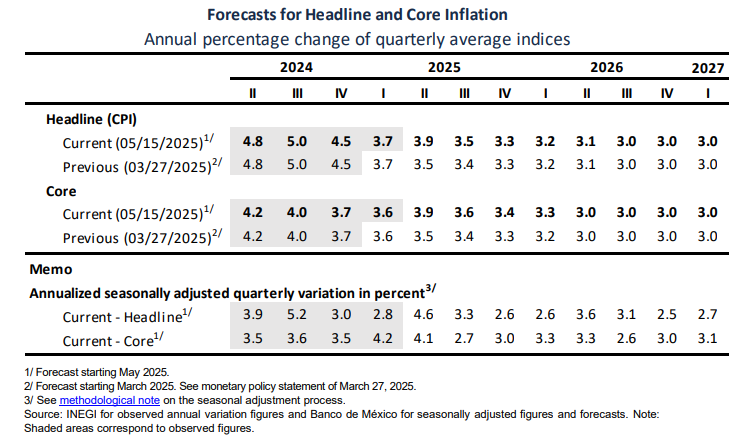

Inflation forecasts were adjusted upwards in the short-term; due to an increase in merchandise inflation.

Although Inflation risks are skewed to the upside, the outlook has improved as the global shocks have been fading

Banxico Forecasts

(Click on image to enlarge)

USD/MXN Reaction to Banxico's decision

(Click on image to enlarge)

The USD/MXN continues to aim higher, posting gains of over 0.60% after hitting a yearly low of 19.29 on May 14. If buyers wish to regain the 20.00 figure, they need a daily close above the 20-day Simple Moving Average (SMA) at 19.57, which could pave the way for testing the 50-day SMA at 19.94, followed by the 200-day SMA at 20.00.

Conversely, expect further weakness if USD/MXN stays below the 19.50 figure. Key support levels lie below that level, with the 19.00 figure being up next.

More By This Author:

GBP/USD Rises Towards 1.3300 As UK Economy Grows Above ForecastsSilver Price Forecast: XAG/USD Drops Over 2% On High US Yields, Hovers Near $32.00

Mexican Peso Hits 7-Month High Amid Weak U.S. Dollar, Eyes On Banxico

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more