Bank Pulse: No Change To TLTRO And Two-tier Reserve Remuneration… Yet

In today’s meeting, the European Central Bank left the targeted longer-term refinancing operations (TLTRO) terms and the two-tier reserve remuneration multiplier untouched. It has effectively pre-announced that it will revisit the latter at a later stage.

European Central Bank building and the Frankfurt skyline

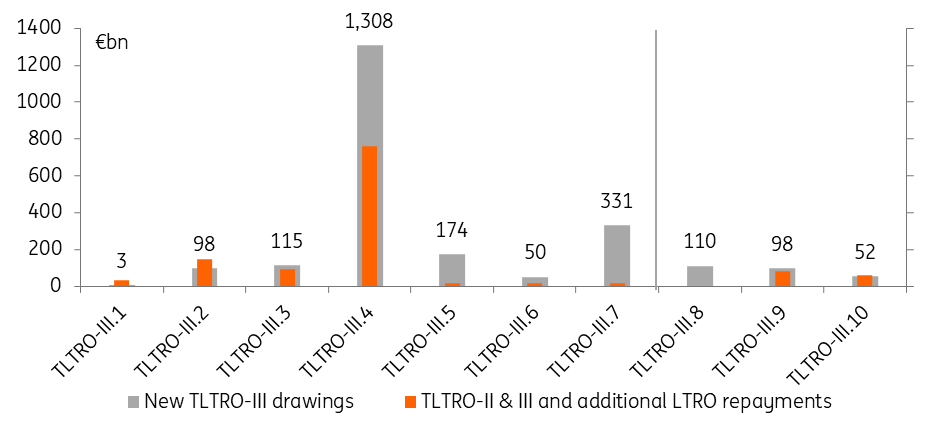

While the focus was on the decisions taken by the ECB Governing Council today, the ECB also released the drawings under the tenth and last TLTRO-III tranche. Banks attracted only €52bn across 159 bidding banks. This was €8bn less than the €60bn of early repayments on TLTRO-III.1-6 tranches. Hence the total TLTRO loans outstanding actually declined slightly. The modest use of this final drawing opportunity was not unexpected. As we wrote in our Banks outlook at the beginning of November, many banks already drew funds from the ECB up to their maximum drawing capacity.

Moreover, there was little incentive to shift from the older TLTRO-III-tranches into the final tranche. This would have had the advantage of lengthening the TLTRO borrowing term until the end of 2024. However, it would have come at the cost of missing out on the favorable -1% special interest rate from June to December 2021 (i.e. from the start of the “second special reference period” until early repayment).

Meanwhile, as was expected, the ECB decided not to extend the favorable -1% TLTRO borrowing rate beyond June 2022. As we noted in our ECB meeting preview, without further measures this will lead to a cliff edge effect for banks: as the TLTRO favorable rate of -1% resets to, at best, the deposit facility rate of -0.5%, the costs of the negative rate on the substantial reserves held at the Eurosystem starts to weigh heavily on banks. In fact, today Eurozone banks in aggregate receive some €300m per month in TLTRO negative rate revenues more than they pay in negative rate costs on their reserves. On currently announced ECB asset purchase plans, and extrapolating current TLTRO borrowing, this monthly €300m net revenue abruptly changes into a monthly €700m net loss from July 2022 onwards. Importantly, these negative rate costs are not the result of banks’ own actions, such as TLTRO borrowing. Instead, they are the result of the Eurosystem’s accumulated asset purchases, which have caused bank reserves to rise in tandem.

The ECB is aware of this, noting it will “assess the appropriate calibration of its two-tier system for reserve remuneration so that the negative interest rate policy does not limit banks’ intermediation capacity in an environment of ample excess liquidity”. Perhaps this particular can was kicked down the road because there was already enough to discuss today. One might also be inclined to think that the ECB wants to await further early repayments on TLTRO-III tranches, which can be made in March for the TLTRO-III.1-7 tranches (not a lot expected, as banks would miss out on the three remaining months of the favorable -1% rate) and in June, also for the TLTRO-III.8-10 tranches.

We note in this respect that in aggregate, from July 2022 onwards, TLTRO holdings are irrelevant for the net costs of negative rates to the banking sector (the TLTRO rate matches the deposit facility rate, canceling each other out). However, given the skewed distribution of TLTRO borrowing and reserve holdings across banks in the Eurozone (see our preview note), TLTRO borrowing and reserves do matter for net negative rate costs or revenues for individual banks. Even if the ECB were to take this skewed distribution into account, the central bank will find it hard to come up with a tiering multiplier that will make all banks equally happy.

TLTRO drawings and repayments

(Click on image to enlarge)

Source: ECB, ING

Meanwhile, we remain of the view that thanks to the high liquidity positions of Eurozone banks, notable early repayments of TLTRO-III drawings in June next year will not coincide with an equally high refinancing need for the banks concerned. As such we remain comfortable with our bank bond supply forecasts for 2022, which pencil in a roughly €35bn increase in EUR issuance by banks compared to this year.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more